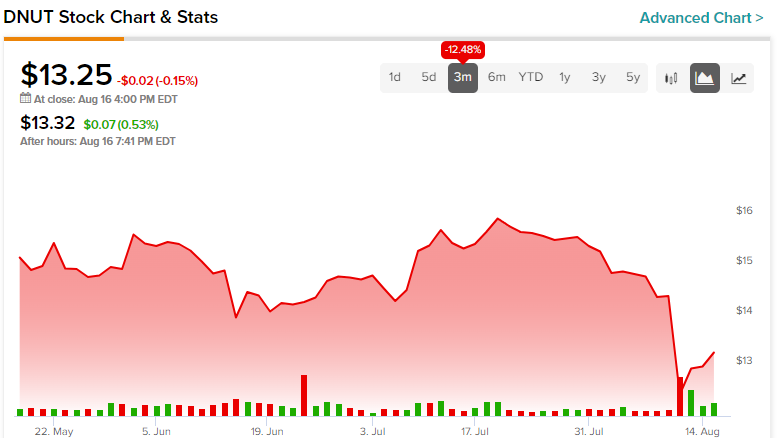

For contrarians entering the arena without much context, the implosion of Krispy Kreme (NASDAQ:DNUT) following its poor second-quarter earnings report may appear as a compelling discount. While the Q2 print was disappointing, it was technically a mixed showing, certainly not something that deserved a double-digit percentage loss. However, there’s something much deeper going on with the confectionary provider. Therefore, I am bearish on DNUT stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A Sour Note in Q2 Hurts DNUT Stock

Still, one of the problems associated with presenting a rough earnings print centers on rising economic pressures. While the Federal Reserve has implemented aggressive rate hikes to combat inflation, core consumer prices remain stubbornly elevated. Combined with the ongoing threat of mass layoffs, consumers on the ground floor of the economy aren’t feeling robustly confident.

Therefore, the sour note in Q2 absolutely matters for DNUT stock, which partially explains its fallout. As TipRanks reporter Shrilekha Pethe stated, Krispy Kreme posted adjusted earnings per share of $0.07, down by one cent against the year-ago quarter. To be fair, though, this metric met Wall Street’s consensus estimate.

However, the top line presented a different story. Here, the doughnut and coffeehouse chain rang up sales of $408.9 million. This haul represented a 9% year-over-year lift. However, it, unfortunately, fell short of analysts’ consensus target of $410.75 million. Subsequently, DNUT stock slipped by almost 14% on the day of the disclosure.

Nevertheless, many analysts felt the market’s response was too harsh and responded in kind. Bank of America’s (NYSE:BAC) Sara Senatore believes Krispy Kreme is gaining traction in markets outside the U.S. Specifically, the expert believes DNUT stock will benefit from outsized growth in Canada and Japan.

Further, JPMorgan (NYSE:JPM) stuck with its Buy rating. Its analysts anticipate an increase in accessibility that will facilitate gains in the worldwide indulgence market, according to TipRanks reporter Kailas Salunkhe.

Krispy Kreme Lags the Retail Food and Beverage Industry

Interestingly, Senatore stated that Krispy Kreme saw relatively stable unit sales. Further, the analyst mentioned that the company’s pricing and product mix were actually “better than for the industry.” That might very well be true. However, the problem is that the doughnut shop operator is technically losing market share to its underlying retail food and beverage industry.

Evidence comes from the combination of Krispy Kreme’s past quarterly revenue print and total retail sales from food services and drinking places, provided by the U.S. Census Bureau. Back in Q2 2020, the doughnut shop posted revenue of nearly $245 million, whereas the retail food and beverage sector posted sales of $41.69 billion. Therefore, Krispy accounted for 0.59% of all retail sales.

However, since Q4 2020, when the aforementioned metric hit 0.57%, Krispy’s share of total food/beverage retail sales generally declined. In the latest Q2 report, the $408.9 million posted in the top line accounted for only 0.46% of total retail sales, and this figure was down from Q1 2023’s figure of 0.48%.

In other words, the erosion in DNUT stock arguably isn’t just about the mixed Q2 earnings report. Rather, the company is effectively losing ground to sector rivals. That’s just not a great place to be because rising economic pressures have forced consumers to close their wallets.

Watch the Trade-Down Effect

In all fairness, the still robust consumer sentiment regarding “revenge travel” may help augment DNUT stock. However, if broader conditions falter, Krispy Kreme may struggle. Therefore, investors really need to watch the phenomenon known as the trade-down effect.

Basically, when consumers face financial challenges, they might not cut their discretionary spending outright. Instead, they may trade down to cheaper alternatives until an equitable equilibrium is found between pricing and product/service quality. For a big corporate brand like Krispy Kreme, the trade-down comes in the form of the local grocery store.

Is Krispy Kreme Stock a Buy, According to Analysts?

Turning to Wall Street, DNUT stock has a Moderate Buy consensus rating based on two Buys, five Holds, and zero Sell ratings. The average DNUT stock price target is $16.43, implying 24% upside potential.

The Takeaway: DNUT Stock Appears to Have Lost Ground

Back during more stable economic conditions, the narrative for DNUT stock made sense. People not only had jobs but also confidence in forward stability. However, that might not be the case currently. Not only that, but Krispy Kreme has been steadily losing market share in its core industry. Therefore, investors should be extremely cautious about DNUT.