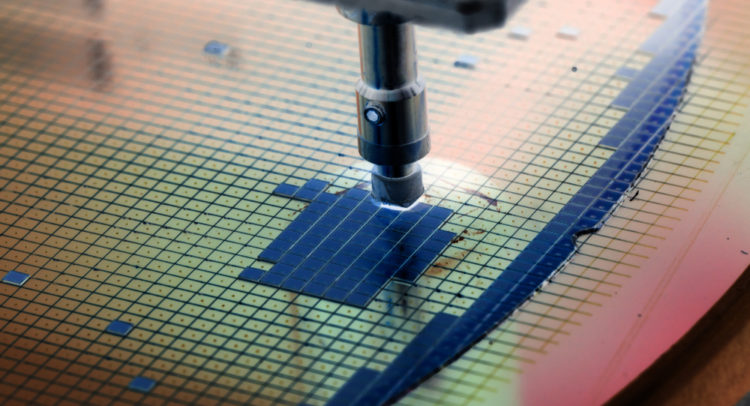

KLA Corporation (KLAC) manufactures process diagnostics and control (PDC) equipment and has a comprehensive portfolio of products serving photomask (reticle) inspection, wafer inspection/defect review and metrology.

Recently, KLA’s four new wafer inspection products for the automotive semiconductor market drove its fourth-quarter Fiscal Year 2021 results. Moreover, the company also revealed a positive outlook toward the wafer fab equipment (WFE) industry. It anticipates strong semiconductor demand to continue to drive positive industry dynamics in Calendar Year 2022.

Nonetheless, the latest earnings call wasn’t the first time the company appeared on analysts’ radar. Needham analysts, led by Quinn Bolton, started observing an upside to KLA’s potential since its previous earnings (third-quarter Fiscal Year 2021), in which the company projected that its semiconductor process control systems witnessed around 30% year-over-year growth in the full Fiscal Year 2021, two days after Lam Research (LRCX) raised its systems growth view to 40% for the year.

This made Bolton realize that KLA might be catching up with other process equipment players in an industry upcycle, overthrowing Lam Research and Applied Materials (AMAT) as the only outperformers in the market.

On July 30, Bolton upgraded KLA to a Buy from Hold, with a price target of $390, implying 12% upside potential. He stated, “We now believe KLA, which has historically underperformed in past WFE upcycles, will be an outperformer in the current WFE upcycle and continue to outperform in the next WFE downcycle.”

KLA’s Economic Moat in WFE Market

Improved wafer cleanliness and geometry specifications in the bare wafer industry are fueling the demand for KLA’s wafer products. As per Gartner, a leading research and advisory company, WFE spending in 2021 is expected to grow 7.8% year-over-year in 2021. This bodes well for KLA, which is one of the biggest manufacturers of wafer metrology products.

The analyst believes that the WFE industry is structurally changing and shifting to foundry/logic, EUV (extreme ultraviolet lithography) spreading into DRAM, and Intel (INTC) returning to an annual process technology cadence are tailwinds for KLA to shine in the current upcycle.

Tables Could Turn for Intel

In 2019, KLA suffered a huge setback in its reputation when Intel badmouthed its product roadmap publicly, criticizing its wafer inspection technology. This public criticism made analysts bearish and investors wary of KLA. However, Taiwan Semiconductor Manufacturing Company (TSMC) outpaced Intel in process technology in the same year, becoming the first semiconductor manufacturer to include EUV in high volume production. Notably, KLA, as one of TSMC’s key equipment suppliers, was an enabler in this achievement.

Now, Intel is on the way to leverage EUV and catch up with TSMC by 2024 and has little choice but to collaborate with KLA. This is also because KLA’s compelling technology has already been leveraged by TSMC and Samsung Foundry, and contributed greatly to their success. Bolton believes that Intel may see the benefits of partnering with KLA for the sake of its business. This gives KLA an upper hand in the industry.

Interestingly, due to its continued underperformance, the stock has lost its charm among investors and is trading at a much lower valuation than its more glamorous peers like Lam Research and Applied Materials. However, it should have been the other way round as KLA enjoys low business volatility in downcycles, impressive margin performance, and has consistently increased shareholder value. This makes the analyst hopeful of a mean reversion in relative valuation in favor of KLA. This also gives investors a golden opportunity to invest in the stock. (See KLA Dividend Date and History on TipRanks)

Consensus among TipRanks’ analysts for KLA is a Moderate Buy based on 3 Buys and 3 Holds. The average KLA price target of $385.33 implies 10.2% upside potential.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.