Investors are always on the lookout for ways to beat the market and can use several strategies to try and do so. Tracking the purchases made by leading investors is one way. Following the recommendations of stock experts at one of Wall Street’s most well-known banks is another. Then there’s also the option to ride the latest trend.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

So, when all three of these possibilities combine, investors should really take note.

Using the TipRanks database, we’ve pulled up the details on two stocks that tick all those boxes. These stocks have been endorsed by a billionaire investor, Ken Griffin, whose hedge fund Citadel generated record profits of $16 billion last year – even against a backdrop of harsh bear market conditions. Additionally, one of the Street’s most prominent banking institutions, Goldman Sachs, has recommended investors to consider investing in these stocks as well.

And as for the latest trend? Both names are making use of 2023’s hot topic: Generative AI, a rising trend, that via the release of ChatGPT and the possibilities it represents across multiple industries, has been getting huge amounts of attention this year. In fact, Goldman Sachs reckons adoption could result in nearly $7 trillion in global economic growth over the next 10 years.

So, let’s see why Griffin and Goldman both believe these generative AI stocks are ones that could make the most of that opportunity.

Intuit Inc. (INTU)

We’ll start with Intuit, a leading financial software provider. With its QuickBooks platform, the company has approximately an 82% market share of the U.S.’s SMB accounting software market. But the legacy software company has expanded its remit by adding various other products. Intuit’s offerings also include credit monitoring service Credit Karma, email marketing platform Mailchimp, personal finance app Mint, and tax preparation application TurboTax.

The company is also one of the pioneers in the effective implementation of AI-driven consumer-facing solutions; Intuit uses AI in a large-scale for its Virtual Expert Platform, which via the personalization of every taxpayer’s journey and by linking users with tax professionals, powers TurboTax Live.

The company’s solutions helped Intuit dial in a strong recent quarterly report, for the second quarter of fiscal 2023 (January quarter). Revenue rose by 14% year-over-year to $3.04 billion, while beating the Street’s call by $130 million. Adj. EPS of $2.20 compared well to the $1.55 delivered in the same quarter last year while trumping the Street’s $1.44 forecast. The company also repurchased $500 million of shares, with $2.5 billion left on its share repurchase authorization.

Obviously, Griffin likes what’s on offer here. During Q4, he bought 269,000 shares, upping his INTU stake by 179%. He now owns 419,615 shares, currently worth $184.55 million.

Reflecting Griffin’s confidence, Goldman Sachs analyst Kash Rangan sees a bright future for the company.

“The company’s natural language processing, AI tools (that can extract the needed tools from key tax forms, for example) and chatbot services (which use customer’s text and interactions to generate the best response) are additional examples of Intuit’s investment in such technology that can improve its product offering and user retention over time,” the analyst explained.

“Intuit has built a strong reputation of investing ahead of the curve in terms of next-gen technology and embodying that into its product framework for future innovation. This leads us to expect Intuit to have the same mentality when building new products and growing existing services, such as QuickBooks Live Mailchimp and Credit Karma,” Rangan added.

These comments form the basis for Rangan’s Buy rating while his $575 price target makes room for 12-month returns of 31%. (To watch Rangan’s track record, click here)

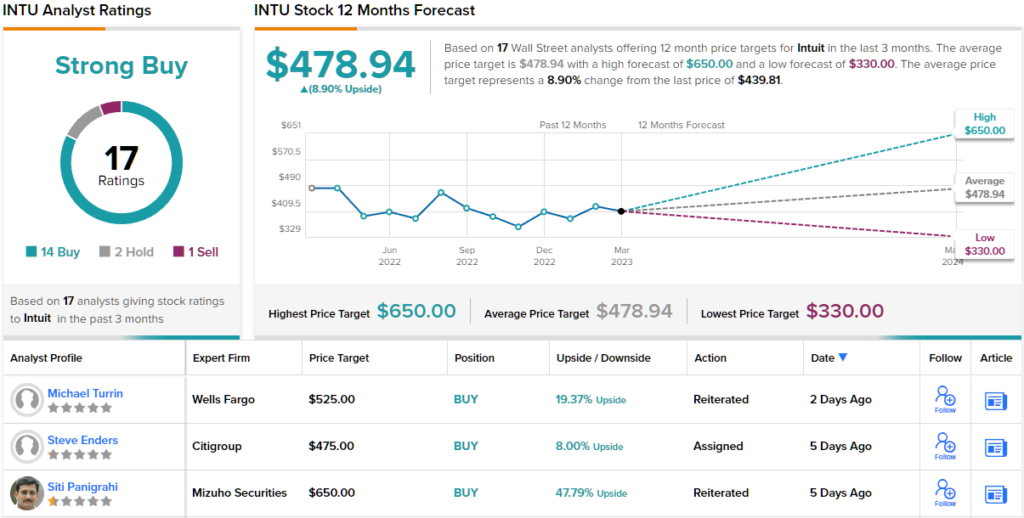

Elsewhere on the Street, the stock garners an additional 13 Buys, 2 Holds and 1 Sell, for a Strong Buy consensus rating. (See INTU stock forecast)

Adobe Inc. (ADBE)

The next Griffin/Goldman-endorsed stock has a long history of being at the forefront of technological innovation. Software giant Adobe is the maker of famous products such as Photoshop, Illustrator, Adobe Flash, Premiere and the PDF.

Therefore, it’s not surprising to learn the company’s AI/ML investments go back a while – to the 2016 release of Sensei, its artificial intelligence tool that integrates under the hood with Adobe software and is a component of different Adobe programs, such as Photoshop and Premiere Pro, amongst others.

More recently, the company announced Firefly, a “family” of generative AI tools aimed at creators. A beta version has been released and Adobe intends to eventually integrate it into apps. That should help further expansion for a company with a strong history of growth, as was the case again in its first quarter fiscal year 2023 report (February quarter).

Revenue reached a record $4.66 billion, amounting to a 9.4% year-over-year increase and coming in ahead of the consensus estimate by $40 million. Adj. EPS of $3.80 also came in above the $3.68 analysts were predicting. And during the quarter, Adobe repurchased around 5 million shares.

They are not the only ones to have bought shares in recent times. Griffin loaded up on 772,857 shares in 4Q22. That almost doubled his holdings; in total, Griffin now counts 1,575,124 ADBE shares in his portfolio, presently worth $607 million.

Goldman’s Rangan also covers ADBE and he believes the AI offerings set Adobe up well for the future. He writes, “The release of Sensei GenAi (focused on Digital Experience use cases) and Firefly (a suite of new Generative AI solutions across its portfolio), further situate Adobe to help shape the role Generative AI will play in driving productivity boosts expected to be a by-product of greater adoption. For example, these products can jump start the ideation process, extract more value from the same assets (by allowing for a broad range of seamless editing to take place via Adobe Express), automatically generate campaign analytics or build customer journeys.”

“Adobe’s strong direct-to-consumer go-to-market motion, along with its product led growth will likely allow Adobe to drive net-new user growth and be one of the first benefactors of these investments, especially in its Creative Cloud and wider Digital Media business,” Rangan summed up.

How does it all translate to investors? Rangan rates the shares a Buy while his $480 price target implies one-year appreciation of 23% lies in store.

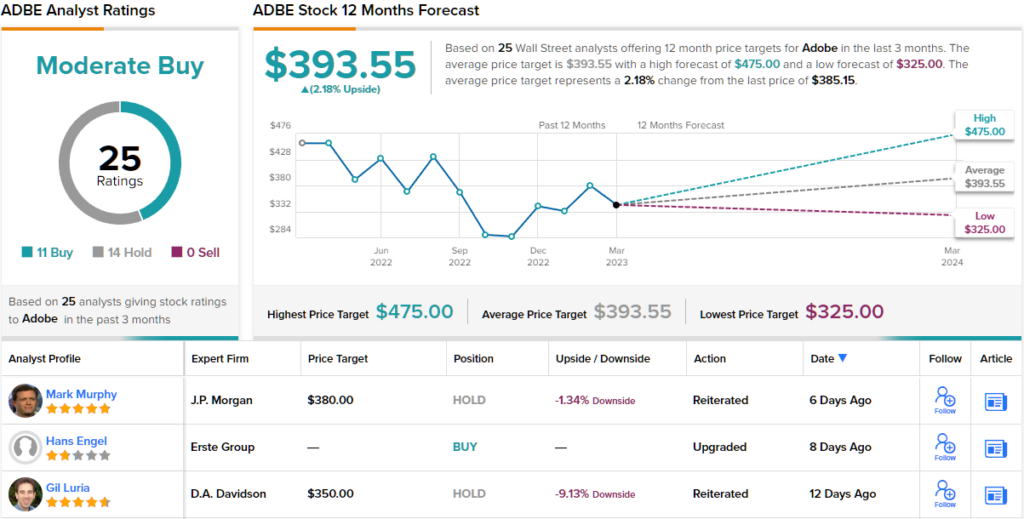

Looking at the ratings breakdown, with 11 Buys and 14 Holds, the analyst consensus rates this stock a Moderate Buy. (See Adobe stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.