Nvidia (NASDA:NVDA) has been on a remarkable run this year, with its shares surging by an impressive 89% year-to-date. The chip giant’s success can largely be attributed to this year’s hottest trend: Generative AI. The company is widely recognized as a leader in the field and seen as one set to benefit from increased adoption of the tech.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In fact, with a view to next month’s F1Q earnings (May 24), Morgan Stanley analyst Joseph Moore thinks all the hoopla around AI should result in a strong report.

“We see a positive setup for NVIDIA in this quarter’s earnings, with checks indicating that the significant enthusiasm we’ve seen from AI adopters has translated into reacceleration for data center (DC) product,” the 5-star analyst said.

Moore also sees the flagship AI chip H100 and the return of its predecessor, the A100, driving the quarter’s growth.

Moreover, looking ahead, with Nvidia’s state-of-the-art AI/ML hardware solutions given a proper boost from all the enthusiasm around generative AI, over the next 5 years, the DC business should be responsible for much of the anticipated growth.

But not only the DC segment. Moore also gives a shout out to Nvidia’s once main breadwinner – Gaming. After several quarters of declining growth, the segment showed signs it was coming back to life in FQ4 (January quarter) and with anticipated tailwinds from 40-series product over the course of the year, Moore sees an “opportunity for the company to reaccelerate growth in the gaming business.”

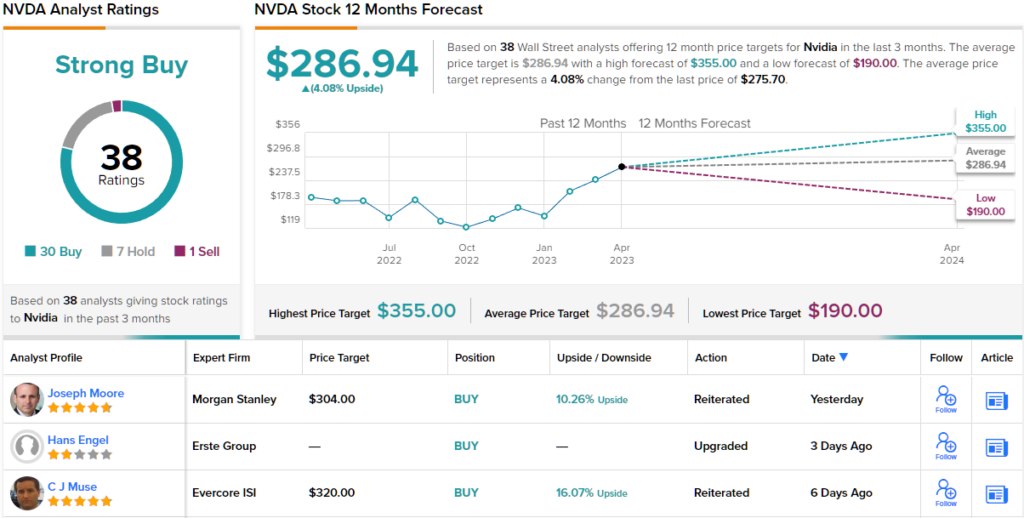

Down to the nitty-gritty, what does it all mean for investors? Moore currently rates the shares as Overweight (i.e., Buy) while his $304 price target suggests they will be changing hands for a 10% premium a year from now. (To watch Moore’s track record, click here)

Let’s turn our attention now to the rest of the Street, where based on 30 Buys 7 Holds, and just a single Sell, NVDA currently carries a Strong Buy consensus rating. Although with an average price target of $286.94, the analysts project a modest 4% upside over the coming months. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.