With 2023 imposing a distinctly challenging environment of high inflation and high interest rates, the affordability crisis has never been more pronounced, thus clouding the narrative for homebuilding stalwart KB Home (NYSE:KBH). However, prospects for relief in borrowing costs seemingly offer an intriguing buying opportunity here. Nevertheless, investors may want to check in with options traders first, who appear pessimistic. Based on fundamental challenges and the smart money’s skepticism, I’m bearish on KBH stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fundamentals Seem Positive for KBH Stock, but Not Really

Throughout much of 2023, the big question on investors’ minds was, when will the Federal Reserve ease up on its hawkish interest rate hiking policy? They received somewhat of an answer last month when policymakers hinted at three possible rate cuts later this year. Naturally, the news helped invigorate sentiment on Wall Street. For KBH stock, the acknowledgment implied a wider total addressable market.

In some respects, American households acclimated to the post-pandemic inflationary cycle. However, higher interest rates mean higher borrowing costs – and that effectively eliminates many would-be homebuyers from their financing options. Lowering the benchmark rate could see an increase in qualified borrowers, thereby boosting home sales. And that would be very good for KHB stock.

As TipRanks reporter Michael Marcus pointed out, Deutsche Bank’s (NYSE:DB) Joseph Ahlersmeyer expressed optimism for the housing market, assuming a dovish Fed. While Ahlersmeyer acknowledges macroeconomic pressures influencing the residential real estate market, governmental responses to address the COVID-19 crisis may play a lesser role in housing, moving forward. At the same time, reduced rates would help bring down financing rates to more normal levels.

On the surface, the narrative makes sense. However, the broader issue for KBH stock may be that affordability has become completely misaligned with underlying cost structures. For example, the Case-Shiller U.S. National Home Price Index soared to 313.28 points in October 2023. That’s a far cry from the 214.97 points printed in January 2020, or a 45.7% difference.

Yes, wages have increased, but they’re not keeping pace with inflation in the housing market. Per data from the U.S. Bureau of Labor Statistics, the average hourly earnings of all private employees stood at $34.27 last month. In January 2020, this metric was $28.43. Growth, yes, but at only 20.5% up, regular folks find themselves increasingly falling behind.

Options Traders Tip Their Hands Regarding KB Home

To get a better view of the possible trajectory of KBH stock, it’s best to check pricing dynamics in the derivatives market. Essentially, options represent the trading platform of the “smart money.” And while betting with these folks doesn’t guarantee anything, they have access to superior information than the average retail investor. What they’re implying with their transactions doesn’t necessarily bode well for KB Home.

Looking at TipRanks’ unusual options activity screener, between January 10 and January 18, 29 transactions materialized that featured bearish sentiment. In contrast, only 20 transactions were bullish, with one landing as neutral.

To be fair, the biggest trades in terms of volume among unusual transactions in the aforementioned date range carried optimistic implications. However, the number of bearish (short) calls – such as the 393 contracts sold of the KBH Feb 16 ’24 65.00 call – imply a rather aggressive belief that KBH stock won’t rise materially higher from current levels.

Even more telling, options flow data – which exclusively filters for big block trades likely made by institutions – purportedly affirms a wider belief among Wall Street giants that KBH stock will likely erode in the long run. Notably, on October 27 of last year, a major trader (or traders) bought 3,090 contracts of the KBH Jan 17 ’25 35.00 put, paying a premium of nearly $1.11 million for the privilege.

At the time of the transaction, KBH stock traded hands at $43.12. Obviously, the trade has not gone according to plan. Still, the put buyer has until January of next year for the “negative” trade to become profitable. With more than a million bucks on the line, that shows tremendous confidence in KB Home’s decline.

Financials Don’t Provide Much of a Counterargument

At the moment, KBH stock trades at a trailing-year earnings multiple of 8.72x. Technically, it’s undervalued, but barely, with the real estate development sector printing an average multiple of 8.9x. The fact that KB Home isn’t trading at a discount isn’t shocking. And since the end of October, shares gained nearly 39%.

In fairness, it’s possible that lower interest rates could reinvigorate the business. Yes, revenue in Fiscal 2023 landed at $6.41 billion, below Fiscal 2022’s print of $6.9 billion. However, a dovish Fed could change this narrative.

Then again, lower rates may not materially change the affordability crisis that clouds states like California. And that’s what the options traders may be responding to, casting skepticism on KBH.

Is KBH Stock a Buy, According to Analysts?

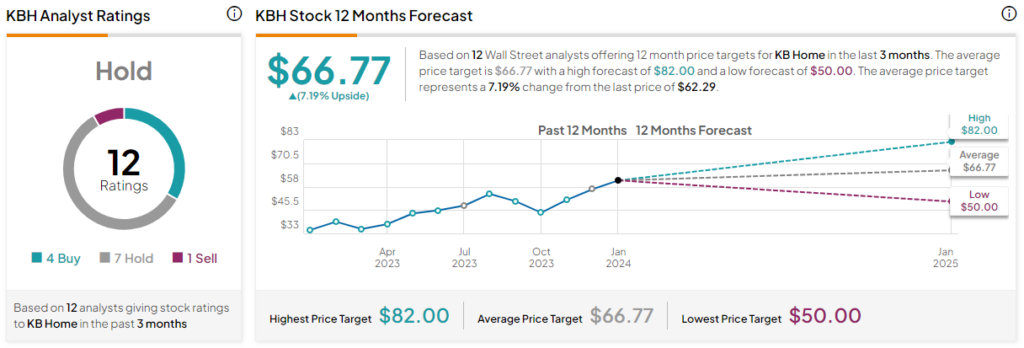

Turning to Wall Street, KBH stock has a Hold consensus rating based on four Buys, seven Holds, and one Sell rating. The average KBH stock price target is $66.77, implying 7.2% upside potential.

The Takeaway: Heed the High-Level Warnings of KBH Stock

With the possibility of the Fed reducing interest rates, it’s natural to be optimistic about KB Home. After all, lower borrowing costs could boost the company’s total addressable market. However, a high level of bearish options trades indicates that dovish policy may not be enough. Therefore, investors should be cautious with KBH stock.