The residential housing market has seen turbulent times in the last few years as a combination of high inflation and then high interest rates pushed up both home prices and mortgage rates. With housing growing more expensive, the building industry felt the pressure – and investors started looking askance at building and building-related stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

More recently, however, some of that pressure has been easing. While prices remain high, the pace of inflation is slowing down – and there’s a strong argument that the Federal Reserve will start lowering rates in the first half of 2024. This has a supportive effect on the housing market, one that has caught the attention of Deutsche Bank’s Joseph Ahlersmeyer.

The analyst, who holds a 5-star rating from TipRanks and is counted in the top 3% of Wall Street’s stock experts, writes of the homebuilder stock segment, “Macro crosswinds will always play a role in investing in housing and construction stocks, but we do not think it is controversial to say that consumer stimulus, inflation, Fed policy and recession fears all played an outsized role over the past several years. And while macroeconomics still matter, we see the influence on the group lessening in ’24, giving way to idiosyncratic opportunities for investors to align themselves to today and capture real value over the coming 12-18 months.”

Taking a cue from Ahlersmeyer’s insights, let’s explore two of the building stocks he recommends right now.

Don’t miss

- These 2 MedTech Stocks Look Too Cheap to Ignore, Says Morgan Stanley

- Morgan Stanley Says These 3 Semiconductor Stocks Are Hot Buys Right Now

- ‘Time to Upgrade,’ Says J.P. Morgan About These 2 Energy Stocks

Beacon Roofing Supply (BECN)

The first stock we’ll look at is Beacon Roofing Supply, which helps put roofs over our heads. The company is one of the building market’s major providers of roofing materials, offered under a wide range of the industry’s best-known brand names. Contractors can find everything they need to complete a roofing job, including asphalt shingles, slate and other natural shingles, wood and tile roofing materials, simple metal sheeting, as well as the roof rolling materials frequently used in light industrial and commercial projects where low-sloping roofs are common.

In addition to roofing products, Beacon’s customers can take advantage of a wider range of construction materials provided by the company. Lumber and composite materials, plywood and similar materials, decking products, windows and skylights, and even HVAC ducting all find their way into Beacon’s catalog. This solid product list has put Beacon in a leading position as a materials provider for building contractors – and it helped the company build up a $5.1 billion market cap.

Beacon is active in the nation’s fastest-growing residential regions, and last month, it opened two new locations – one in Houston, Texas, and the other in Riverside, California. Specifically, these locations are sited to serve residential homebuilders and commercial contractors in the high-growth areas south of Houston and in California’s Inland Empire.

When we examine the financial results, we find that, like many firms in the construction business or related industries, Beacon shows a predictable seasonal pattern in its revenues and earnings. These peak in the warm months of the calendar year, Q2 and Q3, and fall off in Q4 and Q1. This was evident in the last quarterly report, from 3Q23.

The earnings release showed that the company brought in $2.58 billion in net sales during Q3, compared to $2.42 billion in the prior-year period. While up 6.6% year-over-year, the revenue result slightly missed the forecast by $6.8 million. On the financial bottom line, the company reported adjusted earnings of $2.85 per share, which topped the consensus mark of $2.63.

Turning to Deutsche Bank’s Joseph Ahlersmeyer, we find that the analyst is upbeat on Beacon’s ability to generate strong business and beat the earnings forecasts, as well as its ability to execute a solid growth plan.

“BECN has exhibited strong business momentum, beat estimates and raised throughout the year, and has now offered constructive commentary on the Roofing market into FY24. Management has been building tremendous credibility over the last two years after offering a vision for the business through FY25 and then diligently executing against that plan despite a stock valuation that suggests investors have been more focused on when volume and pricing eventually disappoint, and less focused on the underlying operational and financial progress and capital allocation actions taken,” Ahlersmeyer opined.

Getting down to the brass tacks, Ahlersmeyer concludes on the following optimistic note: “For our part, we see a company intent on continuing to execute on its value creation initiatives, deploy cash in a shareholder-accretive manner and push even further to demonstrate through share repurchase actions that management is not content with BECN’s trading multiple.”

Taken all together, this stance supports Ahlersmeyer’s Buy rating, and his selection of the stock as a ‘Top Pick.’ His price target, set at $119, implies a one-year upside potential of 47%. (To watch Ahlersmeyer’s track record, click here)

Overall, this stock holds a Moderate Buy consensus rating from the Street’s analysts, based on 7 reviews that break down 4 to 3 in favor of the Buys over Holds. The shares are trading for $80.88 and their $99.71 average target price suggests an upside of 23% on the one-year timeline. (See BCEN stock forecast)

Owens Corning (OC)

The next stock on our list, like the previous, is hardly a ‘household name,’ but you might remember the commercials it used to run on TV. Based on the Pink Panther cartoons, and using the familiar character and theme music, Owens Corning’s old ad campaign poked gentle fun at the company’s main product: fiberglass home insulation, and its bright pink color.

Home insulation is easy to overlook, but in the highly seasonal climate that prevails over most of North America, it is also an essential product, vital for maintaining the efficiency of residential and commercial heating and cooling systems.

In addition to insulation, Owens Corning is also a leader in the roofing and roofing materials segment, and in composite materials. All of these, from roofing shingles to flexible fiberglass and sturdy poured concrete composites, have uses in the construction industry – and all are needed on call, usually to exacting specifications. Owens Corning has a long history of meeting builders’ and contractors’ demands on these product lines.

Owens Corning’s overall stock performance has mirrored the broader market’s pattern over the past year; shares in OC participated in the bullish run through the summer, before taking a hit that lasted into October. The stock is up again, riding the bullish wave that has carried the markets since early November. Overall, the stock is up approximately 71% year-to-date, outperforming the S&P 500 index by a wide margin.

Like Beacon, OC shows a distinct seasonal pattern to its financial results, with the stronger quarters in the warmer months. In the last quarter reported, 3Q23, the company’s revenue of $2.5 billion was down 2% from the prior year, and came in $50 million below expectations. The bottom-line earnings, reported as an adjusted $4.15 per diluted share by non-GAAP measures, were 29 cents per share ahead of the forecast.

Ahlersmeyer, in his write-up on the stock, outlines his expectations for OC to maintain a growth trajectory, despite some lingering weakness. Describing the stock’s position, he writes, “Within Roofing, we expect solid sales growth in ’24 with margins also surprising to the upside on better volume leverage, carry-over deflation, positive price carry over and the potential for further price increases. R&R activity remains healthy, and storm demand will continue well into the new year, while new construction though just a small piece also remains steady. We believe OC also has a built-in volume tailwind for the year given low inventories in distribution and on its own balance sheet, and the need to improve its inventory position will drive higher production rates and put a floor under margins even if there are some pockets of volume weakness in the market next year.”

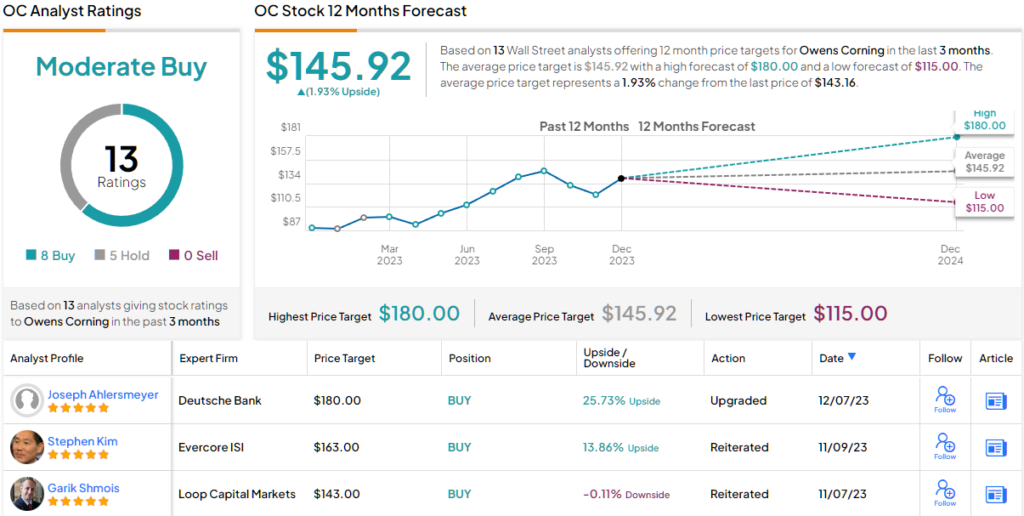

The analyst goes on to upgrade OC shares to a Buy rating, and sets a price target of $180, pointing toward a 26% upside on the one-year horizon.

All in all, Owens Corning has earned a Moderate Buy rating from the Street’s analysts, based on 8 Buys and 5 Holds set in recent weeks. However, the company’s $143.16 current trading price and $145.92 average target price together suggest a modest 2% upside in the coming year. (See OC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.