Does it make sense to buy shares of JPMorgan Chase (NYSE:JPM) even though the CEO just released a warning about U.S. banks? I am bullish on JPM stock as the company is well-positioned to survive the banking crisis. Plus, the stock isn’t extremely overvalued, and JPMorgan Chase pays a nice dividend.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan Chase is an American mega-bank, and its chief executive, Jamie Dimon, is known for being frank about the state of the economy and markets. When the future prospects are shaky, Dimon won’t hesitate to say so, even if there’s a negative impact on JPM’s stock price.

However, don’t be fearful or frustrated if Dimon’s cautionary tone casts some U.S. banks in an unfavorable light. With its deep capital position and wide brand-name recognition, JPMorgan Chase will shine compared to less reliable banks.

JPM Stock Dips in Response to Dimon’s Warning

Surely, it’s not a coincidence that JPM stock fell as much as 2.1% on the same day that the company released its annual letter to the company’s shareholders. The financial sector was down, too, so this just goes to show how influential Dimon’s words can be.

It’s perfectly understandable that Dimon would want to respond to the collapse of SVB Financial Group subsidiary Silicon Valley Bank and Signature Bank. After all, economists and investors look to Dimon to bestow some words of wisdom during times of crisis.

Dimon may have provided wisdom, but he certainly didn’t offer much reassurance for jittery investors. “Even when it is behind us, there will be repercussions from it for years to come,” Dimon stated ominously.

Moreover, if you’re assuming that the reputational fallout will be contained to smaller regional banks, think again. “Any crisis that damages Americans’ trust in their banks damages all banks,” Dimon proclaimed. So, does this mean that JPMorgan Chase is in trouble?

There’s no need to jump to any hasty conclusions about JPMorgan Chase, which is much bigger and better-capitalized than Silicon Valley Bank and Signature Bank ever were. Besides, JPMorgan Chase didn’t over-leverage itself on government bonds and/or cryptocurrencies to the extent that the failing banks did.

A report from Barron’s indicates that JPMorgan Chase has a capital ratio adjusted for bond losses of 11.5%, which is within a reasonable range compared to the company’s competitors. Hence, JPMorgan Chase wasn’t found to be excessively exposed to Treasury bonds.

JPM Stock Offers a Decent Dividend Yield and Value

Now that Dimon’s warning brought JPM stock a little bit lower, it’s a great time to determine whether the stock is a good bargain now. If you agree that JPMorgan Chase should be able to weather the storm, then I encourage you to take a look at the attractive value and yield that JPM stock has to offer.

As smaller banks collapse, chances are excellent that their customers will seek relative safety in financial strongholds like JPMorgan Chase. Perhaps the market doesn’t fully recognize this quite yet, as JPM stock provides good value. As evidence of this, consider that JPMorgan Chase’s GAAP trailing 12-month price-to-earnings (P/E) ratio is 10.77x, which isn’t far above the sector median P/E ratio of 9.59x despite it being a leader in the sector. In other words, the company’s shares aren’t very overpriced, according to this metric at least.

Additionally, JPMorgan Chase hasn’t cut its dividend recently, so that’s a positive sign for the company. JPMorgan Chase’s forward annual dividend yield of 3.1% is generous, as it’s substantially higher than the sector median dividend of 2.11%. Furthermore, that dividend is probably safe as JPMorgan Chase is consistently profitable and, more often than not, beats analysts’ quarterly EPS forecasts.

Is JPM Stock a Buy, According to Analysts?

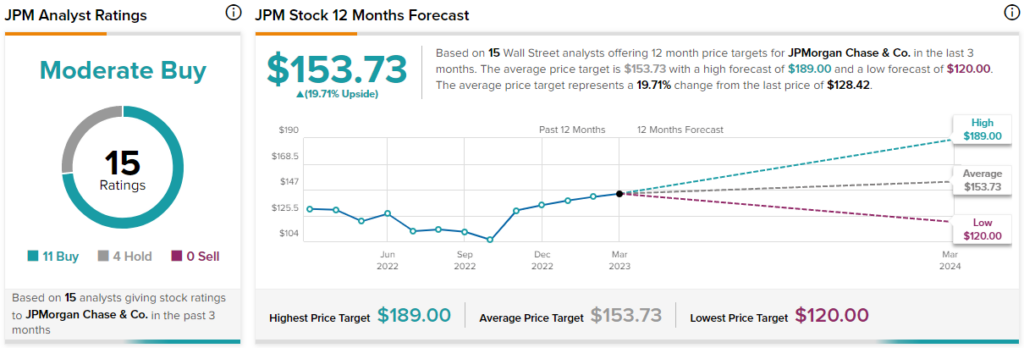

Speaking of analysts, let’s take a look at Wall Street’s general outlook on JPMorgan Chase’s future prospects. JPM stock comes in as a Moderate Buy based on 11 Buys and four Hold ratings. The average JPMorgan Chase stock price target is $153.73, implying 19.7% upside potential.

Conclusion: Should You Consider JPM Stock?

If any bank is equipped to ride out the financial sector storm in 2023, it’s JPMorgan Chase. The company is earnings-positive and can easily afford to reward its shareholders with generous quarterly dividend distributions.

Sure, it’s important to take Dimon’s warning seriously. There may be a rocky road ahead for American banks, especially the smaller ones that didn’t invest their depositors’ funds responsibly. JPMorgan Chase isn’t at risk of collapse, though, and can certainly be viewed as a safe haven among financial institutions. All in all, JPM stock is definitely worth considering despite – or maybe, even because of – legitimate concerns about U.S. banks.