Not for nothing does the phrase “buy low, sell high” get overused. The best opportunities often arise following a pullback and the investment experts at JPMorgan are keen to point them out.

They have been closely monitoring the energy market and are seeing a lot of promise in energy companies. The banking giant is showing a positive outlook on two specific energy stocks with the pair offering different value propositions. That said, both have been underperforming the market this year, but JPM’s analysts are projecting a potential upside of 40% or more from current levels.

We ran these tickers through the TipRanks database to also get an idea of the Street’s overall take on these names. Let’s check the details.

Bloom Energy (BE)

First up is Bloom Energy, a company in the clean-energy industry, working on electric power generation and storage through the use of solid oxide fuel cell technology. Solid oxide fuel cells use a chemical reaction – the oxidation of a fuel – to directly produce usable electricity. The cells offer a solution to problems of resiliency and sustainability in clean energy, along with an electricity supply that is both reliable and predictable. In addition, Bloom’s solid oxide cells generate only one waste product, simple hydrogen, an element that is non-polluting and usable in energy and fuel applications. The fuel cells provide efficient, combustion-free power, without producing carbon emissions of any form.

Bloom’s platform, the Energy Server, is designed to provide always-on power, available at the customer’s beck and call, without needing to power-up a generator. The Energy Server can be scaled directly to the customer’s needs, providing a flexible energy source for any purpose. Bloom has already begun to partner with major companies, such as the oil field service firm Baker Hughes, to provide clean power alternatives.

Bloom Energy saw its most recent stock peak in February of this year, but since then, the stock is down more than 46%, although revenues have been showing year-over-year gains.

In the last financial report, for 1Q23, the company had a top line of $275 million, up almost 37% from the year-ago period and beating the forecast by $19.1 million. On the negative side, earnings came in at a net loss; the non-GAAP EPS figure was -$0.22, better than the 32-cent loss reported in 1Q22 but 1 cent worse than had been expected. Year-over-year, the company’s gross margin improved from 15.8% to 21.2%. The company did burn cash in Q1, seeing its liquid assets fall by $28 million, but it still has $320 million in cash and cash equivalents on hand.

For JPM’s 5-star analyst Mark Strouse, all of this adds up to a company that’s worth a second look. Strouse writes, “We believe the recent pullback, since mid-February, is overdone and that investors can take advantage of the volatility to add to positions in a stock that we believe will be a long-term beneficiary of the energy transition… While we acknowledge that EBITDA margins were lackluster on the 1Q print, this was primarily driven by higher than expected opex owing to timing of spend, in our view. We believe the gross margin trajectory over the past few years is encouraging with FY23 guidance implying record highs, and we expect further improvement as the supply-chain normalizes and the company returns to its historical cadence of lowering costs by double-digits annually.”

“We note that BE’s balance sheet remains in good condition with ~$33m in net cash as of 1Q ($320mm unrestricted cash less $288mm in recourse debt), which we believe provides comfort during the current capital markets environment,” Strouse went on to add. “In our view, the improving gross margins and relative balance sheet strength enables further growth-oriented operating investment, as operating leverage comes over time.”

Looking ahead from these comments, Strouse gives BE shares an Overweight (Buy) rating, with a price target of $20 to suggest a one-year upside potential of 43%. (To watch Strouse’s track record, click here)

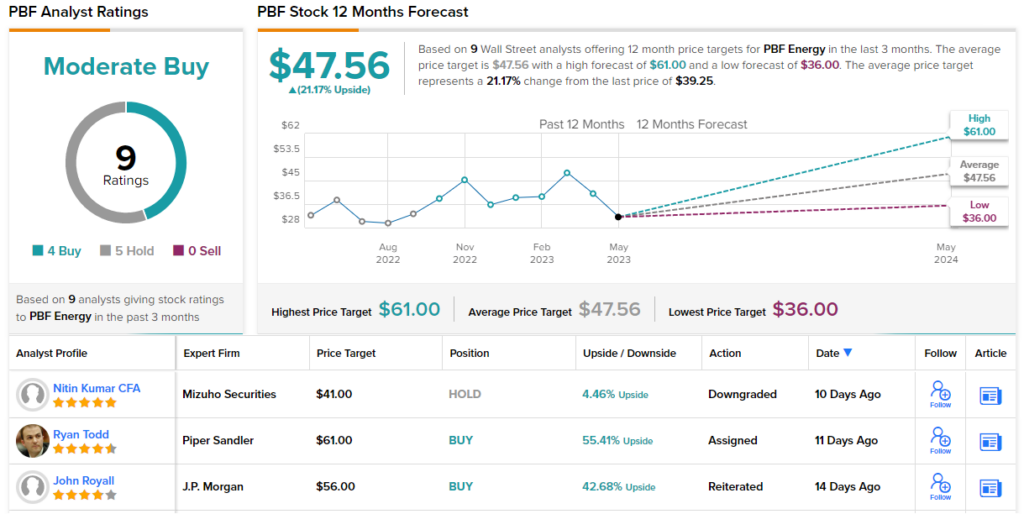

Turning now to the rest of the Street where BE stock gets a Moderate Buy from the analyst consensus, based on an additional 4 Buys and 5 Holds. The stock is selling for $13.99 and its $24.32 average price target implies a 74% gain in the coming year. (See Bloom stock forecast)

PBF Energy (PBF)

For the second stock on our short list, we turn from alt energy to the traditional hydrocarbon energy sector. PBF Energy is one of the largest independent crude oil refiners in the US market, producing and distributing a wide range of petroleum products – including heating oil, transportation fuels, lubricating oils, and petrochemical feedstocks. These products are distributed as unbranded fuels, in part through PBF’s own logistic operations. These operations include storage facilities, marine vessels, and tanker trucks – as well as the Delaware Pipeline Company.

PBF’s refinery operations are extensive, and include refineries in Delaware City, DE; Paulsboro, NJ; Toledo, OH; New Orleans, LA; and Torrance and Martinez, both in CA. The facilities have a combined production capacity of 973,000 barrels per day.

This is big business, and in the most recent quarterly release, from 1Q23, the company had a top line of $9.29 billion, $903 million more than had been expected and up 2% year-over-year. The firm’s income, reported at $2.86 per diluted share in non-GAAP measures, was a strong turnaround from the 18-cent loss reported one year earlier – and beat the forecast by 26 cents. Additionally, PBF increased its share repurchase authorization from the prior $500 million to $1.0 billion.

Pre-COVID, the company paid a regular dividend – but that ended with the February 2020 payment. In November of last year, however, the dividend was reinstated at 20 cents per share. PBF declared it again on May 5, for a May 31 payout. This marks the 3rd quarter of the renewed dividend payment, which annualizes to 80 cents per common share and gives a yield of 2%, in line with market averages.

With all of that, the stock has still fallen in recent months. Shares in PBF peaked this year in March, at about $48, and are down 18% from that level.

This stock’s retreat has caught the eye of analyst John Royall, who said in his note for JPM, “We believe PBF’s current levels are attractive, particularly after trading off in 2023, given improvements in the company’s balance sheet. The company has created significant equity value via reduction of net debt, while significant incremental value was created with the $800mm+ sale of half of its interest in the Chalmette RD project (given a ~$675mm project cost on a 100% basis). Further, with PBF now repurchasing stock and paying a dividend, lack of returns of capital to shareholders are no longer a negative to PBF’s thesis, while the buyback should continue into a less constructive crack environment.”

Quantifying his stance, Royall set an Overweight (Buy) rating and a $56 price target on the stock, implying a 43% upside on the one-year horizon. (To watch Royall’s track record, click here)

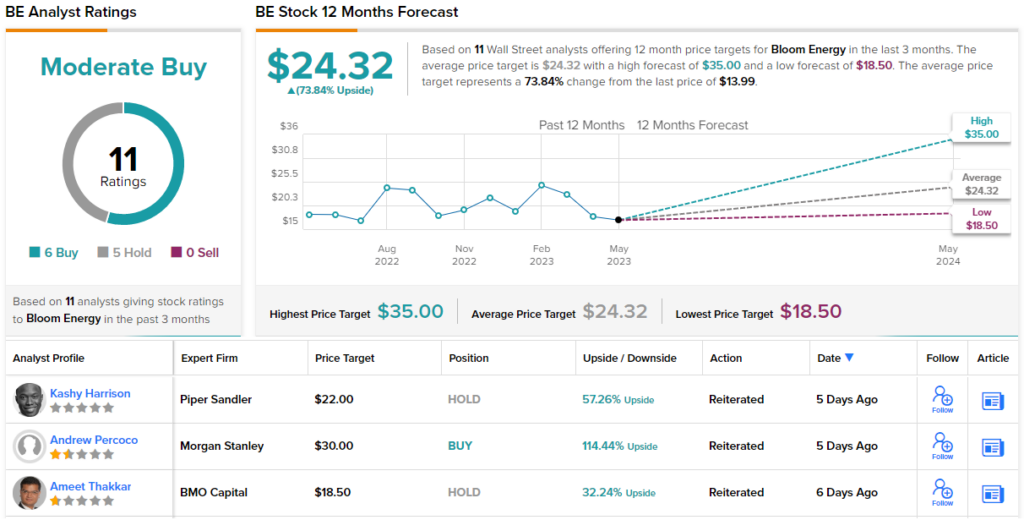

Once again, we’re looking at a stock with a Moderate Buy consensus rating, based on a total of 5 Buys and 4 Holds. Shares in PBF are priced at $39.25, and the average price target of $47.56 suggests the stock will gain 21% in the next 12 months. (See PBF stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.