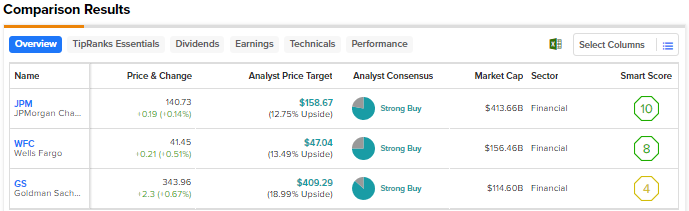

Most of the major U.S. banks fared better than expected in the first quarter despite the negative sentiment sparked by the collapse of Silicon Valley Bank and Signature Bank. The leading U.S. lenders continued to benefit from higher net interest income (NII) due to rising interest rates. However, banks also booked higher provision for loan losses due to persistent macro uncertainty. We used TipRanks’ Stock Comparison Tool to place JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and Goldman Sachs (NYSE:GS) against each other to pick the best bank stock as per Wall Street pros.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan Chase (NYSE:JPM)

JPMorgan Chase, the leading U.S. bank based on assets, crushed analysts’ Q1 expectations due to a 49% rise in NII to $20.8 billion. Q1 EPS surged 56% year-over-year to $4.10, easily surpassing analysts’ estimate of $3.41.

JPM’s average deposits declined 14% year-over-year and 3% compared to Q4 2022, as customers continued to shift funds to higher-yielding products. However, inflows due to the collapse of regional banks helped the total deposits rise 2% quarter-over-quarter at the end of Q1 2023.

Further, investors were impressed by the increase in the company’s full-year NII guidance to $81 billion from $74 billion. JPM raised the NII estimate as its expects to pay lower rates in its consumer and wholesale businesses based on the expectation that the Federal Reserve would cut interest rates later this year and modestly higher card revolving balances.

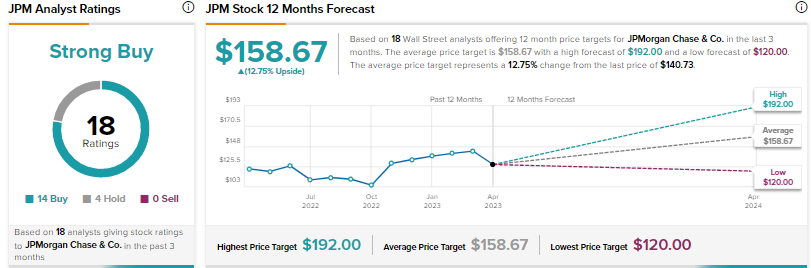

Is JPM Stock a Buy, Sell, or Hold?

Following the Q1 print, Bank of America analyst Ebrahim Poonawala increased his price target for JPMorgan to $158 from $152 and reaffirmed a Buy rating. The analyst feels that while it is convenient to attribute JPM’s strong performance to “deposit flight at regional banks,” such thinking ignores the management’s strong execution.

Poonawala raised his FY23 and FY24 EPS estimates, supported by the upgraded NII outlook and higher buybacks.

Wall Street’s Strong Buy consensus rating for JPM stock is based on 14 Buys and four Holds. The average JPM price target of $158.67 suggests nearly 13% upside potential. Shares have risen nearly 5% since the beginning of this year.

Wells Fargo (NYSE:WFC)

Like JPM, Wells Fargo delivered upbeat results for Q1 2023, even as the company recorded $1.2 billion in provision for credit losses. The company’s EPS increased 35% year-over-year to $1.23, with net interest income rising 45% to $13.3 billion.

However, it is worth noting that average deposits fell more than 7% year-over-year and 2% compared to Q4 2022 due to the consumer deposit outflows, as customers continued to reallocate cash to higher-yielding alternatives. WFC’s period-end deposits declined 2% quarter-over-quarter, with the company stating that the brief rise in inflow experienced due to the regional banks crisis abated soon.

Wells Fargo resumed buybacks in the first quarter of 2023 and repurchased 86.4 million shares worth $4 billion.

What is the Target Price for WFC?

Last week, Citigroup analyst Keith Horowitz lowered his price target for Wells Fargo stock to $50 from $52 and reiterated a Buy rating. Horowitz highlighted that company’s better-than-expected Q1 performance was driven by robust NII and trading results.

However, Horowitz noted that the stock slightly underperformed following the results due to unchanged NII and expense outlook. Nevertheless, the analyst views Wells Fargo’s forecast as “very conservative” and expects it to be most active in its coverage in terms of buybacks.

With 12 Buys and four Holds, Wells Fargo commands a Strong Buy consensus rating. At $47.04, the average price target suggests 13.5% upside. WFC shares are flat year-to-date.

Goldman Sachs (NYSE:GS)

Goldman Sachs delivered mixed Q1 results, with earnings exceeding expectations while revenue fell short of estimates. While JPM and WFC reported higher revenue, Goldman’s Q1 revenue declined 5% to $12.2 billion.

The top line was hit by a loss of about $470 million related to the partial sale of the Marcus loan portfolio and weakness in trading and investment banking businesses, which were hit by persistent macro challenges.

Macro pressures and rising interest rates have impacted deal activity and hit Goldman Sachs, which has higher exposure to investment banking and trading than some of its rivals. Meanwhile, the bank is taking various steps to streamline its operations and cut costs. It is also reducing its retail finance presence and is exploring the sale of its GreenSky business, acquired in 2021.

Is Goldman Sachs Stock a Buy or Sell?

Following the Q1 results announced last week, RBC Capital analyst Gerard Cassidy raised his price target for Goldman Sachs to $375 from $339 and maintained a Hold rating. The analyst noted that the investment banking industry and Goldman Sachs were impacted by continued weakness, but will eventually recover. Cassidy expects Goldman Sachs to be one of the biggest beneficiaries on recovery.

Meanwhile, JMP Securities analyst Devin Ryan raised his price target for Goldman Sachs to $470 from $460 and reiterated a Buy rating. Ryan feels that Goldman’s Q1 earnings included some “noise,” but the quarter seemed stronger than the headline suggested, with a better-than-expected guidance. Ryan believes in Goldman Sachs’s ability to navigate a complicated backdrop and win additional market share.

Overall, the Strong Buy consensus rating on Goldman Sachs stock is based on 13 Buys and two Holds. The average price target of $409.29 implies nearly 19% upside. GS shares are essentially flat compared to the start of the year.

Conclusion

Wall Street is bullish about all the three banks discussed here. Nonetheless, they see higher upside potential in Goldman Sachs compared to JPMorgan Chase and Wells Fargo. While, Goldman Sachs is currently under pressure due to higher exposure to investment banking, analysts continue to be optimistic about the long-term potential of its business.