Warnings of a recession have been prevalent for a while now, and while J.P. Morgan’s global markets strategist Marko Kolanovic thinks one could well be on the way, he believes the market is already reflecting that possibility.

“While recession odds are increasing,” Kolanovic said, “a mild recession appears already priced in based on the YTD underperformance of Cyclical vs. Defensive equity sectors, the depth of negative earnings revisions that already matches past recession moves, and the shift in rates markets to price in an earlier and lower Fed Funds peak. With the peak in Fed pricing likely behind us, the worst for risk markets and market volatility should also be behind us.”

In fact, with this in mind, Kolanovic makes the case for the battered tech segment. “We have been arguing to tactically favor Growth over Value, which can also be expressed through a better showing of the Tech sector,” he further explained.

Taking Kolanovic’s outlook and turning it into concrete recommendations, JPMorgan tech expert Doug Anmuth has tagged two tech stocks he sees as primed for over 100% growth. Anmuth holds a top rating from TipRanks, and is ranked among the top 3% of all analysts covered. Let’s find out what JPM’s go-to tech guru has to say.

Nerdy (NRDY)

Let’s start with Nerdy, an education/tech company that uses an interactive digital platform to deliver online learning programs. The company uses its proprietary platform, powered by AI, to personalize learning experiences for students at all levels, from kindergarten through primary and secondary ed, out to professional enrichment. Courses are available in more than 3,000 subjects, in a variety of formats, including one-on-one tutoring, small and large group classes, and self-directed study.

Nerdy, which was founded in 2007, entered the public trading markets last year, through a SPAC transaction with TPG Pace Tech Opportunities. The transaction was approved on September 14, and the NRDY ticker started trading on September 21. The transaction brought more than $575 million in gross proceeds to Nerdy, which was valued at the time at $1.7 billion. Since then, reflecting the market woes, the stock has fallen ~80%.

During that time, however, Nerdy has managed to reach company-record revenue levels. In 1Q22, Nerdy’s top line hit $46.9 million, while the company also recorded $48.5 million in bookings. Per management, these results were up 36% and 30%, respectively, from the year-ago quarter. The company’s Small Class and Group Instruction segment lead the gainers with a 243% year-over-year increase in revenue, to $6.4 million.

On an equally impressive note, Nerdy finished Q1 with no debt on the books and with $141.7 million in cash and liquid assets, putting the firm in a solid position to pursue further growth.

In his note for JPMorgan, Anmuth sees multiple positives supporting Nerdy going forward, writing: “We believe Nerdy’s best-in-class Experts and AI/ML algorithm leveraging 100+ attributes and 80M+ data points to match Active Learners/Experts differentiates the platform from other online learning peers. We believe Nerdy is well positioned for sustainable 20%+ revenue growth driven by 1) US DTC learning TAM expanding from $47B in 2019 to $75B+ by 2025; 2) further expansion of Varsity Tutors for Schools to penetrate the $24B+ ARP learning loss funding; 3) recovery of COVID-driven learning loss; and 4) product innovation— format and subject expansion should create cross-selling opportunities.”

To this end, Anmuth rates Nerdy an Overweight (i.e. Buy), and his $6 price target implies a one-year upside potential of a hefty 183%. (To watch Anmuth’s track record, click here)

With 8 recent analyst reviews, breaking down 6 to 2 favoring Buys over Holds, NRDY shares hold a Strong Buy consensus rating from the Street’s stock pros. The shares are priced at $2.12, and their average price target of $5.13 suggests a robust upside of 142% in the next 12 months. (See Nerdy stock forecast on TipRanks)

Uber Technologies (UBER)

The next JPMorgan pick we’ll look at is Uber, the company that turned the taxi industry inside out and made ride-sharing a household term. Uber pulled up to our front curb back in 2009 offering an easier way for commuters to hire a ride; today the company has expanded its services to include ‘seamless’ employee travel, food deliveries, and even freight bookings. Uber now operates in over 10,000 cities in 72 countries, boasts 115 million monthly active users taking 19 million rides daily, and has paid out a cumulative $180 billion to passenger and delivery drivers.

A month into the third quarter, with the Q2 numbers set for release next week, we can take stock of Uber’s reported results so far this year. The company’s share price is down 45% year-to-date, although revenues are up, having shown a mostly consistent pattern of increases since the corona pandemic crisis hit in 2Q20. The top line in 1Q22 came in at $6.9 billion, for a year-over-year increase of 136%. This number came in higher than the gross bookings; bookings rose y/y by 35%, to reach $26.4 billion.

While Uber has usually posted net quarterly losses, the loss in 1Q22 was unusually large at $3.04 per share. This was a dramatic increase from the 6-cent loss of the year-ago quarter. Uber management attribute the loss to a one-time hit, a $5.6 billion pre-tax charge, relating to various of the company’s equity investments. Uber does not expect the deep loss to continue in further quarters, but rather to moderate back to previous ranges.

In looking at Uber, Doug Anmuth sees a company that is strongly positioned to lead its niche and bring value to investors – and even to cope well with the current inflationary environment.

“We continue to believe Uber is emerging stronger from the pandemic as it focuses on product innovation (Upfront Fares, UberX Share, Hailables) & cross platform advantages (Uber One, accelerated earner onboarding)… Inflationary pressures are harder to gauge as consumers already bear the brunt of higher prices. But elevated living costs could attract more drivers & create greater supply, which could actually help bring down rideshare prices. We recognize Delivery could be more at risk, but Mobility will be the bigger mover on the bottom line. Uber remains a top pick,” Anmuth opined.

As a ‘top pick,’ Uber gets an Overweight (i.e. Buy) rating from Anmuth, who also sets a price target of $48, showing his confidence in a 108% upside for the coming year.

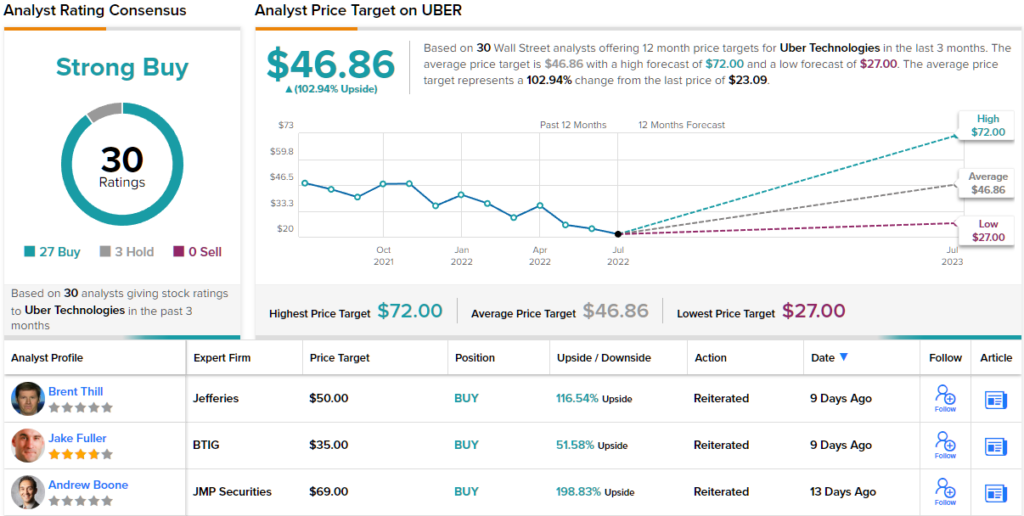

Ever since its founding, Uber has been great at generating buzz, and in the past few months the company has continued to draw attention – in the form of 30 Wall Street analyst reviews. These include 27 Buys against just 3 Holds, for a Strong Buy consensus, and the $46.86 average price target implies ~103% upside from its current trading price of $23.09. (See Uber stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.