There’s been a lot of doomsaying about the economy in recent months, with predictions of a coming recession. The markets have also been a bit shaky in August, with the S&P 500 falling about 3%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But in a note from JPMorgan, global investment strategist Madison Faller keeps a generally favorable outlook and assuages investors that market swings are par for the course.

“In any given year, there are good things and bad things that impact the economy and markets,” Faller said. “And while we tend to see the glass half-full when we examine the current slate of opportunities and risks, we’re also reminded that volatility is normal.”

The mistake many investors make during such times of market pullbacks is a common one. “Investors tend to sell during the dips and miss the recovery – already, flows into cash and out of stocks have been meaningful this year,” Faller explained, before paraphrasing a classic piece of investing advice. “But when investors are fearful, that is often the time to pounce.”

Taking that advice and running with it, J.P. Morgan analysts have homed in two stocks they see as primed to deliver the goods over the coming months – they see them posting gains of up to 110%. We put these names through the TipRanks database to also find out what other Street analysts make of their chances. Here’s the lowdown.

Telephone & Data Systems (TDS)

The first JPM pick we’re looking at is Telephone & Data Systems, a leading provider of telecom services to around 6 million customers across the US. The company offers an array of services, including wireless mobile plans, TV packages, landline phones, high-speed internet, and IT solutions. These IT solutions encompass everything from cloud and hosting services to local connectivity and data centers.

The US telecom sector suffered a body blow earlier this summer, when news broke that a large portion of the ‘legacy’ cable infrastructure, especially in the telephone sector, had originally been laid with lead sheathing. Such leaded cables have long been phased out of newer projects, due to environmental concerns, and there is a public cry to have the old cable sheathing removed – a process that will be costly for landline providers. TDS’s telephone subsidiary, TDS Telecommunications, announced in July that it had less than 10 miles worth of such cables in its network.

In a more recent development, TDS shares experienced a substantial surge this month, more than doubling in value. This upswing followed TDS’s announcement that it’s actively exploring ‘strategic alternatives’ for US Cellular, a company in which TDS holds an 83% stake.

On the flip side, TDS’s recently released Q2 results were a more muted affair. Total revenues, at $1.27 billion, were down ~6% year-over-year and came in $28.15 million below the forecast. The bottom-line EPS, a 17-cent loss per share, was 15 cents per share below expectations.

Even though the company missed the top and bottom lines, it did declare its dividend for the coming Q3. The payment, at 18.5 cents per common share, is scheduled for September 29; the annualized rate 74 cents gives a yield of 4%.

While JPMorgan analyst Philip Cusick highlights the disappointing readout, he makes the case that restructuring the business could be an excellent move – particularly for investors.

“2Q results were generally not impressive and the company lowered its 2023 USM revenue guidance. While churn is doing well, clearly the costs to drive gross adds to USM and retain customers are uneconomic, so selling the company seems like the right move,” Cusick explained. “The exploration of strategic alternatives is likely to unlock substantial value. For TDS, the company’s ~83% stake in US Cellular represents ~80% of its enterprise value. The incremental value from a potential sale of USM supports a higher valuation for TDS shareholders.”

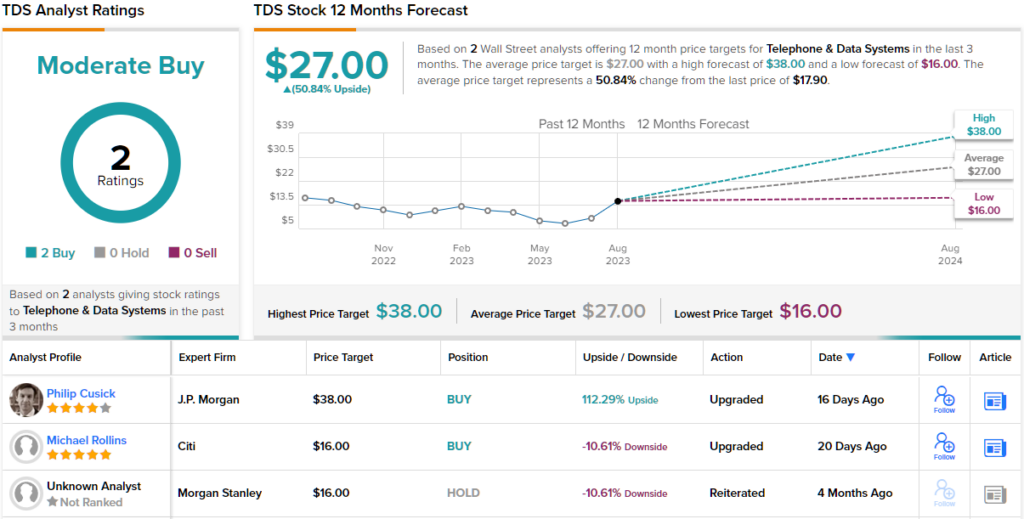

Looking ahead, Cusick rates TDS an Overweight (i.e. Buy) while his price target of $38 implies a robust one-year upside potential of ~110%. (To watch Cusick’s track record, click here)

TDS has slipped under the radar a bit, and only has 2 recent analyst reviews. They both agree, however, that it’s a stock to buy, making the Moderate Buy analyst consensus unanimous. The shares are selling for $17.90 and their $27 average target indicates room for ~51% upside over the next 12 months. (See TDS stock forecast)

HilleVax, Inc. (HLVX)

Next up is HilleVax, a clinical-stage biopharmaceutical firm that specializes in the development of new vaccines for prevention of the norovirus disease. The norovirus is a common – and highly contagious – virus, and is the most common viral cause of acute gastroenteritis in the world. In short, this is the ‘stomach bug,’ responsible for vomiting, diarrhea, and GI-tract pain. The viral disease typically runs 1 to 3 days.

While this is not in the same league as Ebola, the norovirus still exacts a cost on human society. Norovirus is considered responsible for more than 90% of the non-bacterial epidemic outbreaks of gastroenteritis worldwide, and causes more than 700 million cases around the world every year. While not normally lethal, the sheer numbers involved mean that some 200,000 people die of norovirus every year. And, the virus causes some $60 billion in economic costs annually.

That’s what HilleVax is up against. The company is working on preventative treatments, vaccines, for the virus. It’s leading drug candidate, HIL-214 is a virus-like particle (VLP) based vaccine currently underdoing several clinical trials – in infants, children, adults, and older adults.

In the company’s recent business update, for 2Q23, HilleVax announced that it had completed enrollment of the NEST-IN1 trial, the Phase 2b study of the vaccine in infants. There are now over 3,000 subjects enrolled in the study, across six countries. The company expects to release topline safety and efficacy data from this clinical trial in the middle of next year.

The drug’s potential has JPMorgan’s Eric Joseph upbeat on HLVX stock. The analyst writes of the company, its program, and its quality for investors, “Acute gastroenteritis due to norovirus infection posed a significant global health economic burden, concentrated among young children and older adults, and for which there are no approved vaccines or direct acting treatments. Forecasting a ~$1.8B TAM (~$650M in the US) in the infant pediatric setting, we view HilleVax’s HIL-214 as a materially derisked vaccine candidate in the prevention of norovirus speak illness, the commercial potential of which is under-reflected at current levels. Top-line phase 2b data (mid2024) is seen as the primary value for shares over the foreseeable horizon.”

These comments support Joseph’s Overweight (i.e. Buy) rating, while his $22 price target indicates potential for ~69% upside over the next year. (To watch Joseph’s track record, click here)

Overall, this biopharma gets a Strong Buy from the analyst consensus, based on 4 unanimously positive reviews on file. The shares are trading for $13 and the $31.25 average price target is even more bullish than Joseph will allow, implying a strong gain of ~141% lies in wait for the coming year. (See HLVX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.