The Fed’s efforts to tame runaway inflation are evidently working. In June, inflation increased by just 3% year-over-year, well under headline inflation’s 41-year-record of 9% seen a summer ago.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That’s some schooling for the bears, says Jeremy Siegel, who hails the latest figures a “goldilocks report.”

The effect is to not only send the bears into hibernation, but to herald a new outlook for the economy and the markets. The Wharton School professor of finance thinks the “battle is won against inflation and there’s no reason to turn on the screws and risk a recession.”

“The progress we have made is really very very substantial,” Seigel goes on to say. “The real economy is really hanging in there and it’s remarkable, it’s the ideal environment for stocks.”

But what stocks to lean into against such a positive backdrop? Wall Street’s cadre of analysts have some ideas about that. We delved into the TipRanks database and pulled up the details on two names certain analysts think make good additions to a portfolio right now. In fact, some experts believe both boast triple-digit upside potential. Moreover, the pair are also rated as Strong Buys by the analyst consensus. Here’s the lowdown.

IHS Holding (IHS)

We’ll start off with IHS Holding, a prominent telecommunications infrastructure provider operating in various emerging markets across the globe. In fact, it is the world’s fourth-largest telecom tower operator, with the bulk of its operations in Africa – Nigeria, where the company was founded – representing its biggest revenue generator, while the rest are primarily in South America.

Founded in 2001, the company’s primary focus lies in building, maintaining, and leasing telecommunications towers to mobile network operators. By providing essential infrastructure, IHS has been behind the growth and development of telecommunication services in many of the regions it operates in.

The company has been posting steady sequential growth for the past couple of years, as was the case in the most recently reported quarter, for 1Q23. The revenue for this quarter amounted to $602.53 million, reflecting an impressive year-over-year increase of 35.06%. This figure surpassed the consensus estimate by $32.56 million. Furthermore, the adjusted EBITDA saw a significant rise of 37% from the same period last year, reaching $335.4 million. The company also stuck to its 2023 guide for revenue in the range between $2.190-2.220 billion, and adjusted EBITDA of $1.200-1.220 billion.

The shares have put in a good showing this year, beating the market by delivering gains of 46%. Nevertheless, TD Cowen analyst Gregory Williams thinks the company is not being appreciated to the extent it deserves.

“The IHS model is proving resilient despite the volatility in emerging markets, and is a testament to solid execution, contractual protection (FX resets, CPI escalators, diesel hedges), wireless demand, and healthy carrier customers. The balance sheet is in good shape, Nigeria FX overhang is wrapping up, and share float should meaningfully improve in October to attract a broader set of investors… All said, despite the meaningful YTD stock rally, shares remain woefully undervalued,” Williams opined.

“Woefully undervalued,” indeed. According to Williams’ $29 price target, the shares are trading 212% below their fair value. No need to add, Williams rates the shares an Outperform (i.e., Buy). (To watch Williams’ track record, click here)

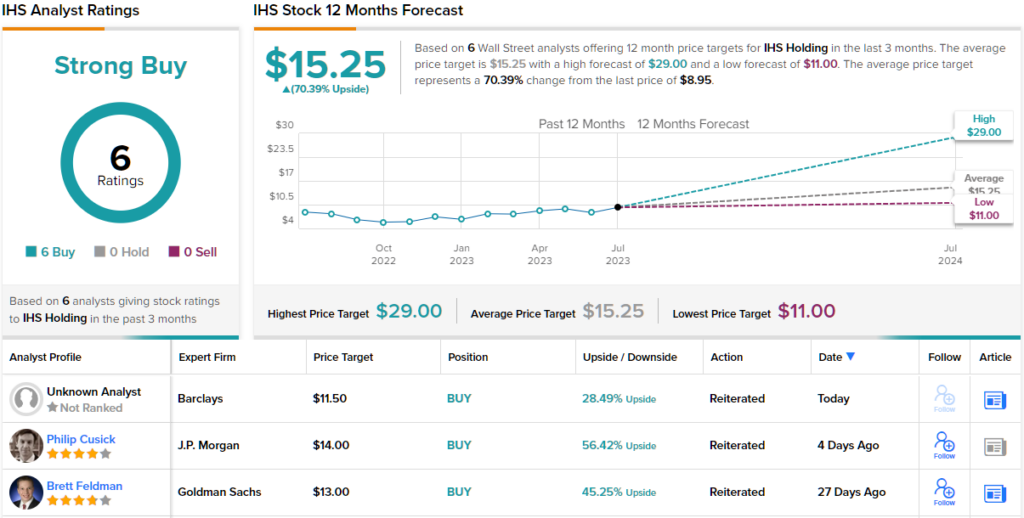

Turning now to the rest of the Street, other analysts are on the same page. With 6 Buys and no Holds or Sells, the word on the Street is that IHS is a Strong Buy. Given its $15.25 average price target, upside of ~70% could be in store for investors. (See IHS stock forecast)

Nuvei Corporation (NVEI)

Now, let’s shift our focus from the telecom industry to the realm of payment processing. Montreal-based Nuvei is a leading global payment technology company that provides businesses with payment processing solutions.

Nuvei’s comprehensive platform enables merchants to accept various payment methods, including credit cards, alternative payment options, and electronic transfers. The platform is able to accommodate over 450 regional and non-traditional payment methods, allowing merchants to receive payments in over 200 global markets. The company’s advanced technology also incorporates features like fraud prevention and risk management, ensuring enhanced security and reducing potential financial risks for businesses.

It’s a model that served the company well in the last reported quarter, for 1Q23. In the quarter, revenue climbed by 19.6% to $256.5 million, while beating the Street’s call by $3.65 million. At the other end of the scale, Adj. EPS of $0.44 met analyst expectations.

While those results were good, the outlook for the immediate future was a bit of a disappointment for investors. The company anticipates Q2 revenue will be in the range between $300 -$308 million, below the $312 million consensus had in mind. Adjusted EBITDA is expected to hit $105-$110 million, also below the Street’s forecast of $120.4 million.

Nevertheless, in the quarter, Nuvei completed a major acquisition that should serve it well in the long run. It bought integrated payment and commerce solutions provider Paya into the fold, for $1.3 billion.

The potential of the new addition partly informs Canaccord analyst Joseph Vafi’s bullish thesis for Nuvei. The 5-star analyst writes, “Nuvei is not standing still on margin drivers and has indicated that it will move forward with its own back-end processing platform for the US this year as well which will result in higher gross margins over time. We see this move right now as strategically sound on many fronts. First, with the recent acquisition of Paya, NVEI now has a much larger US footprint, which balances its large ex-US presence. Investing now in this processing capacity will reap material cost savings on growing US volumes. But perhaps just as importantly, bringing processing in-house becomes one more step in making the Nuvei platform an even more elegant solution for customers, enhancing payment flexibility and reporting while also boosting approval rates.”

“We continue to see NVEI shares as quite attractive relative to its margin/growth profile in comparison to close peers. We believe the valuation here has room to move at least three or four turns higher relative to its current EV/EBITDA multiple,” Vafi summed up.

Accordingly, Vafi rates NVEI shares a Buy while his $70 price target implies one-year share appreciation of ~105%. (To watch Vafi’s track record, click here)

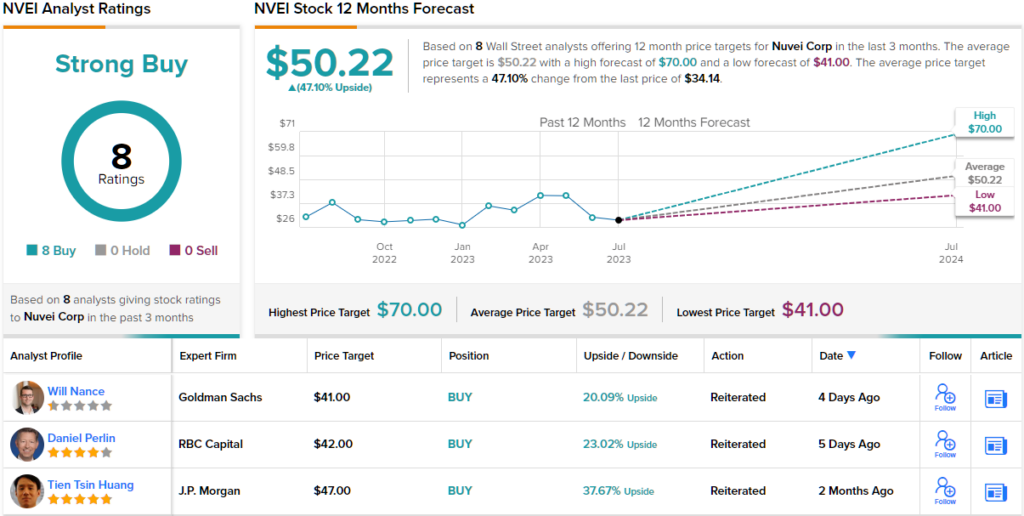

Overall, NVEI gets a full house of Buys – 8, in total – naturally making the consensus view here a Strong Buy. At $50.22, the average target represents 12-month returns of a robust 47%. (See NVEI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.