The iShares U.S. Aerospace & Defense ETF (BATS:ITA) can serve as a useful hedge to defend your portfolio in a world where armed conflict is increasingly coming into the foreground. Additionally, I’m bullish on the ETF, as it has been a strong performer over the long term. The stocks it owns are strong businesses with significant “moats,” and many of them trade at reasonable valuations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What is the IAT ETF’s Strategy?

iShares explains that the “iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector.” It aims to give investors “exposure to U.S. companies that manufacture commercial and military aircrafts and other defense equipment.”

Escalating Conflict Worldwide

Unfortunately, we live in a world where armed conflict is intensifying in many areas around the globe, and demand for this defense equipment should remain high.

The war between Russia and Ukraine has turned into a major, prolonged land war in Europe. Elsewhere in Europe, while it hasn’t received as much press, there are high tensions between Armenia and Azerbaijan over the disputed Nagorno-Karabakh region.

The Middle East is sadly a hotspot of conflict, and the war between Israel and Hamas in Gaza could theoretically spread to become a larger conflict and include other actors in the region. And while we don’t hear as much about it in the media, the war in Ethiopia’s Tigray region has actually been more deadly than the Russia-Ukraine conflict. There are also ongoing conflicts in places like Mali, Nigeria, Yemen, and Myanmar.

While it may be more of a ‘grey swan’ (an event that is known and possible but perceived as unlikely to occur) than something imminent, there are also concerns that the likelihood of a major conflict between the United States and China in the Pacific is increasing.

There are a multitude of territorial disputes between China and its neighbors in the South China Sea, and the Council on Foreign Relations’ Global Conflict Tracker classifies the likelihood of a confrontation between the United States and China over Taiwan as “worsening.”

Beyond the destruction and loss of life, any escalation of these conflicts or ripple effects where other regional powers are drawn into the fighting could also severely disrupt the global economy and serve as a major shock to the stock market, causing major stock indices to decline in value. For instance, the U.S. National Security Council has warned, according to Bloomberg, that an attack on Taiwan could lead to a $1 trillion disruption of the global economy.

Holding an ETF like ITA, which owns aerospace & defense stocks, the companies that make the defense systems, weapons, and other equipment that will be needed in these conflicts, would be one way for investors to hedge against these risks.

IAT’s Holdings

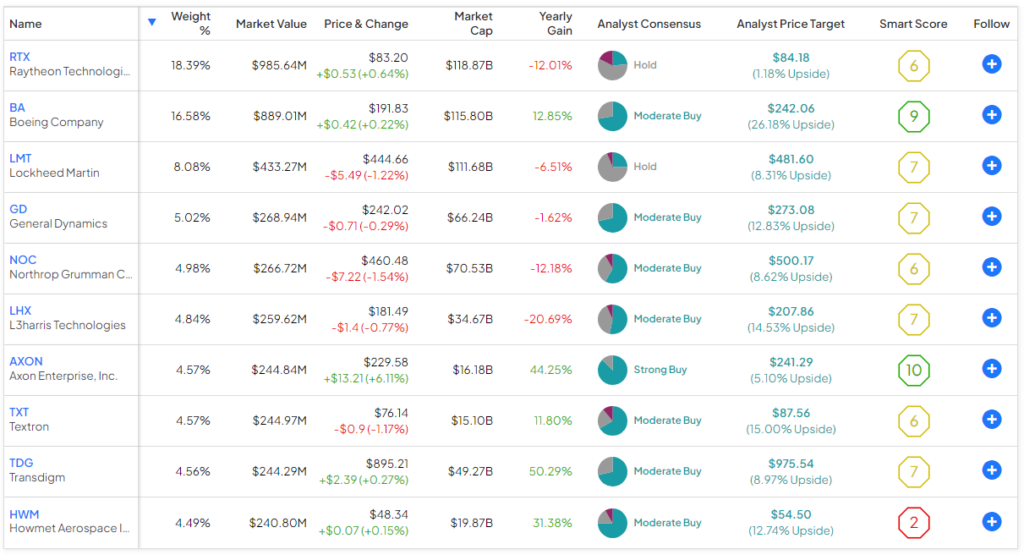

IAT has just 35 holdings, and its top 10 holdings make up over 76% of the fund, so this is not a particularly diversified ETF if that’s what you’re looking for.

Below, you can check out an overview of ITA’s top 10 holdings using TipRanks’ holdings tool.

Note that several large-cap defense and aerospace companies occupy huge positions within the fund. Top holding RTX Corporation (NYSE:RTX), which recently beat earnings and announced a large buyback plan, has an 18.4% weighting, while Boeing (NYSE:BA) has a 16.6% weighting. Lockheed Martin (NYSE:LMT) comes in at 8.1%.

Normally, this lack of diversification could be troubling, but an ETF like this is used to express a single-sector view on the defense sector, ameliorating this concern. Furthermore, I view ITA as more of a hedge or an ‘insurance policy’ as part of a balanced portfolio in case a major conflict escalates and threatens stock market valuations. If there is a major escalation of the aforementioned conflicts, these are the stocks that you want to own.

Solid Long-Term Performance

The nice thing about ITA is that even if these major conflicts don’t intensify, the ETF has been a solid performer over the long term anyway. Its track record indicates that it should be able to provide solid returns for investors going forward.

For example, over the past three years, ITA has generated an impressive annualized total return of 14.3%. Its five-year annualized return of 3.9% is less impressive, but looking back 10 years, ITA has generated annualized returns of 9.8%. Furthermore, since its inception in 2006, it has generated annualized returns of 10.0%. Investing in stocks or ETFs with double-digit annualized returns over a long time frame is a great way to compound your portfolio.

Strong Moats, Modest Valuations

This ETF has performed well because these aerospace & defense companies are strong businesses with significant moats around them. Aerospace & defense equipment is technologically advanced and takes considerable expertise to manufacture. Not only that, but there are significant barriers to entry, as it takes considerable financial resources and investment in research and development (R&D) to create these types of products.

Furthermore, companies like Lockheed Martin and RTX have strong, longstanding relationships with the U.S. government that took years to build, so it would be difficult for a new challenger to come in and disrupt these incumbents.

Despite these advantages, the valuations of many of these top aerospace & defense stocks aren’t prohibitively expensive. For example, top holding RTX Corporation trades at 16.5 times 2023 earnings estimates, while Lockheed Martin also trades at 16.5 times 2023 earnings estimates. These aren’t the types of single-digit multiples that value investors would be pounding the table over, but they still represent tangible discounts to the S&P 500 (SPX), which currently has a forward price-to-earnings multiple near 20.

Reasonable Expense Ratio

ITA has a fairly middle-of-the-road expense ratio of 0.40%. This means that an investor allocating $10,000 into IAT would pay $40 in fees in year one. Assuming that the expense ratio remains at 0.40% and the fund returns 5% per annum going forward, this same investor would pay $505 in fees over the course of 10 years.

Is ITA Stock a Buy, According to Analysts?

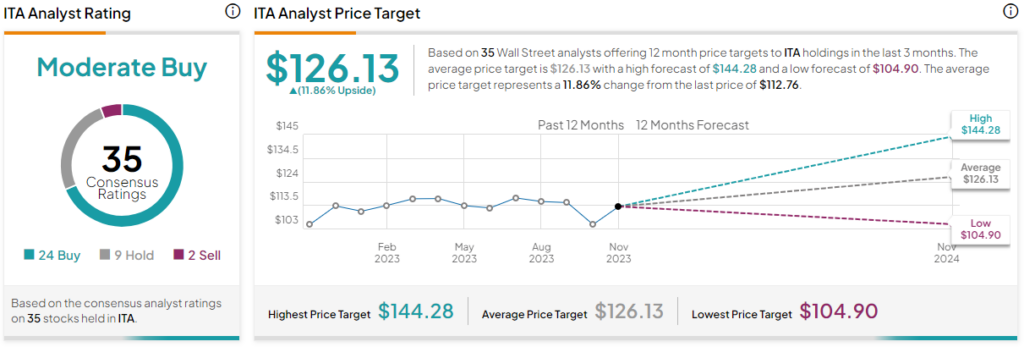

Turning to Wall Street, ITA earns a Moderate Buy consensus rating based on 24 Buys, nine Holds, and two Sell ratings assigned in the past three months. The average ITA stock price target of $126.13 implies 11.9% upside potential.

Looking Ahead

ITA has been a strong compounder over the course of many years, building a solid track record of performance. Its holdings are strong businesses with real moats, and many also trade for quite reasonable valuations. While its expense ratio isn’t cheap, it also isn’t prohibitively expensive.

Because of the nature of its holdings (U.S. aerospace & defense stocks), ITA seems well-positioned in a world of intensifying armed conflict and could help protect the value of your portfolio in the event of more major wars breaking out. In the meantime, if this doesn’t happen, it seems likely to continue to keep chugging along and putting up some nice gains for investors as it has for many years.