Workhorse (WKHS) has had its fair share of problems recently. A delay to the decision on a coveted US Postal Services (USPS) contract – for which the electric delivery van maker is a frontrunner – plus battery supply issues have slightly soured one of 2020’s success stories. However, despite shares pulling back by 20% so far in December, the year has been a bountiful one; the stock is up by a mighty 618% year-to-date.

The question investors have to ask, then, is the bull case for WKHS still intact?

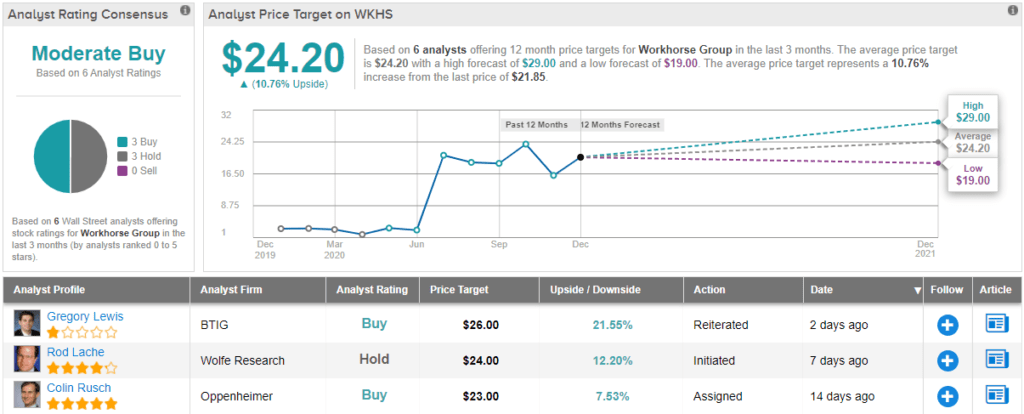

After hosting investor meetings with the company’s top brass, BTIG analyst Gregory Lewis says ‘yes.’ Lewis rates WKHS a Buy along with a $26 price target. Investors could be scooping up 19% of gains, should the analyst’s thesis play out over the coming months. (To watch Lewis’ track record, click here)

Addressing the two recent stumbling blocks, Lewis believes Workhorse made a mistake by sourcing its batteries from only one vendor. The supply constraints have impeded production rates, although Covid-19 also played its part in the disruption. To remedy the situation, the company has been looking at adding other battery suppliers and “expects to add two battery suppliers to its supply chain next year.”

The company also reiterated its Q3 earnings call target of producing 1,800 vehicles next year; Workhorse expects to manufacture 100 vehicles a month by the end of the first quarter, and 200 by the end of Q2.

“In terms of getting to free cash flow positive,” Lewis said, “Management thinks volume needs to be in the 300 vehicle/month range.”

Currently, however, the WKHS story is heavily reliant on the outcome of the lucrative USPS contract award.

The decision on which company will receive the $6.3 billion 165,000 vehicle contract to replace the USPS’s aging delivery trucks has already been through several delays.

According to the USPS, its verdict on the matter is now expected in 1Q21. Among the 3 bidders left, Workhorse is the only company offering an all-electric option.

“As we have noted in the past, we are less concerned about when it is announced and more concerned about how much of the contract WKHS wins,” Lewis said. “We continue to view the USPS contract as a significant potential catalyst for the stock.”

Amongst Lewis’ colleagues, opinions are split when considering Workhorse’ next 12-month performance. The stock has a Moderate Buy consensus rating, based on 2 Buys and 3 Holds. The bulls are in the driving seat, as the $23.75 average price target suggests upside of ~11% in the year ahead. (See WKHS stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.