Shares of DiDi Global (DIDI) saw a fresh lease of life and bounced back almost 25% to $2.30 on June 6, following the news that Chinese regulators were concluding their months-long probe, which had hammered the stock.

Furthermore, according to a report by the Wall Street Journal, regulators are removing the ban on Didi Global from adding new users and are also allowing its apps back on domestic app stores this week.

DiDi Global is a China-based mobility technology platform. It offers a wide range of app-based services across markets including Asia-Pacific, Latin America, and Africa, which include ride-hailing, taxi-hailing, chauffeur, hitch, and other forms of shared mobility, along with auto solutions, food delivery, intra-city freight, and financial services.

DiDi’s Roller Coaster Ride on the NYSE

The Chinese ride-hailing giant raised a whopping $4.4 billion through a mega-successful IPO listing on the New York Stock Exchange (NYSE) on June 30, 2021.

However, the euphoria over the DiDi stock was short-lived after the much-awaited listing as Chinese regulators immediately commenced a data-security investigation into the company, citing national security concerns.

In July 2021, the regulators ordered 25 mobile apps operated by DiDi to be removed from app stores in the country, and the ban prevented DiDi from adding new users.

The Cyberspace Administration of China alleged that DiDi breached privacy laws and that its IPO documents gave out sensitive information. The extensive probe that followed included rigorous on-site inspections of internal records and emails, as well as internal communications.

The tightening probe by the Chinese authorities had grim ramifications and DiDi’s share price was bludgeoned from its highs of $18.01 around the time of its listing to the absolute lows of $1.37 seen last month.

The situation further worsened last month when U.S. regulators started an investigation over DiDi’s failed IPO listing last year.

To put an end to the regulatory clampdown, last month, the company disclosed that its shareholders approved its plan to delist from the New York Stock Exchange.

The delisting comes less than a year after its initial listing. The company indicated that it will pursue a new listing in the Hong Kong stock index.

Lifting the Prolonged Ban

After grappling with the recent downturn in the Chinese economy following the resurgence of COVID-19 and layoffs at big tech companies, Beijing has decided to revive the economy by loosening its regulatory scrutiny on the Chinese tech behemoths.

Not just DiDi, but two other Chinese tech companies, including the logistics platform Full Truck Alliance (YMM) and online recruitment services company Kanzhun Ltd (BZ), which are listed in the U.S., will have their apps back on app stores this week, according to the WSJ.

According to the WSJ report, while the other two companies may pay a smaller fine, DiDi is expected to pay a huge financial penalty once the probe’s conclusion is announced. Furthermore, the three companies will offer a 1% equity stake to the Chinese government and give them a direct role in their corporate decisions.

Investor Sentiment

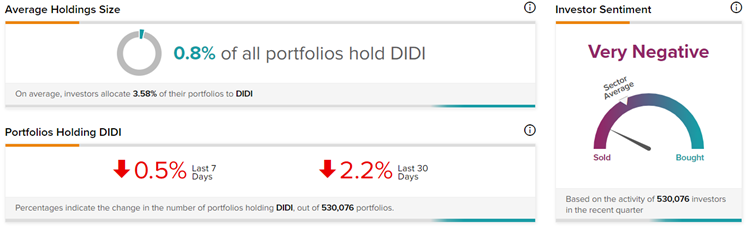

Although the DiDi stock has revived after the regulatory ban was lifted, investors continue to have a cautious outlook.

According to the TipRanks’ Stock Investors tool, investors currently have a Very Negative stance on DiDi, with 0.5% of investors decreasing their exposure to DIDI stock over the past seven days.

Bottom-Line

The resolution of the prolonged cybersecurity investigation by the Chinese regulators is a great positive for the DiDi stock as well as the Chinese economy. The DiDi shares valuation could now bottom out and prepare for an upswing.

Ever since the DiDi fiasco began, U.S. regulators have put a tight leash on Chinese IPOs, demanding more disclosures before allowing them to go public in the U.S.

The investor community’s confidence could be restored and this may put an end to the looming concerns of the shareholders on DiDi as well as the overall Chinese tech space.