The U.S. Securities and Exchange Commission’s (SEC) crackdown on Binance and other crypto entities seems to be impacting BNB-USD, the native currency of the crypto exchange, and Bitcoin (BTC-USD) in different ways. As per Coindesk’s report on Wednesday, the Binance smart chain’s native token touched a five month low of $252. However, the impact seems relatively limited on Bitcoin, the largest cryptocurrency by market capitalization.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Impact of Increased SEC Scrutiny

Several reports on early Tuesday revealed that crypto investors pulled out over $790 million from the crypto exchange Binance in 24 hours after the SEC filed a lawsuit against Binance, CEO Changpeng Zhao, and the operator of Binance.US, accusing them of misusing customer funds and diverting them to entities owned by Zhao.

The SEC is also tightening the noose around another crypto exchange Coinbase Global (NASDAQ:COIN). Coinbase is threatening to take the battle to the Supreme Court if needed. The SEC contends that both Coinbase and its rival Binance violated federal securities laws, based on the regulatory body’s classification of several cryptos as currencies rather than securities.

However, a report by Coindesk on Thursday revealed that there have been no signs of panic among Bitcoin traders, as reflected by options-based implied volatility metrics. The report cited independent crypto derivatives trader Christopher Newhouse, who noted that regulatory concerns have been existing since the start of this year and perhaps the market has already factored in the SEC’s actions.

Meanwhile, Griffin Ardern, a volatility trader at crypto asset management firm Blofin, thinks that the SEC’s crackdown is more damaging to alternative cryptocurrencies, or coins other than Bitcoin. He opines that one of the possible reasons for the limited impact on Bitcoin and Ethereum’s Ether (ETH-USD) is that they have already been certified by the U.S. Commodities and Futures Trading Commission (CFTC), while the SEC is mainly targeting altcoins, with many being classified as securities.

Overall, crypto market might continue to be volatile in the days ahead as the heightened SEC scrutiny remains an overhang. However, currently the impact is expected to be more on BNB-USD and altcoins compared to Bitcoin.

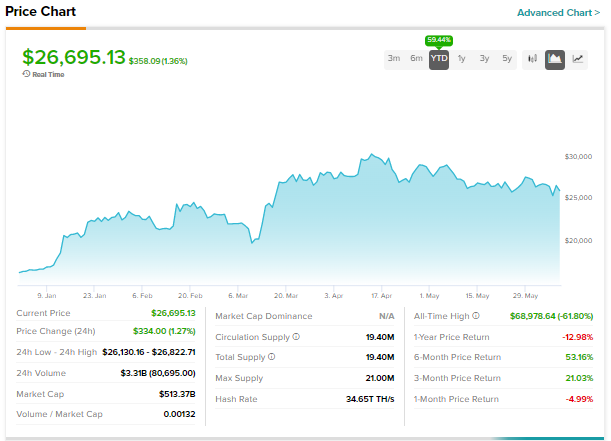

Despite the ongoing volatility, Bitcoin is up over 59% since the start of this year.