Coinbase (NASDAQ:COIN) is gearing up to challenge the U.S. Securities and Exchange Commission (SEC), possibly taking the battle all the way to the Supreme Court. The SEC recently filed suits against both Coinbase and its rival, Binance, arguing that these crypto exchanges violated securities laws due to the SEC’s classification of many cryptos as securities rather than currencies.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

This classification, the SEC claims, necessitates that these assets and the exchanges facilitating their trading be registered. “We’re prepared to take this to the Supreme Court if need be. We believe every court that examines this issue will conclude that the SEC is fundamentally incorrect,” said Coinbase’s Chief Legal Officer, Paul Grewal, during an interview with Bloomberg.

In an ongoing effort to seek clear guidance from regulators, Coinbase filed a suit against the SEC in April, following up on its July 2022 petition requesting the regulator to formally provide guidance to the crypto industry. In reaction to the suit, Coinbase’s CEO Brian Armstrong reiterated the need for clear crypto regulations in the U.S. via Twitter. Amid these ongoing battles, a U.S. appeals court asked the SEC to provide a response regarding its decision on Coinbase’s petition within seven days.

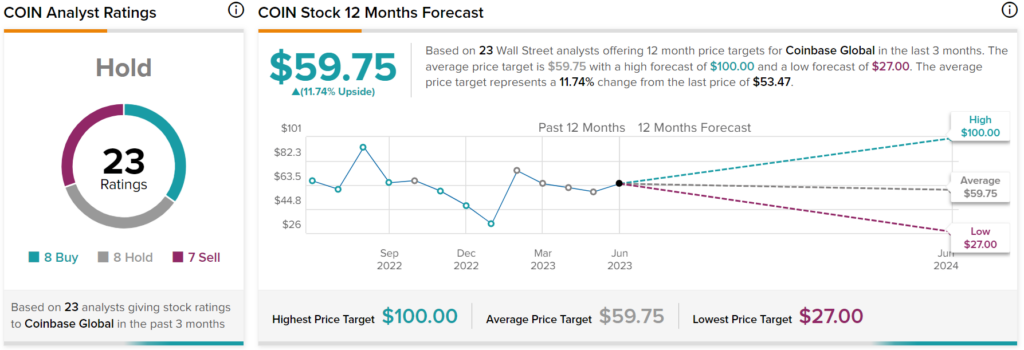

Turning to Wall Street, analysts are uncertain about COIN stock with a Hold consensus rating based on eight Buys, eight Holds, and seven Sells assigned in the past three months. Nevertheless, the average price target of $59.75 per share implies 11.74% upside potential.