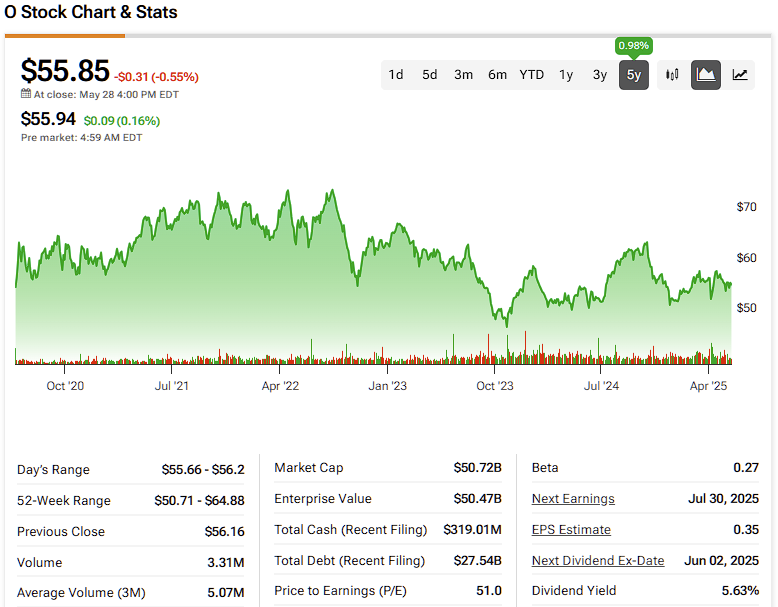

Realty Income (O), the self-proclaimed “Monthly Dividend Company,” is now trading at levels not seen since 2016, a nearly decade-long period of flat capital gains that’s tough to stomach for any investor. High interest rates in recent years have prompted investors to seek higher-yielding alternatives, thereby compressing the stock’s valuation. Yet, after this rough patch, the Realty Income is looking mighty appealing, boasting a sturdy 5.63% dividend yield while steadily hiking its payout. For this reason, I am bullish on the stock from its current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Global Expansion Fuels New Opportunities

To begin with, despite the lackluster sentiment surrounding the stock, there are several reasons to like Realty Income today. Notably, the REIT has been busy stretching its legs beyond the U.S., and it’s paying off in a big way.

In Q1, the company deployed $1.4 billion into investments, with a notable $893 million allocated to Europe at a 7.0% cash yield. A standout move was their €527 million deal with Decathlon, a global sporting goods giant, adding prime commercial properties in the U.K. and Spain to their portfolio. Realty Income is securing long-term, stable leases with top-tier tenants, locking in steady cash flow to support its monthly dividends.

I particularly appreciate seeing the company not just chase new markets, but also intelligently diversify its asset mix. While retail still dominates at 79.9% of their portfolio, they’re leaning into industrial properties (14.4%) and even dipping their toes into gaming and data centers. Their joint venture with Digital Realty to develop hyperscale data centers for an S&P 100 company demonstrates that they’re not afraid to pivot toward high-growth sectors. This global and sectoral spread cushions them against regional slumps, keeping the revenue engine humming.

Steady Portfolio Performance Keeps the Cash Flowing

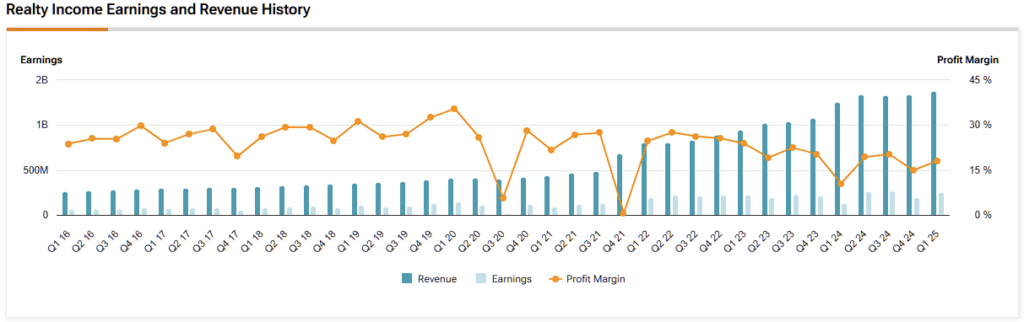

However, beyond the recent investments, Realty Income’s core portfolio remains a well-oiled machine, consistently generating dependable rental income. In Q1, the REIT reported revenue of $1.38 billion, blowing past estimates of $1.27 billion. Same-store rental revenue increased by 1.3% year-over-year, a modest yet steady rise that reflects the strength of their 15,627 properties, leased to 1,598 clients across 91 industries. With a 98.5% occupancy rate and a rent recapture rate of 103.9%, they’re squeezing every penny out of their leases, even in a tricky economic climate.

You have to admit, it is how they manage this growing empire. Long-term net leases, averaging 9.1 years, secure reliable tenants such as Amazon (AMZN) and Starbucks (SBUX), which consistently pay the rent. The stability provided by such dependable tenants is the backbone of the REIT’s ability to pay and grow dividends without issue, even in challenging environments within the retail real estate market.

AFFO Growth Signals a Healthy Future

Turning to the bottom line, Realty Income’s AFFO per share highlights the REIT’s solid profitability. In its latest report, AFFO per share came in at $1.06, a 2.9% increase year over year. While not explosive, this steady growth reflects accretive investments—those that enhance shareholder value on a per-share basis. To put that in perspective, the company achieved a 4.8% increase in AFFO per share last year, marking 14 consecutive years of growth. That level of consistency is exactly what long-term income investors look for.

This steady performance is also what underpins Realty Income’s reliable dividend increases. With 2025 guidance calling for AFFO per share between $4.22 and $4.28—up from $4.19 last year—the REIT is on track for another year of solid bottom-line expansion. As a result, there remains ample room for continued dividend growth, evidenced by the fact that the company has already raised its payout twice this year.

A Rare Yield with Proven Dividend Prowess

After years of underperformance, Realty Income’s stock now offers a compelling 5.63% dividend yield—a rare figure for a Dividend Aristocrat with a 28-year track record of uninterrupted dividend growth. Since going public in 1994, the company has raised its dividend 110 times, often more than once per year. Its monthly payout schedule is an added bonus for income-focused investors seeking consistent cash flow.

What makes this yield particularly attractive is the underlying strength of the business. Both revenue and AFFO per share are on an upward trajectory, supporting a strong investment case that blends dependable income with steady growth. If interest rates begin to decline in the medium term, there’s also the potential for a valuation re-rating, adding a layer of upside to an already appealing income play.

Is Realty Income a Buy, Hold, or Sell?

Despite the lackluster returns in recent years, Realty Income’s investment case seems cloudy to Wall Street analysts. Specifically, Realty Income stock has a Hold consensus rating based on three Buys and ten Holds over the past three months. At $60.75, the average O stock price target implies an upside potential of ~9% over the next twelve months.

Realty Income’s Pullback Offers Opportunity to Lock In Quality Yield

Realty Income’s pullback to 2016 price levels presents a rare opportunity to acquire a high-quality REIT at a compelling valuation. With a diversified global portfolio, consistent AFFO per share growth, and a strong foundation for long-term performance, the company remains well-positioned for the future.

The ~5% dividend yield—supported by nearly 30 years of uninterrupted dividend increases—stands out as a valuable find in today’s uncertain market environment. For income-focused investors, this may be an ideal moment to secure reliable cash flow and benefit from Realty Income’s track record of resilience.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue