Pfizer (PFE) stock has been among the under-performers in the last 12 months. Even with the positive tailwinds related to the vaccine against COVID-19, the stock has trended higher by just 12% during this period.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Considering several business catalysts and forward valuation, it seems that PFE stock is undervalued. While the broad markets trade near all-time highs, Pfizer stock trades at an attractive forward price-to-earnings-ratio of 11.0. (See Pfizer stock charts on TipRanks)

Let’s discuss the factors that make Pfizer worth considering.

Impact of the COVID-19 Vaccine on Pfizer’s Growth

In the foreseeable future, the company’s vaccine against COVID-19 is likely to be the revenue and cash flow driver.

For the current year, Pfizer expects revenue of $26 billion from BNT162b2. The revenue is expected to come from 1.6 billion doses of the vaccine to be delivered in 2021.

Importantly, Pfizer is expected to have a manufacturing capacity of 3 billion doses of the vaccine in 2022. Depending on new contracts, the company’s revenue from BNT162b2 can be possibly higher in the coming year.

Recently, Pfizer announced that the company has signed a deal with Biovac Institute to manufacture and distribute COVID-19 vaccine doses within Africa. The company is also in the final stages of vaccine approval in India, which is another big market.

There are two other factors that can help Pfizer boost top-line from the vaccine.

First and foremost, the U.S. FDA has approved the emergency use of the vaccine among adolescents. It seems likely that more countries will approve the emergence use of the vaccine for the population below 18.

Additionally, Pfizer CEO Albert Bourla believes that a third dose of the vaccine might possibly be needed 12 months after full vaccination.

Therefore, in all probability, healthy cash flows will sustain from the COVID-19 vaccine segment in the next few years.

Strong Pipeline of Drugs

Impact on growth due to drugs losing exclusivity in the coming years is one factor that has translated into depressed valuation.

However, it’s worth noting that Pfizer has a deep pipeline of late-stage drugs. The pipeline is for conditions that include oncology, inflammation, immunology and rare diseases. To elaborate further, Pfizer currently has 10 candidates in the registration phase, 22 candidates in Phase 3, and 37 drug candidates in Phase 2.

Pfizer believes that excluding the impact of the COVID-19 vaccine contribution, the company can sustain top-line growth of 6% through 2025. If this guidance holds true, the stock does seem undervalued.

Pfizer has guided for research and development expense of $9.8 to $10.3 billion for the current year. Given the focus on the pipeline, it seems that the markets might be overestimating the impact of drugs losing exclusivity.

Wall Street’s Take on Pfizer

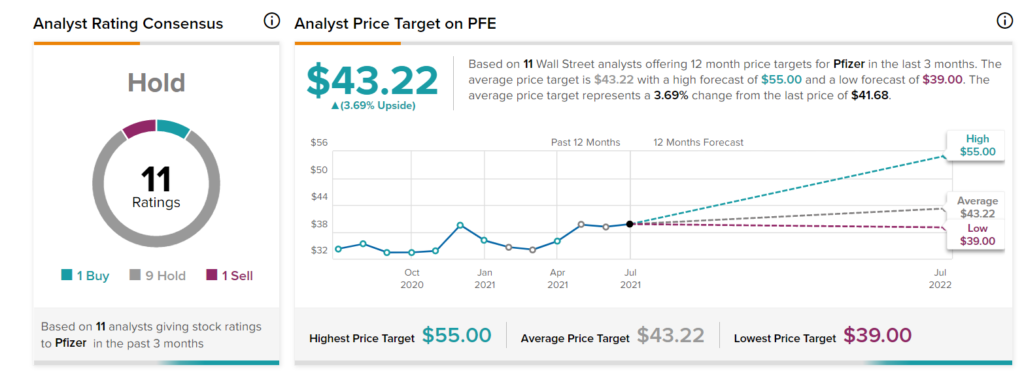

According to TipRanks’ analyst consensus rating, PFE stock comes in as a Hold with 1 Buy, 9 Hold and 1 Sell ratings assigned in the last three months.

As for price targets, the average Pfizer price target is $43.22 per share, implying around 3.7% upside potential from current levels.

Concluding Views on Pfizer

For Q1 2021, Pfizer reported operating cash flow of $4.5 billion. This implies an annualized cash flow of $18 billion. Cash flows are likely to remain robust in the next few years.

This will ensure that Pfizer has ample headroom to invest in the drug pipeline. At the same time, the company has an annualized dividend pay-out of $1.56 per share. This translates into an attractive dividend yield of 3.8%.

With markets trading near all-time highs, it also makes sense to consider exposure to some low beta stocks. Pfizer, with a beta of 0.74, seems like a good pick among defensive stocks.

Disclosure: On the date of publication, Faisal Humayun did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.