Shares of CarParts.com (NASDAQ:PRTS) are down over 49% year-to-date. However, Street is bullish about this penny stock (learn more about penny stocks here). Moreover, analysts’ average price target suggests enormous upside potential in CarParts.com stock from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s see why.

Is CarParts a Good Stock to Buy?

CarParts.com is an online marketplace selling automotive parts and accessories for car repair and maintenance. The company’s stock has faced challenges due to prevailing macroeconomic headwinds, prompting consumers to postpone discretionary spending. With consumers opting to delay nonessential purchases, the company is experiencing price compression, thereby constraining its overall revenue growth.

Nonetheless, the strength in unit growth and a rebound in consumer demand will likely drive CarParts’ financials, which, in turn, will boost its share price. Further, its efforts to drive cost savings, a debt-free balance sheet, and share buybacks act as catalysts, noted Darren Aftahi of Roth MKM. Aftahi lowered his price target on PRTS stock due to the near-term headwinds. However, the analyst said that the company’s focus on its mobile app and logistical upgrades will lead to cost savings in the long term. In an investor note dated October 31, Aftahi reaffirmed a Buy rating for CarParts.com stock, stating, “With $67M in cash, no debt, and a stock buyback in place, we believe PRTS has some miles left in the tank.”

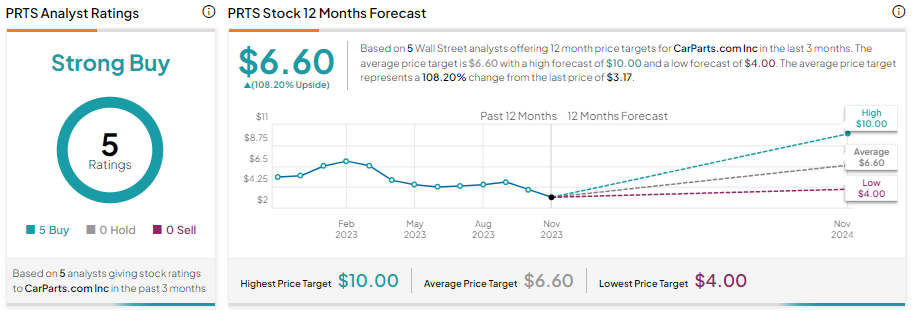

Including Aftahi, CarParts.com stock has five unanimous Buy recommendations, translating into a Strong Buy consensus rating. Further, the average PRTS stock price target of $6.60 implies a 108.20% upside potential from current levels.

Bottom Line

Despite grappling with price compression, CarParts.com is focusing its efforts on enhancing and modernizing its website platform. This strategic move aims to incorporate features such as improvements in search results, cross-sell and upsell capabilities, loyalty programs, and more. These measures have the potential to drive its overall revenue. Additionally, the company’s emphasis on recurring e-commerce revenue and a focus on cost-savings bode well for future growth, as reflected in analysts’ Strong Buy consensus rating.

While PRTS stock presents significant upside potential, as indicated by analysts’ average price target, investors can leverage TipRanks’ penny stock screener to discover more such compelling penny stocks.