Shares of Antero Resources (NYSE:AR) and EQT (NYSE:EQT) have underperformed the broader markets this year, reflecting the significant drop in natural gas prices. However, shares of these natural gas producers closed higher on Monday, April 10, due to the 8% jump in U.S. natural gas futures. While AR and EQT stocks closed in the green, Wall Street analysts are optimistic about their prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the Nymex natural gas May futures closed over 8% higher at $2.172/MMBtu as traders covered their short positions. Further, the expected increase in demand could support natural gas prices, and in turn, the financials of these companies.

Against this background, let’s check what TipRanks’ data indicates for AR and EQT stocks.

Is Antero a Buy, Sell, or Hold?

The decline in average realized prices and lower demand weighed on Antero’s financials and its stock price, which is down about 22% year-to-date. However, analysts maintain a cautiously optimistic outlook on AR stock as the reopening of the Chinese economy provides a favorable backdrop for NGL (Natural Gas Liquid) and propane prices.

On TipRanks, Antero stock sports a Moderate Buy consensus rating, reflecting eight Buy and five Hold recommendations. At the same time, these analysts’ average price target of $35 implies 45.17% upside potential.

Though analysts are cautiously optimistic, hedge funds sold 1.6 million AR. Meanwhile, Antero stock has a Neutral Smart Score of four.

What’s the Prediction for EQT Stock?

While the downtrend in natural gas prices over the past several months has pressured EQT’s revenue and earnings, its lower cost structure and hedges provide significant downside protection against prices. Its free cash flow breakeven price is about $1.65 per million Btu in 2023, much lower than that of its peers, providing it with a competitive edge. Further, its focus on reducing debt and enhancing shareholders’ returns through opportunistic share buybacks makes EQT attractive.

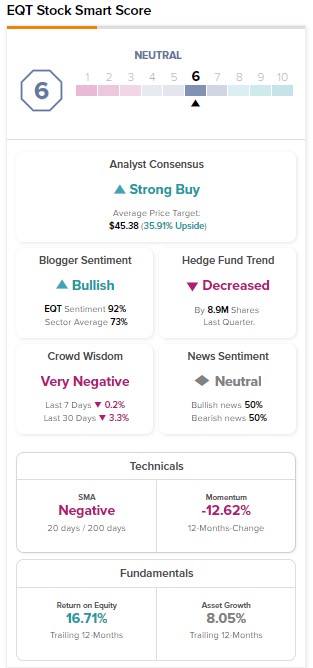

EQT stock has a Strong Buy consensus rating on TipRanks, based on 13 Buys and three Holds. Meanwhile, analysts’ average price target of $45.38 implies 35.91% upside potential.

While analysts are bullish, hedge funds sold 8.9M EQT stock last quarter. EQT stock has a Neutral Smart Score of six.

Bottom Line

The downtrend in natural gas prices amid increased production and a reduction in demand poses short-term challenges for these companies. This is well reflected in TipRanks’ Neutral Smart Score. However, EQT could recover swiftly based on its low free cash flow breakeven price. Moreover, analysts’ strong Buy consensus rating, its focus on debt reduction, and opportunistic acquisitions make EQT more compelling than the AR stock.