Caterpillar (NYSE:CAT) stock closed about 5.4% lower on Tuesday, April 4. While there was no company-specific reason behind the decline, the fear of a recession weighed on investors’ sentiments and decreased the company’s share price. Furthermore, Robert W. Baird analyst Mircea Dobre sees increased risks for the rental/construction equipment manufacturers and downgrades CAT stock to Sell. His price target of $185 reflects a downside potential of 14.92% from the current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Caterpillar is the largest manufacturer of construction equipment in the world.

Dobre expects a slowdown in new small and medium-sized non-residential projects amid credit tightening, which will impact construction activities and weigh on CAT stock.

The analyst added that the backlogs and price/cost tailwinds are peaking for rental/construction equipment OEMs (original equipment manufacturers). He sees “potential for inventory builds in 2H23 pressuring near-term valuation multiples and eventually 2024 production/earnings.”

The analyst expects a decline in CAT’s valuation. However, he sees an upside in near-term earnings, including Q1 and 2023. Increased order levels and backlogs coupled with higher price realizations will support CAT’s near-term sales. However, dealer inventory building could lead to a moderation in volume growth.

While macro headwinds pose challenges, let’s check what Wall Street analysts recommend for CAT stock.

What’s the Prediction for CAT Stock?

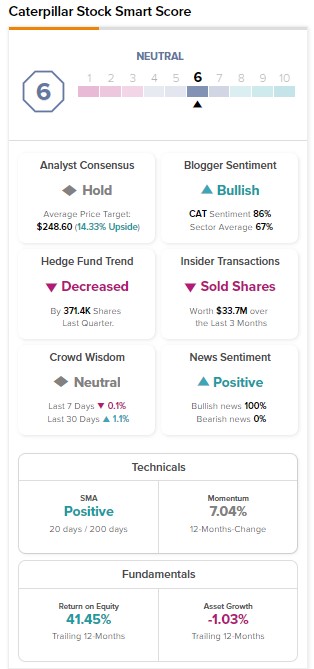

Given the tough macro environment, analysts remain sidelined on CAT stock. It has a Hold consensus rating on TipRanks based on six Buy, six Hold, and three Sell recommendations. Further, these analysts’ average price target of $248.60 implies 14.33% upside potential.

While analysts maintain a Hold, hedge fund managers, including Ray Dalio, sold 371.4K shares of CAT last quarter. At the same time, insiders sold CAT stock worth $33.7M.

Overall, CAT stock has a Neutral Smart Score of six on TipRanks.