There is a lot to like about Netflix (NASDAQ: NFLX) currently, with the company’s most recent results reassuring us on multiple fronts. These include strong momentum in net paid memberships and its recently launched ad-supported model, which should boost revenues anew. That said, it’s hard to tell whether Netflix’s upcoming earnings growth prospects justify its current valuation. Accordingly, I am neutral on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix is Heading Upward

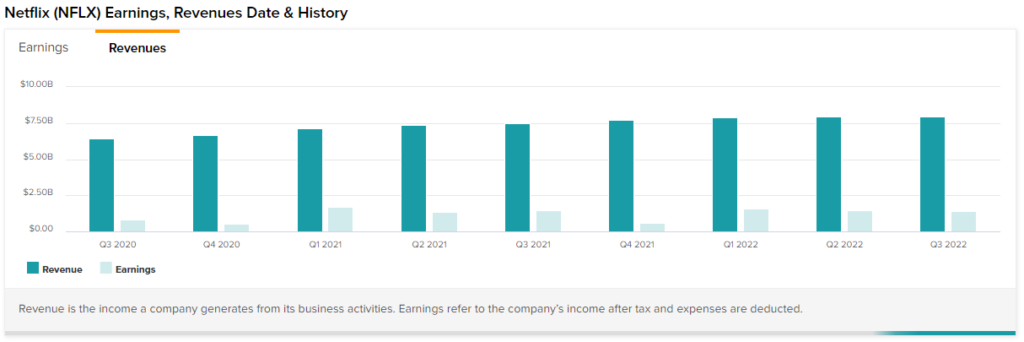

Netflix’s Q3 results included multiple positive developments. Coming off a relatively disappointing Q2, the company posted revenue growth of 6% to $7.9 billion, driven by 5% growth in average paid memberships and a 1% increase in average revenue per membership (ARM).

This may sound like a soft number, but you have to consider two points here. Firstly, Netflix’s revenues were greatly impacted by a much stronger dollar compared to last year. Specifically, excluding the impact of foreign exchange, revenue and ARM rose 13% and 3.8% year-over-year, respectively.

Secondly, Netflix crushed last quarter’s expectations regarding its paid net additions. In particular, while management had forecasted net paid additions to land close to one million in Q2, in Q3, this figure came in at a bloated 2.4 million.

What Do NFLX Numbers Tell Us?

The initial takeaway from these numbers is that Netflix remains an incredibly strong player in the industry that continues to grow on top of last year’s inflated results. Further, we saw an increase in new paid users and ARM, and that’s after the company implemented more than one price increase over the past year. This demonstrates Netflix’s strong brand value and viewers’ willingness to stick to the platform despite the growing wrath of its competitors.

In fact, it’s quite impressive to see that net paid additions are actually accelerating despite concerns that members would cancel their subscriptions during a highly uncertain macro environment like the one we are currently experiencing. If anything, Netflix’s Q3 results demonstrated that Netflix has become a consumer staple with inelastic demand dynamics.

What about the Ad-Supported plan?

Another aspect to like about Netflix is that the company’s lower-priced ad-supported plan launched in 12 countries in November, only six months after its initial announcement. Thus, for the first time, Netflix’s revenues will be diversified away from its subscription plans solely.

In my view, the ad-supported model should end up being a new growth catalyst for Netflix, as the company will now start generating additional revenues from an entirely new user base, which would previously refuse to pay any money for the platform.

Simply put, it benefits everyone. With the Basic Ads plan set to push only ~5 minutes of advertising per hour, users won’t be bombarded with annoying program pauses. Simultaneously, advertisers should be able to push premium ad content based on relevant user data, which means that Netflix should be able to charge above-average ad rates, thus creating a new, highly-profitable segment.

Remember that Netflix will be offering content from its existing catalog. It won’t take on new expenses to fund the ad-supported model. Thus, most of its ad revenues should end up directly in its bottom line.

NFLX – Questionable Valuation

We have so far talked about revenue and user growth, which are certainly great metrics. I also just mentioned that Netflix’s ad-supported model should be highly profitable. However, does this translate to adequate growth in net income that will justify the stock’s current valuation? Here’s where I become cautious.

This is because Netflix’s business model, by nature, is very capital-intensive. To retain its subscriber and hopefully further grow its viewer base, Netflix needs to produce new content consistently. Content gets old fast. If you don’t produce new, exciting content all year long, your competitor will, and subscribers will shift sides. Thus, while Netflix may look like it’s reporting solid profits, a noteworthy portion of these profits ends up in new content expenditures.

Regardless, based on the company’s performance year-to-date and management Q4 outlook, the consensus earnings-per-share estimate for Fiscal 2022 stands at $10.37. Accordingly, the stock trades at a forward P/E ratio of 28.9x.

In my view, this is a rather rich valuation multiple, which demands double-digit earnings growth ahead. Could it be achieved by Netflix’s strong momentum and new contributions from the company’s ad-supported model? Maybe. However, there is a thin margin of safety for current investors if earnings don’t grow quickly.

Is NFLX Stock a Buy, According to Analysts?

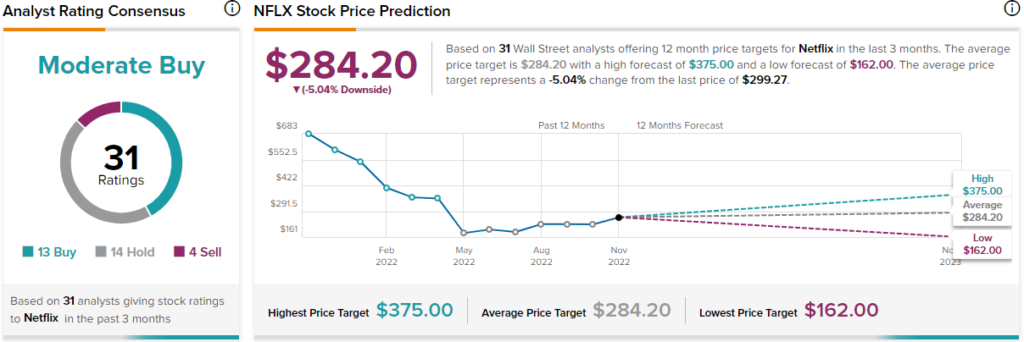

Turning to Wall Street, Netflix has a Moderate Buy consensus rating based on 13 Buys, 14 Holds, and four Sells assigned in the past three months. At $284.20, the average Netflix stock forecast implies 5% downside potential.

Takeaway: Speculation Remains

In line with the mixed sentiment from analysts, Netflix’s investment case appears to be somewhat speculative. Its most recent developments have been undoubtedly cheerful. However, the company’s future earnings growth will determine the stock’s upside potential.