Last month, the Financial Times, citing data from BlackRock (NYSE:BLK), reported that investments in ETFs (Exchange-Traded funds) surged as investors turned risk-averse, expecting a recession. More recently, a Wall Street Journal report highlighted that investors are mobilizing their cash towards less risky investments. As investors flock to safe places amid volatility, the JPMorgan Equity Premium Income ETF (JEPI), with its stellar yield, could be a compelling investment based on analysts’ recommendations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Why Invest in JEPI?

JEPI is a dividend-focused ETF that aims to deliver monthly income with reduced volatility. It invests in large-cap U.S. stocks and sells options to generate income. The image below shows JEPI’s top 5 holdings as of May 5.

Sector-wise, Financials, Consumer Staples, Healthcare, and Industrials account for most of its holdings, giving the ETF stability and the ability to boost investors’ returns.

The ETF offers an attractive yield of more than 11%. Further, its expense ratio of 0.35% is low and competitive with peers. Furthermore, JEPI has a low beta of 0.62, making it less susceptible to high volatility in the stock market.

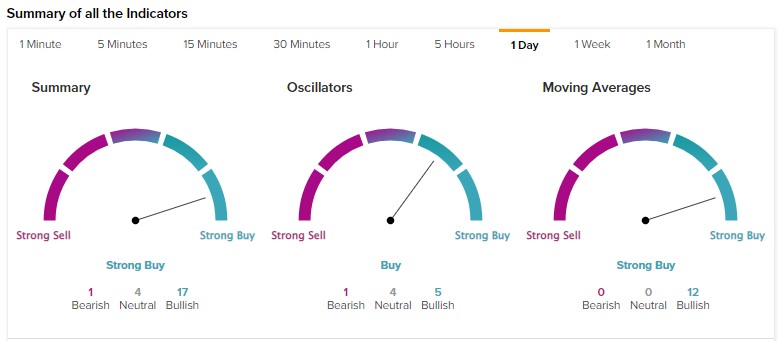

The ETF also looks attractive based on technical indicators. JEPI’s 50-day EMA (exponential moving average) is $53.69, while the ETF’s price is $54.72, signaling a bullish trend. Its short-duration EMA (20-day) also indicates a Buy.

Bottom Line

While the fear of recession is turning investors risk-averse, JEPI, with its focus on high-conviction stocks, low volatility, and stellar yield, appears attractive. Per the recommendations of 1,721 analysts, the 12-month average JPMorgan Equity Premium Income ETF price target of $61.05 implies 11.57% upside potential.

The JEPI ETF sports a Moderate Buy consensus rating. Among the 1,721 analysts providing ratings on 132 holdings of JEPI, 67.64% have given a Buy rating, 29.40% have assigned a Hold, and 2.96% have given a Sell rating.