Container shipping stocks, including Hapag Lloyd (LSE:0RCG), Danaos (NYSE:DAC), and A.P. Moeller Maersk (LSE: 0O77), have surged amid the spread of the coronavirus. The pandemic and government stimulus led to a rise in demand for goods and, in turn, pushed freight rates higher. Notably, freight rates are a key driver of profitability for container shipping companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Now What?

Earlier, Hapag Lloyd stated that container shipping companies benefitted from significantly increased freight rates due to the high global demand for consumer goods in 2021. The company projects tight container transport capacity and demand to support growth in 2022. However, it sees growth normalizing in the second half of the year on the back of the recovery of supply chains.

Meanwhile, Maersk’s CEO, Soren Skou, expects a solid first-half performance. Further, Skou projects normalization in the second half of 2022 as “labor returns to work, bottlenecks open up, capacity held up in port congestion is freed up, and new capacity delivered.”

Providing an outlook for freight rates going forward, Deutsche Bank analyst Andy Chu stated, “We expect 2022 to be a record year for the container shipping industry supported by higher contracted rates.”

However, the analyst thinks “weaker-than-expected demand for goods will help ease the supply chain issues and port congestion, and may help freight rates normalize faster than anticipated.”

Chu downgraded Hapag Lloyd and A.P. Moeller Maersk stocks to Holds and lowered the freight rate forecast for 2023 and 2024.

Chu expects freight rates to decline by 30% and 25% for 2023 and 2024, respectively. Earlier, he projected a 20% and 15% decline in freight rates for 2023 and 2024 for Hapag-Lloyd and Maersk.

Meanwhile, Danaos, whose share price quadrupled in 2021, benefited from higher charter rates and fleet utilization. Further, its investment in Israel-based ZIM Integrated Shipping Services (NYSE:ZIM) supports net income. Citigroup analyst Christian Wetherbee raised his price target on DAC stock. However, Wetherbee has a Hold recommendation on DAC as he sees limited upside from current levels.

Stock Price Forecast

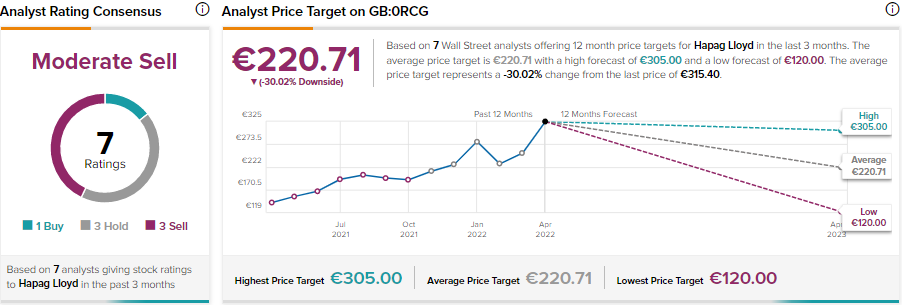

Given the expected weakness in freight rates, analysts remain bearish on Hapag Lloyd stock. On TipRanks, Hapag Lloyd has a Moderate Sell consensus rating based on one Buy, three Hold, and three Sell recommendations. Further, the average Hapag-Lloyd price target of €220.71 implies 30% downside potential to current levels.

As for Maersk, the stock has received three Buy, four Hold, and one Sell recommendations for a Hold consensus rating. However, the average Maersk price target of kr24,530 implies 34.7% upside potential to current levels.

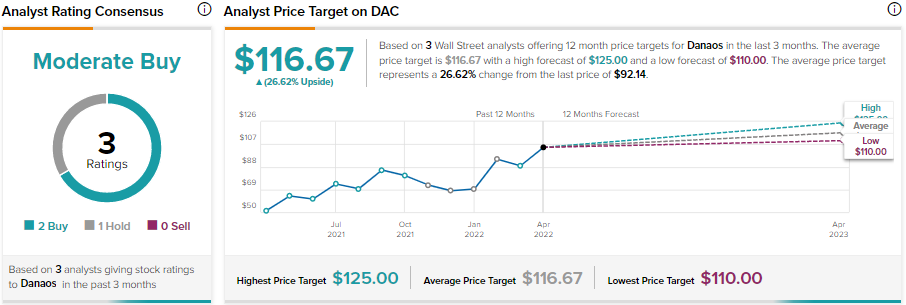

Danaos stated that it had forward fixed several vessels at significantly higher-than-current charter rates over the past few months, which is positive. Meanwhile, it has a strong contracted revenue backlog of $2.8 billion. Danaos stock sports a Moderate Buy consensus rating based on two Buy and one Hold recommendations.

The average Danaos price target of $116.67 implies 26.6% upside potential to current levels.

Bottom Line

The higher freight rates and higher demand compared to the prior year will likely cushion the profitability of container shipping companies in the first half of 2022. However, inflation, the Russia/Ukraine conflict, and other headwinds impacting consumer spending and demand could lead to a deceleration in freight rates and impact the financials of these container shipping companies.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure