CrowdStrike (NASDAQ:CRWD) will announce its Q3 financial results after the market closes on November 29. Meanwhile, the ongoing momentum in its business indicates that this cybersecurity provider could once again beat the Street’s forecast. CrowdStrike’s stellar growth, regardless of macro concerns, shows the strength of its business model and supports the bull case.

Let’s Take a Closer Look at CRWD’s Performance

Despite the macro weakness, the ongoing digital shift and increase in cybersecurity incidents continue to drive demand for security products. During the last quarter’s conference call, CRWD’s CEO, George Kurtz, highlighted that cybersecurity remains a priority for enterprises and that CRWD’s “value proposition resonates strongly with these stakeholders.”

Kurtz added that the company closed all the deals committed in Q2 and entered Q3 with a solid pipeline.

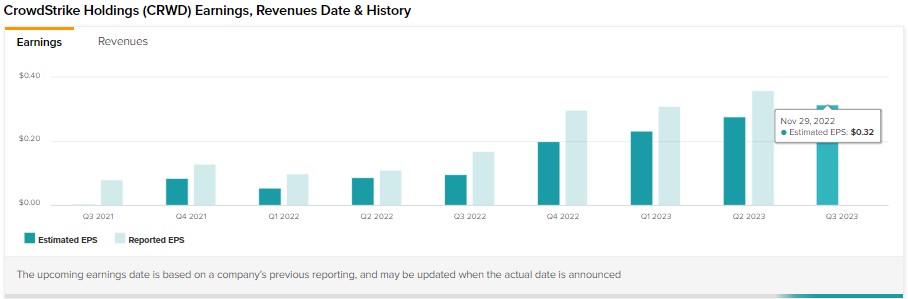

Thanks to the strong demand for its offerings, CrowdStrike has consistently exceeded the Street’s earnings expectations over the past several quarters. (Refer to the graph below).

As for Q3, analysts expect CRWD to post earnings of $0.32 a share, reflecting an increase of about 88% from the prior year.

CrowdStrike’s solid financials reflect strong ARR (annual recurring revenues) growth, customer wins, increased revenues from existing customers, and a high retention rate.

CRWD’s ARR crossed the $2 billion milestone in Q2 and increased 59% year-over-year. Further, the company stated it added a record 1,741 net new subscription customers in Q2. Also, CrowdStrike’s subscription customers who adopted at least five modules increased 59% year-over-year. Meanwhile, customers adopting seven or more modules saw a growth rate of 20%. Furthermore, its gross retention climbed to a new record.

Given the strong demand, CRWD raised its full-year sales and earnings outlook. Further, a Q3 beat could lead the management to increase its full-year forecast again. (Learn more about CRWD’s financials here).

Is CrowdStrike Stock a Buy?

Thanks to its solid growth and steady demand trends, Wall Street is bullish about CRWD stock. On TipRanks, CrowdStrike stock has received 26 Buy and one Hold recommendations, translating into a Strong Buy consensus rating. Furthermore, analysts’ price target of $233.58 implies an upside potential of 67.8%.

Nevertheless, insiders and hedge funds have sold CRWD stock. Our data shows insiders sold CRWD stock worth $17.8M last quarter. Further, hedge funds sold 5.8M CRWD stock. Due to the negative signals from hedge funds and insiders, CrowdStrike has a Neutral Smart Score of four on 10 on TipRanks.

Bottom Line

CrowdStrike’s rapid growth and strength in its key performance metrics indicate that the selloff in its stock is unwarranted. Further, its robust growth at scale with solid unit economics against the challenging macro backdrop is a positive. The company could again deliver strong financials in Q3, and an improvement in the economy could push CRWD stock higher.