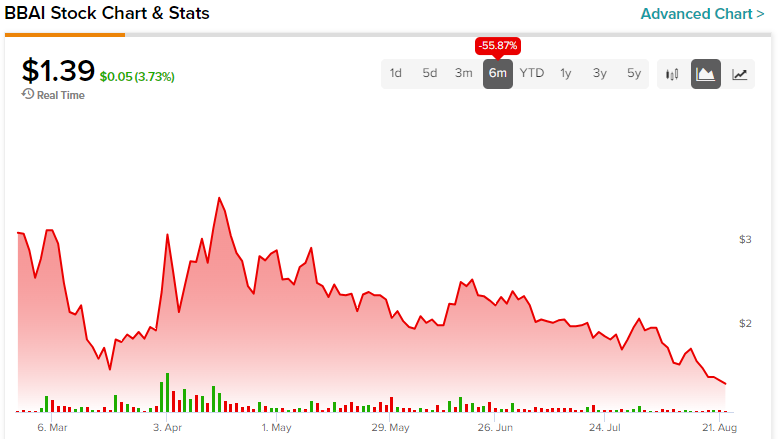

Penny stock BigBear.ai Holdings (NYSE:BBAI) has corrected by about 56% in the past six months due to its low sales growth projections. Despite this massive crash, William Blair analyst Louie DiPalma finds BBAI stock expensive on the valuation front, which could restrict the upside potential from current levels. Against this backdrop, let’s delve into BigBear.ai stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Why Did BBAI Stock Slump?

The immense success of OpenAI’s ChatGPT and the growing adoption and implementation of AI (artificial intelligence) led to a massive rally in BigBear.ai stock. Thanks to the craze around AI, this penny stock jumped from $0.674 on December 30, 2022, to reach a 52-week high of $6.77 on February 6, 2023, delivering a return of over 900% in a short span.

However, BBAI stock started to trend lower after that. BigBear.ai provides AI-led decision intelligence solutions with applications in supply chains and logistics, autonomous systems, and cybersecurity. Its customers include the U.S. Federal Government, the Department of Defense, and the U.S. Intelligence Community.

Despite the hype around AI, as well as the massive market for AI/ML (Machine Learning) augmented analytics solutions and BBAI’s top-notch customers, the company expects its top line to stay flat or increase by a mere 10% in 2023, which is a dampener. Further, it recently announced its second-quarter results wherein its revenue inched up 2%, while it reiterated its full-year sales outlook. These factors have irked investors leading them to dump its stock.

What is the Price Target for BBAI Stock?

Currently, two analysts are covering BBAI stock. BigBear.ai stock has received a Buy recommendation from Northland Securities with a price target of $5. On the other hand, BBAI stock has a Hold rating from Louie DiPalma. The analyst didn’t provide any price target on BigBear.ai stock.

DiPalma expects BBAI stock to trade range-bound due to its rich valuation. In a report dated August 8, the analyst said BigBear.ai stock is trading at 2.9 times his 2024 revenue estimate compared to the peer group average of 1.5 times, supporting his Hold recommendation.

The Takeaway

The advancement in AI, large addressable market, BBAI’s solid customer base, and increasing backlogs will likely support BigBear.ai’s financials. However, the low sales growth outlook and high valuation present concerns, so exercising caution would be prudent.

If you’d like to research other penny stocks as well, TipRanks’ easy-to-use penny stock screener can help you find attractive penny stocks with high growth potential.