Advances in technology often come loaded with financial opportunities and scanning the one presented by the nascent autonomous driving sector, Cathie Wood thinks there is a huge one at play.

The Ark Invest CEO has not been shy about making some bold predictions in the past and thinks investors should not underestimate what’s in store for this up-and-coming industry.

“We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most important investment opportunities of our lifetimes,” Wood said. “One of the reasons for this is that it will save lives; 80-90% of auto fatalities and accidents are caused by human error, and autonomous driving is going to take away the human error.”

Good news, then, both for humanity and investors. And while the first name that comes to mind that stands to gain from such a development is the current undisputed EV leader Tesla, there are other companies operating in the space that are readying for a driver-less world.

We this in mind, we opened up the TipRanks database and got the lowdown on 3 robotaxi-themed stocks that certain Street analysts believe are primed to make the most of this “opportunity of a lifetime.” Here are the details.

Mobileye Global (MBLY)

One company that is already operating at the forefront of this secular trend is Mobileye, a leader and pioneer in the ADAS (advanced driver assistance systems) space. Having bought the already public entity back in 2017, last October, Intel spun off Mobileye in what was one of the year’s blockbuster IPOs.

The company has already established working relationships with more than 50 auto OEMs including VW, Ford and Zeekr and since being formed in 1999, over 125 million vehicles have already made use of the firm’s driver-assisting tech. The company sees an additional 270 million cars using its offerings by the start of the next decade and expects its commanding position in the ADAS segment will be complimented by the opportunity in self-driving cars.

The company is already targeting a leading position in the autonomous vehicle market although the days when these cars become more commonplace could be a while away still. Nevertheless, acting as a test, Mobileye intends to deploy between 100 and 150 robotaxis this year in several European cities and in Israel, while CEO Amnon Shashua has predicted that hundreds of thousands of robotaxis will be zooming across major global hubs by the end of the decade.

As a firm specializing purely in the ADAS and AV field, Tigress analyst Ivan Feinseth thinks Mobileye offers a unique value proposition.

“MBLY is a pure play on the ongoing evolution of ADAS and AV technologies and offers investors one of the best ways to play the growth and ongoing integration of these emerging technologies,” the 5-star analyst said. “MBLY’s industry-leading vision/AI EyeQ SoC system processor currently has about 70% market share and will continue to grow through ongoing innovation along with future regulatory mandates and increasing auto manufacturer product offerings and consumer demand.”

“MBLY has significant proprietary value and key attributes well positioning it to take advantage of and benefit from a potential $500 billion TAM that includes onboard consumer and commercial vehicle ADAS and AV technology as well as the upcoming Robo taxi industry and overall AMaaS (Autonomous Mobility as a Service) market opportunities by the end of the decade,” Feinseth went on to add.

These comments underpin Feinseth’s Buy rating while his $52 price target suggests the shares will climb 38% higher over the coming months. (To watch Feinseth’s track record, click here)

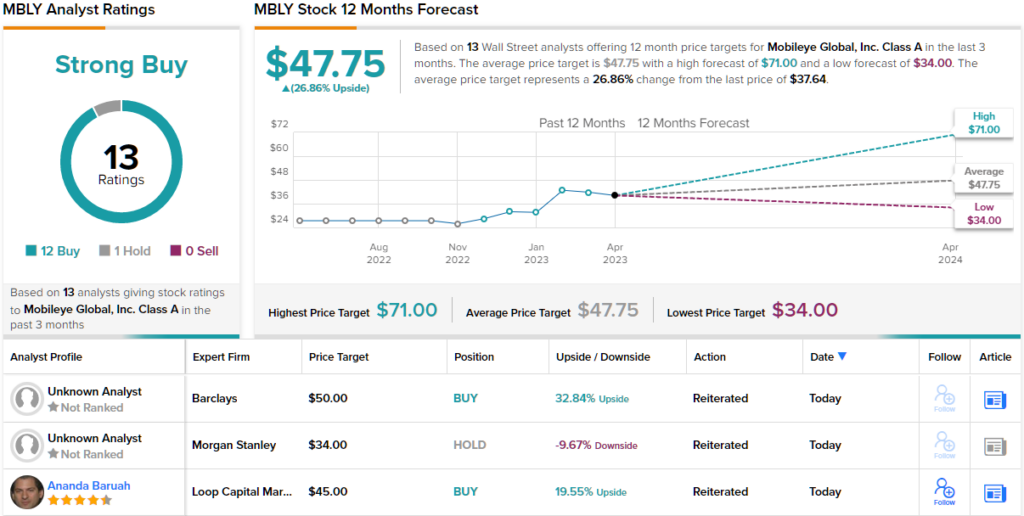

Almost all of Feinseth’s colleagues agree. One skeptic aside, the 12 other recent analyst reviews are all positive, making the consensus view here a Strong Buy. The average target stands at $47.75, implying gains of ~27% could be in the cards over the coming months. (See MBLY stock forecast)

General Motors (GM)

If Mobileye represents the new school in auto tech, our next name has been an auto industry mainstay since the industry’s early days. General Motors is one of the biggest car manufacturers in world, and in fact, by sales, it was the largest automaker in the United States last year. In 2022, GM sold around 2.3 million vehicles in the U.S., representing roughly a 17% share of all vehicles bought in the U.S. throughout the year.

You might think the Motor City-based giant belongs squarely in the auto legacy camp with the company’s vehicle portfolio including iconic names such as Cadillac, Buick, and Chevrolet, but GM has been making a concerted effort to keep up with the times. Not only has it targeted 2035 as the year when production and sales of ICE (internal combustion engine) vehicles will come to an end, but the company also owns an 80% stake in L4 robotaxi firm Cruise.

With operations in San Francisco, Austin, and Phoenix, alongside Google’s Waymo, Cruise is one of just 2 robotaxi providers in the United States. And barely a year after conducting the first fully driverless journey in a major city, in February, the firm announced it had notched 1 million driverless miles.

Furthermore, the company’s purpose-built vehicle – which lacks a steering wheel or pedals – could kick off its service this year. This bus-like vehicle can transport up to 6 people without a driver, and is expected to travel 1 million miles over its lifespan.

By 2025, the GM-owned Cruise aims to deliver revenues of $1 billion, a target RBC analyst and robotaxi fan Tom Narayan thinks should not be too hard to meet.

“We have long been optimists on robotaxis, as we think they have the ability to save lives, time, space in our cities, the environment, and increase mobility,” Narayan explained. “We sense automakers seeing cost escalation (especially from electrification and in particular, batteries) are likely focusing their investments on more immediately commercial L2+/L3 offerings. That said, we do applaud GM’s commitment to L4 even given a potential long time horizon for profitability. Moreover, we don’t think $1B in revenues is an ambitious target for 2025. Our math suggests using Uber’s current fare/mile, Cruise would only need ~4,000 cars on an end-to-end service and ~5,000 if it outsourced the backend to Uber/Lyft. To put this in context, there are 45,000 Uber/Lyfts in San Francisco alone.”

Quantifying his stance, along with an Outperform (i.e., Buy) rating, Narayan has a $48 price target for the shares, making room for 12-month returns of 45%. (To watch Narayan’s track record, click here)

Elsewhere on the Street, the stock garners an additional 5 Buys and 6 Holds, for a Moderate Buy consensus rating. At $50.08, the average suggests the shares will post 12-month growth of ~52%. (See GM stock forecast)

Hesai Group (HSAI)

For our last robotaxi-stock we’ll head to China, a country that accounted for 59% of global EV sales last year, easily making it the biggest EV market in the world right now.

Based in Shanghai, Hesai’s specialty is LiDAR (light detection and ranging) systems – the remote sensing method used to calculate with a laser an object’s exact distance.

In fact, the company held the number 1 spot in global LiDAR shipments in 2022, boating a 58% market share in the Level-4 autonomous mobility LiDAR segment and 36% market share in the Level-3 ADAS (advanced driver-assistance system) LiDAR market. Hesai saw out last year having made more than 100,000 LiDAR unit deliveries since being founded in 2014, building on its relationships with leading automotive OEMs and robotics firms.

The company is relatively new to the U.S. public markets, with its IPO of American Depositary Shares (ADS) taking place in February. Having raised $190 million, it represented the biggest IPO of a Chinese company since October 2021.

However, it has been tough going for this stock. Since the debut, HSAI shares are down by 57%. Nevertheless, Credit Suisse analyst Bin Wang thinks the shares will claw back those losses and some.

Along with an Outperform (i.e., Buy) rating, the analyst’s $28 price target suggests investors could see returns of 210% over the next year. (To watch Wang’s track record, click here)

Explaining his stance, it’s the robotaxi opportunity that partly informs Wang’s bullish thesis, with the analyst expecting the robo-car’s “cost inflection point arrival to boost Autonomous Mobility LiDAR demand.”

“Currently,” explained Wang, “the typical Robotaxi monthly depreciation is below the total cost of a conventional taxi’s depreciation and driver salary in high-tier cities. By replacing the current 1.4mn-unit human-driven conventional taxi fleet in China, we estimate the Robo-car fleet size to reach ~200k units by 2025 and to 1.4mn by 2030. The key drivers are fast-falling hardware cost, upgrading algorithm, improving infrastructure, and favourable government policy. We estimate Hesai’s Autonomous Mobility LiDAR (for Robo-cars) to increase from 12k units in 2022 to 18k/40k units in 2023/24 on the fast-growing Robo-car fleet size.”

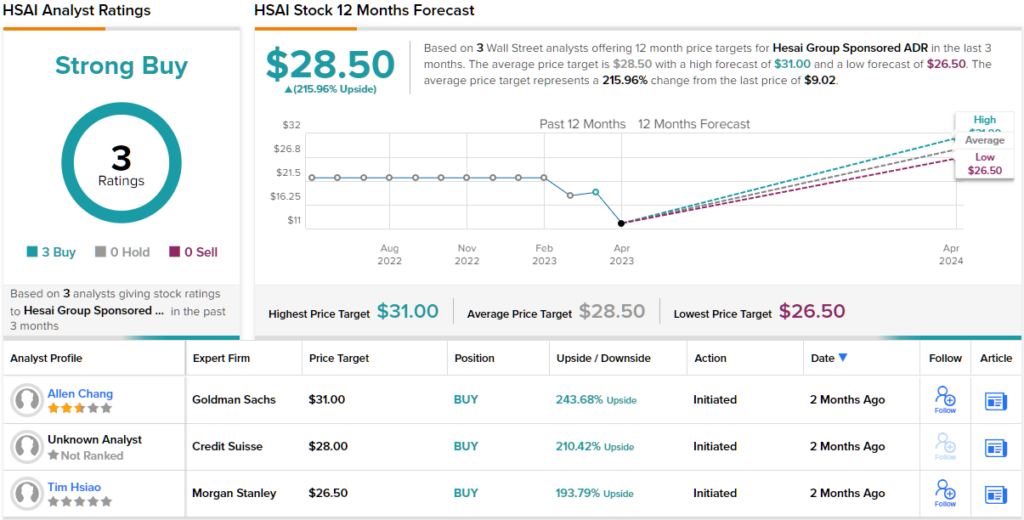

Over the past 3 months, only two other analysts have waded in with HSAI reviews, but they are also positive, providing the stock with a Strong Buy consensus rating. Not only that, but they also see plenty of gains ahead. The forecast calls for one-year returns of 216%, considering the average target clocks in at $28.50. (See HSAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.