Shares of Intuitive Surgical (NASDAQ: ISRG), a robotic surgical systems maker, have dropped 22.2% year-to-date amid soaring inflation and supply-chain disruptions.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Intuitive is widely known for its da Vinci surgical systems and is considered a pioneer in the minimally invasive robotic-assisted surgery space. There are over 6,700 da Vinci surgical systems installed in 69 countries.

Notably, a significant portion (75% in 2021) of Intuitive’s revenue is recurring in nature and includes revenue from operating leases, instruments and accessories, and services.

Will Q122 Financials Impress?

Intuitive’s business was hit by the decline in elective procedure volumes amid the COVID-19 outbreak. However, higher system placements and increasing volumes following the reopening of the economy drove a 16.7% rise in Q421 revenue to $1.55 billion. Adjusted EPS increased about 9% to $1.30.

While Q4 results beat expectations, investors were disappointed with the company’s FY22 guidance of lower gross margins than the 71.2% in FY21, reflecting the impact of higher fixed costs and a rise in supply-chain costs.

Intuitive is scheduled to announce its Q122 results on April 21. Analysts expect Q1 revenue to rise 10.3% to $1.43 billion and adjusted EPS to decline by about 8% to $1.08.

Word on the Street

RBC Capital analyst Shagun Singh Chadha is positive about Intuitive’s leading position in the $6 billion robotic-assisted surgery market, which she sees as being “among the least penetrated and fastest growing” medical device sub-markets.

Further, the analyst believes that Intuitive is uniquely positioned for multi-year growth given the market expansion in line-of-sight procedures and its ability to drive penetration using its technological leadership, diversified offerings, and no major competition.

In line with her optimism, Chadha initiated coverage of Intuitive with a Buy rating and a price target of $340. This implies 21.56% upside potential from current levels.

However, Evercore ISI analyst Vijay Kumar added Intuitive stock to his firm’s tactical Underperform list ahead of Q122 results, citing the recent stock movement, supply-chain issues, and lesser potential for upside to his forecasts.

Consequently, Kumar reiterated a Hold rating but raised the price target to $294 from $290.

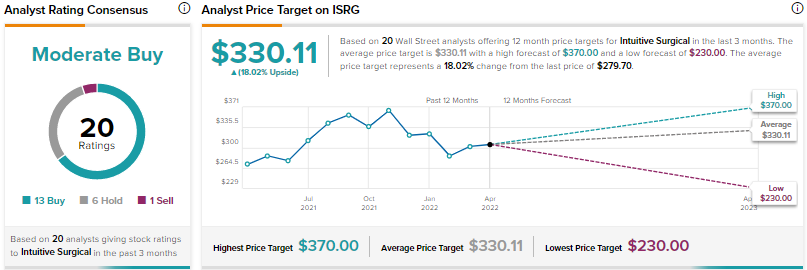

All in all, the Street is cautiously optimistic about Intuitive, with a Moderate Buy consensus rating based on 13 Buys, six Holds, and one Sell. At $330.11, the average Intuitive Surgical price target suggests 18.02% upside potential from current levels.

Conclusion

Intuitive’s dominant position in the robotic-assisted surgery market and the growing demand for robotic surgical systems make it an attractive long-term play. That said, near-term concerns like higher costs and supply-chain bottlenecks could continue to weigh on the company’s results.

Currently, Intuitive scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue