Intuit (INTU) has performed well since its fiscal Q3 results in May. The company’s continuous investments to expand its software capabilities, combined with its predictable business model, should lead to another excellent report in Q4. Nonetheless, Investors should be wary of the possibility of short-term valuation headwinds. I am neutral on the stock.

Intuit’s Business Model and Qualities

Intuit’s cloud-based accounting and tax preparation software solutions can generate predictable cash flows. The company’s software suite offers financial management, compliance, and various similar services to individuals, small businesses, self-employed entrepreneurs, and accounting professionals all across the globe.

Intuit’s primary platforms include QuickBooks, TurboTax, Credit Karma, Mailchimp, TSheets, and Mint. Jointly, they assist more than 100 million clients in complying with their financial responsibilities.

What I value the most about Intuit is that it has an outstanding moat. The company’s solutions have become the go-to place for individuals and organizations, with barely any noteworthy competition endangering its cash flows. Additionally, Intuit’s financial performance is completely recession-proof.

While nothing is certain in life, it is uncontroversial to say that paying taxes won’t go away anytime soon. Intuit has completed more than 38 acquisitions since its inception to guarantee its superiority in the industry. No other organization in the space offers as much of a comprehensive suite of tax-related products as Intuit. Combined with the fact that individuals are guaranteed to keep paying their unavoidable taxes, Intuit is set to keep enjoying a predictable and routine stream of cash flows.

To exhibit the quality of Intuit’s revenues, even during the Great Financials Crisis, when numerous firms suffered, the company raised its sales by around 12% in 2008. In 2020, another year of unprecedented hardships resulting from the COVID-19 pandemic, Intuit grew its top line by 13.2%. No matter what the underlying market conditions are, Intuit’s performance should not be negatively affected due to the unique traits of its business model.

Intuit to Wrap Up Fiscal 2022 with Great Momentum

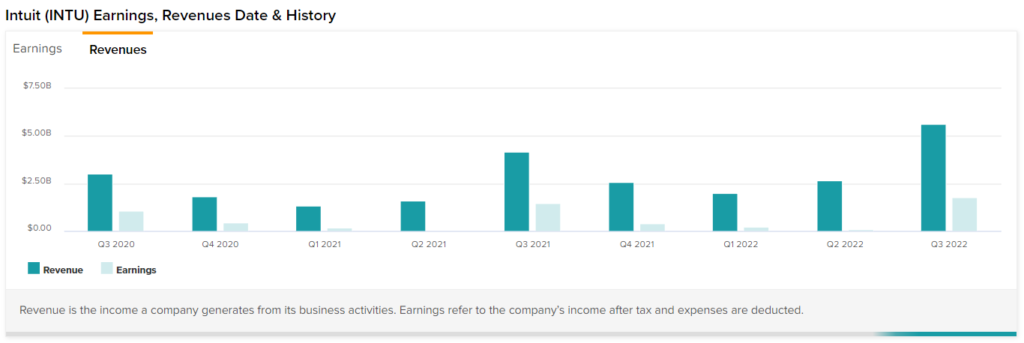

Intuit’s Q3 results came in remarkably strong, with the company posting another thriving quarter. With growth sustained all across the board, the company should close Fiscal Year 2022 with great momentum. For context, last quarter, the company grew its “Small business and Self-Employed Group” revenues by 42%, while its Online Ecosystem revenues expanded by 67%.

QuickBooks Online Accounting revenues rose 32% versus the prior-year period as well. Accordingly, total revenues increased 35% to $5.6 billion, primarily powered by its customer count growing, better revenue mix, and elevated effective prices. Intuit’s adjusted EPS came in at $7.65 for the quarter, suggesting a year-over-year increase of 26%.

Following a better-than-expected Q3 performance, management raised its full-year outlook, anticipating Fiscal Year 2022 revenues to land between $12.6 billion and $12.7 billion (previously $12.1 billion and 12.3 billion). This indicates a 30.5% growth rate compared to Fiscal Year 2021. Further, adjusted EPS is expected to land between $11.68 and $11.74 (previously $11.48 and $11.64), suggesting a growth rate of around 19% at the midpoint.

For its upcoming Q4 results in August, Wall Street expects a revenue decline of roughly 9%, matching management’s Q4 guidance, which also warned of an 8% to 9% drop in revenues. However, this decline is only due to this year’s earlier tax filing deadline compared to last year. In reality, there should be no slowdown in Intuit’s growth momentum, as its full-year guidance suggests.

INTU isn’t Cheap, but It Rarely Trades at a Discount

Using management’s midpoint EPS guidance of $11.71 for Fiscal Year 2022, Intuit is presently trading at a P/E of 38.6. In my opinion, this is a premium multiple, considering that the company’s growth will likely decelerate over the medium term. Nevertheless, I believe that investors will keep paying a premium for the stock due to its distinctive qualities and exceptional moat. After all, Intuit has always traded at a rich P/E for this reason.

Wall Street’s Take on INTU Stock

Turning to Wall Street, Intuit has a Strong Buy consensus rating based on 14 Buys assigned in the past three months. At $526.92, the average Intuit stock forecast implies a 17.7% upside potential over the next 12 months.

Takeaway – Intuit is a Reliable Investment despite Potential Valuation Headwinds

Intuit is an uncontested industry leader, likely to keep generating rising and enduring results for decades. The company should make for a reliable long-term investment, whose financials are likely to remain unaffected even during the harshest economic environments. Nevertheless, short-term valuation headwinds could take a toll on the stock’s future total return prospects, despite the possibility of Intuit retaining its premium multiple.

Thus, the stock is only worth buying ahead of Intuit’s upcoming results if one has a long-term investment horizon.