With Spring storm clouds hovering over the tech-heavy Nasdaq 100 (NDX), investors with a bit of extra cash may wish to deploy it in some of the most promising tech higher flyers as their recent corrections look to extend. Turning to the Wall Street community, there are a handful of tech stocks that Wall Street analysts still stand by (like INTU, NOW, and SNPS), even as the going gets rougher for their share prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

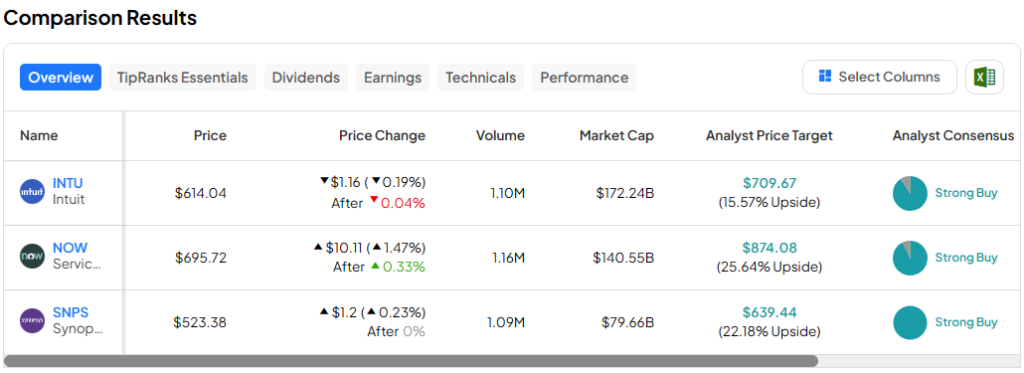

These stocks may be worth monitoring while their implied upside looks to swell further as things turn a tad more bearish. Thus, let’s check in with TipRanks’ Comparison Tool to determine which Strong Buy tech stock could be in for the most upside potential for the year ahead.

Intuit (NASDAQ:INTU)

Tax season has come and gone, but the maker of Turbotax and QuickBooks is still worth considering after its latest 10% drawdown. The Wall Street community has been quite bullish on the stock, but don’t look for recent share price turbulence to cause them to turn their backs on the name or lower their price targets.

Moving into year’s end, the company has a lot going for it as it looks to make its incredibly popular (and Intuit-ive) software that much better with a sprinkle of generative artificial intelligence (AI) magic. On the latest dip, I can’t help but stay bullish on the financial software innovator as it looks to play AI in its own unique way.

On the TurboTax side, Intuit stands to gain as federal governments continue introducing various tax code changes. From proposed wealth taxes under the Biden administration to adjusting the capital gains tax, it’s clear the reporting requirements are ever-evolving. With that, it’s becoming more time-intensive to file one’s taxes and stay up to date with the latest reporting needs. And it’s not just the U.S. tax code that’s subject to substantial year-over-year changes, either.

As Intuit makes its AI-powered offering, Intuit Assist (which is run on its generative operating system), smarter and ready to go for the latest tax season, it’s becoming even harder to swap TurboTax for an alternative. Of course, Intuit needs to stay on its toes when it comes to AI, as many of its rivals have also been hopping aboard the AI bandwagon.

What Is the Price Target for INTU Stock?

INTU stock is a Strong Buy, according to analysts, with 19 Buys and two Holds assigned in the past three months. The average INTU stock price target of $710.15 implies 15.65% upside potential.

ServiceNow (NYSE:NOW)

ServiceNow stock has also been falling lately, now down around 15% from its February 2024 peak. The latest bout of weakness came in spite of a pretty decent round of quarterly earnings. For the latest (first) quarter, the cloud- and AI-driven enterprise workflow software developer clocked in earnings per share of $3.41, comfortably ahead of the $3.14 estimate.

Despite the beat and the AI-heavy conference call that ensued, shares of NOW sunk under the weight of mild investor disappointment. Given the relatively lofty price of admission, though, you can’t really fault investors for being picky and hard to impress. Even after the latest stock slide, shares aren’t exactly a steal at more than 73 times trailing price-to-earnings (P/E). That said, sometimes you’ve got to pay up for growth, especially top-notch AI growth, with a proven leader like Bill McDermott running the show.

With the stock experiencing a breather following an underrated quarter, I’m inclined to stay bullish alongside most Wall Street analysts. Perhaps investors who sold the stock did not tune into the post-quarter call, or the market is experiencing a bit of “AI fatigue.” Either way, ServiceNow stands out as a company that has so much to gain from generative AI as more clients become willing to spend on such innovations to get ahead of the pack.

CEO Bill McDermott noted that his firm is putting Now Assist AI (the company’s generative AI offering designed to boost productivity for users) “into every business workflow across every enterprise.” Combined with the Now platform, ServiceNow certainly stands out as a likely long-term winner as the AI revolution gradually transforms the enterprise. The biggest AI gains, though, are probably just a few years ahead.

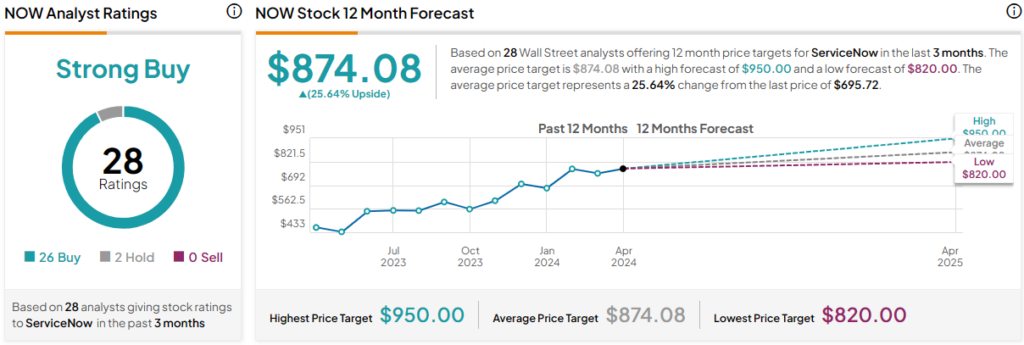

What Is the Price Target for NOW Stock?

NOW stock is a Strong Buy, according to analysts, with 26 Buys and two Holds assigned in the past three months. The average NOW stock price target of $874.08 implies 25.6% upside potential.

Synopsys (NASDAQ:SNPS)

Shares of semiconductor design software maker Synopsys have been very magnificent to stash away for the past five years. Over the span, shares have more than quadrupled, up around 330%. Of course, there have been stumbles along the way, but on every occasion, such falls have proven to be great buying opportunities.

This time around, with shares now down more than 12% from highs, I believe it will be no different. Indeed, the broader tech sector has dragged just about everything, even the most promising red-hot semiconductor plays, lower lately. In any case, I’m sticking with Wall Street and am staying bullish for its long-term potential in these early innings of the AI race.

Synopsys is in the business of electronic design automation (EDA). Indeed, chip design is a rather complicated field with a lot of low-hanging fruit that AI to grab a hold of. With its profoundly powerful Synopsys.ai suite (an industry-first AI EDA suite), Synopsys pretty much gives its clients a shot in the arm.

As you’re probably aware by now, powerful AI needs powerful chips. But what you may not know is that the next generation of powerful AI chips also needs powerful AI software in the design stages. It’s a pretty virtuous cycle that’s likely paving a rate of AI advancement that may be difficult for most to fathom.

Looking ahead, management expects AI to drive growth higher. Sales are expected to grow by 14-15.1% for the fiscal year, with the slower-growth and soon-to-be-sold Software Integrity Group business taken out of the equation.

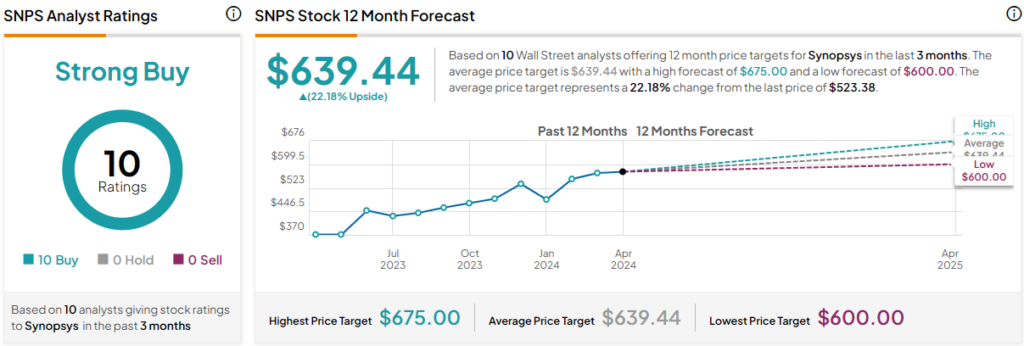

What Is the Price Target for SNPS Stock?

SNPS stock is a Strong Buy, according to analysts, with 10 unanimous Buys assigned in the past three months. The average SNPS stock price target of $639.44 implies 22.2% upside potential.

The Takeaway

The tech scene is full of promising long-term innovators to consider nibbling on the latest round of broader market weakness. Of the trio, analysts see the most upside in NOW stock (25.6% upside potential).