Chipmaker Intel (INTC) is in some of the best conditions the market has ever seen. Demand for chips is soaring. The supply of chips can only move so fast in response.

To address that shortfall, Intel recently made a play to acquire Israeli firm Tower Semiconductor (TSEM). Such a move produced an unexpected effect, giving both companies a raise in their share prices in premarket trading.

Staying bullish on Intel is likely a good plan as market conditions make for a great environment. Intel is responding to conditions on the ground accordingly, and making for a likely positive outcome.

Intel’s last 12 months haven’t reflected a company that should be on top of the world with current market conditions, however. A spike in late January was followed by a disastrous plunge.

Two weeks later, Intel shrugged off that plunge and recovered to its late January levels. It built on that recovery, and by April, challenged the $70 per share level.

These gains didn’t last, and between April 8 and May 11, the share price dropped from close to $67 to just over $52. A more timid recovery followed. Intel held between $50 and $57 per share from late May until late October.

Another crash followed, and Intel dropped to just over $47 in a matter of days. A slower recovery followed, getting Intel above $55 once more, until it lost more ground and the company slipped back under $50.

The latest news brought gains to both Tower Semiconductor and Intel, with Intel notching up 1.6% in premarket trading and Tower Semiconductor exploding upward 44.6%.

Intel agreed to buy the Israeli chipmaker for $53 per share. That makes the total value of the deal $5.4 billion. With Intel picking up Tower Semiconductor, it will be better able to increase Intel’s development and production processes, allowing it to better compete with the likes of Taiwan Semiconductor (TSMC).

Wall Street’s Take

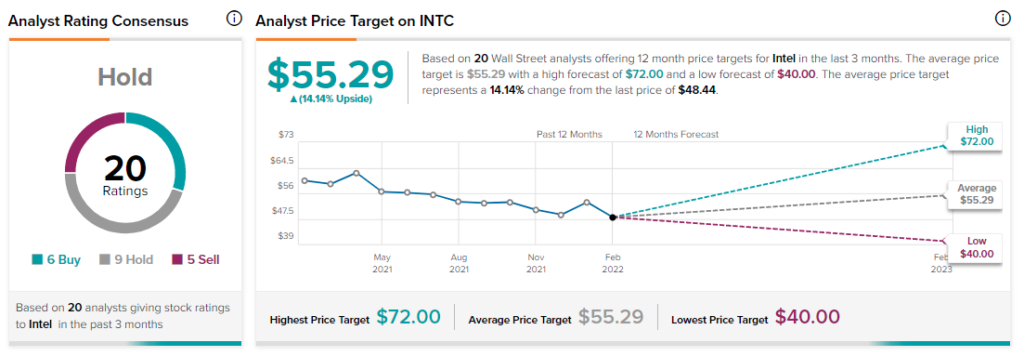

Turning to Wall Street, Intel has a Hold consensus rating. That’s based on six Buys, nine Holds, and five Sells assigned in the past three months. The average Intel price target of $55.29 implies 14.1% upside potential.

Analyst price targets range from a low of $40 per share to a high of $72 per share.

The Extra Firepower Intel Needed

This is a great time to be a chipmaker. Pretty much everything that rolls off the line can be sold immediately. These conditions look to go on for some time, especially as more and more of the products in our lives have some kind of chip in them.

Intel picking up Tower Semiconductor is likely a good idea; the company can now roll out more chips, even as it works to ramp up its own production and seize a wider portion of the market.

This approach hasn’t always worked out; we know that Peloton (PTON) ramped up its production as sales spiked during the pandemic. It also had to retract some of those increases as sales started to decline. The odds of this problem hitting Intel, whose produce is much less specialized, is a lot less likely, however.

Thus, Intel gets a powerful new production arm to add on to its own operations. It’s also better able to compete on the global stage. This news comes at an excellent time, too; earlier Wednesday, Taiwan Semiconductor announced that Denso Corp. was joining in on Taiwan Semiconductor’s new plant in Japan.

Denso, which expects to be a major customer of the plant once it’s built, is set to chip in $350 million for construction costs. Clearly, this will hurt Intel. With Tower Semiconductor now part of Intel, the hurt will be much less than it might have been.

Intel will need the extra product to ensure its cash flow. Intel’s dividend history makes that clear; it’s been steadily growing over the last 13 years. It’s also several times larger than the technology sector average dividend. It offers a yield of 2.95% against the average of 0.69%.

Concluding Views

The acquisition of Tower Semiconductor should be a winner for Intel. With more product to sell into an environment where demand is white-hot, why wouldn’t Intel shell out big money to pick up a ready-made production arm? It’s the perfect time for Intel to try and get out in front of the market.

Granted, perhaps Intel paid a little more than it needed to: a 60% premium by some figures. It likely wanted to ensure the deal went through. Plus, it could take advantage of all that new production as soon as possible.

This is likely to be good news for Intel in the long run, and for its investors. That’s why I’m bullish on Intel. With the company currently trading closer to its lowest targets than its highs, it looks like a good time to get in on potential gains to come. .

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure