Intel (INTC), a semiconductor chip maker, will report earnings for the first quarter of 2022 on April 28.

With a market valuation of $189.4 billion, Intel has lost about 10% of its value year-to-date. Intel used to be the market leader in chips, but that is no longer the case. Increasing competition in the chip space has put Intel under great pressure.

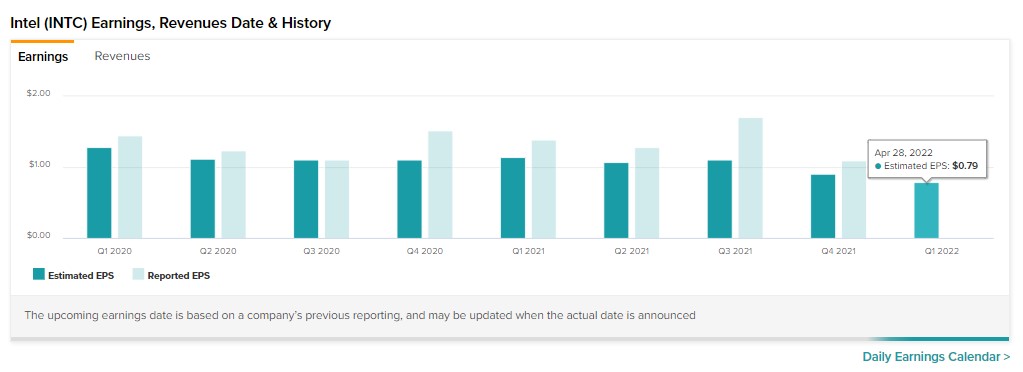

In terms of earnings results, Intel outperformed Wall Street consensus projections on both sales and earnings per share in the fourth quarter. Revenues of $19.5 billion were higher than the average projection of $18.32 billion. Meanwhile, adjusted earnings per share of $1.09 came in above analysts’ expectations of $0.90 per share.

Q1 Expectations

According to experts, Intel is projected to announce adjusted earnings of $0.79 per share in the first quarter. This represents a year-over-year decrease of 43%.

Meanwhile, Intel projects adjusted revenue of $18.3 billion and non-GAAP earnings of $0.80 per share for the first quarter.

Wall Street’s Take

Christopher Rolland of Susquehanna expects Intel to report results in line with expectations for the first quarter.

According to the analyst, Intel’s continued Alder Lake (Alder Lake is Intel’s codename for the 12th generation of Intel Core CPUs) ramp is believed to have helped the company gain moderate market share in the first quarter.

However, the analyst believes that the business may face difficulties in the medium term due to “a weakening PC demand backdrop and potential margin headwinds.”

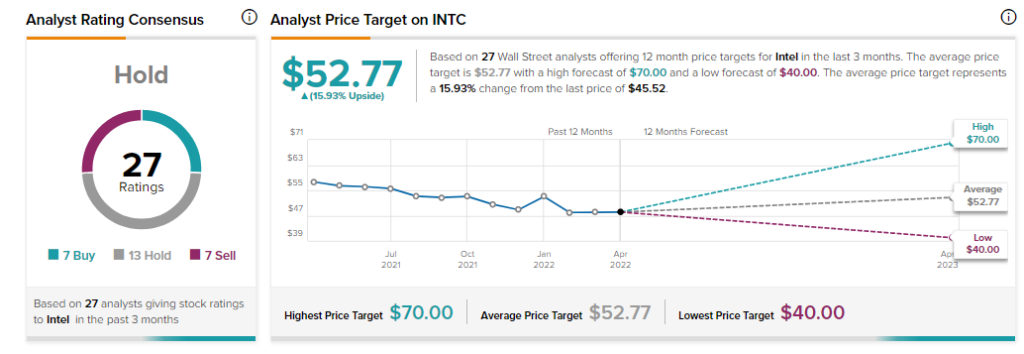

As a result, Rolland maintained a Neutral rating on the stock and a price target of $52 per share. This implies 14% upside potential from current levels.

On TipRanks, Intel stock commands a Hold consensus rating based on seven Buys, 13 Holds, and seven Sells. As for price targets, the average INTC price target of $52.77 implies almost 16% upside potential from the current levels.

Bottom Line

Given the fierce competition in the chip industry, Intel’s short-term prospects do not appear to be very promising. On the other hand, it is positioning itself for the long haul by aggressively investing in its business. The company is increasing its fabrication capacity and making the foundries available to third parties. During the Q1 conference call, investors will be interested to hear about Intel’s product selection and other expansion plans.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure