Shares of fallen chip maker Intel (INTC) have fallen considerably over the past few quarters.

With the stock looking to hit at a multi-year level of support at around the $45 per-share range, questions linger as to what the firm’s next course will be as it attempts to move forward with its plan to retake the lead in processors.

Undoubtedly, it’s hard to play in the chip space if you’ve fallen behind by so much. With new rivals, including the likes of Apple (AAPL) and Microsoft (MSFT), building their own chips, Intel’s glory days seem to be in the rear-view mirror.

Even if the company can get back up to speed with its current architecture roadmap, the total addressable market could shrink as more firms look to in-house internal hardware components. Indeed it’s not a significant trend in the tech space for a firm that once was vital in the hardware space.

There’s never been a better time to reduce one’s reliance on other firms’ supply chains. Simply put, the next five years seem very uncertain, as the company risks falling victim to rising competition that looks to have been given a bit of a jolt by the COVID-19 pandemic. I am neutral on the stock.

Historic Turnaround Effort

Though Intel is still in the early innings of its multi-year plan to retake the lead in the chip space, its newly appointed CEO Patrick Gelsinger already appears to be raking it in, with a whopping ~$180-million pay package in 2021. That’s a rich sum, especially early on in the man’s tenure.

If Gelsinger can steer Intel stock back to its former glory, I’m sure investors will be happy with Gelsinger’s big payday. Until then, time is of the essence for the firm whose stock has underperformed the S&P 500.

With shares of INTC falling into single-digit earnings multiple territory, the name is likely to gain the attention of technically inclined value investors.

Of course, it’s hard to evaluate the company as it navigates between the line of value and value trap. For that reason, I’m hesitant to load up on shares until the company can share updates on its long-term investment plan.

How Intel Can Retake the Lead

Intel is still in the race, though its valuation would suggest otherwise. At writing, Intel stock trades at a mere 9.7 times trailing earnings and 2.5 times sales.

With Apple’s M2 line of chips on the horizon, it’s clear that Apple is looking to change the game. It’s raising the bar on per-watt performance. So much so that it could make its last generation of chips look bad.

At this juncture, I think it’s incredibly unlikely that a Mac computer will have anything other than an Apple-made ARM-based chip. The company has invested way too much, and every year, the M-series could increase the gap between its own performance and that of its peers.

Despite losing its spot in the latest and greatest Apple-powered computers, Intel still has a world of share to spread its wings in the PC market. Intel is spending considerable sums to close the gap with its rival AMD (AMD). The company knows it needs to sprint to get ahead, which is a major reason it recently decided to pour €33 billion into European R&D.

A commoditized industry is at risk of becoming more commoditized, in my books. Just how much of a discount is warranted on the old players like Intel remains a mystery for now.

Still, I think a lot of the negativity and doubt surrounding Intel’s future is already mostly baked into the share price. A single-digit P/E multiple leaves a low bar ahead of a firm that’s more than capable of surprising.

In any case, the stakes are high in the semi market, but so too are the potential rewards, as various trends like IoT (Internet of Things) fuel the appetite for processing power across a broader range of devices.

Wall Street’s Take

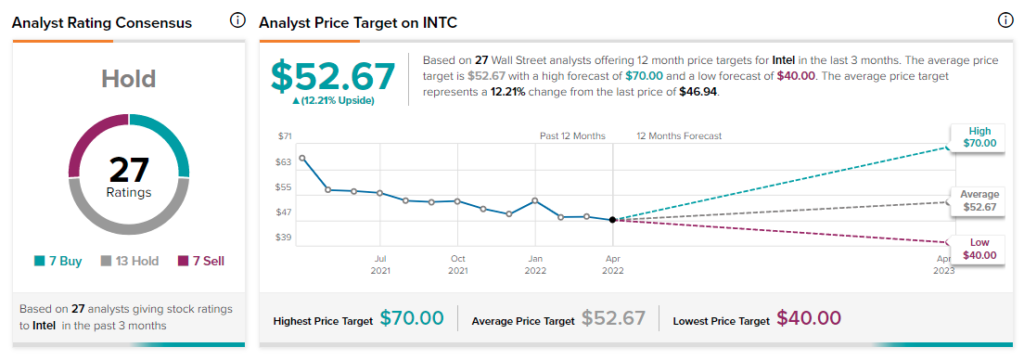

According to TipRanks’ consensus rating, INTC stock comes in as a Moderate Buy. Out of 28 analyst ratings, there are seven Buy recommendations, 13 Hold recommendations, and seven Sell recommendations.

The average Intel price target is $52.67, implying 12.2% upside potential. Analyst price targets range from a low of $40 per share to a high of $70 per share.

Bottom Line on INTC Stock

Intel may be an underdog, but it’s still generating ample cash flow from its PC and server CPU markets.

Though it may have to get more competitive with pricing, I think too many investors are counting the firm out of the game, when it’s still on track to hit its goal over the coming three years.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure