If you only had to choose one chipmaker to wager on in 2024, which would you pick? Not everyone would choose Intel (NASDAQ:INTC), but it’s actually a great processor producer that’s somewhat underappreciated on Wall Street. All in all, I am bullish on INTC stock and am preparing for higher share prices this year.

Intel is a well-known American chipmaker, and the company could benefit if there’s a resurgence in the market for personal computers (PCs). This could happen if AI-enhanced PCs become popular this year.

Furthermore, Intel stands out among U.S. chipmakers because the company has its own foundry business. That’s in contrast to rivals like Advanced Micro Devices (NASDAQ:AMD), which rely on Taiwan Semiconductor (NYSE:TSM) to manufacture their microchips. This advantage could position Intel to substantially grow its business in the coming quarters.

This Insider Keeps Buying INTC Stock

Along with analyst ratings (which we’ll explore in a moment), I like to monitor insider buying and selling activity closely. That’s because when a corporate insider is buying shares of a company, that’s a sign of confidence, and it makes me want to consider the stock.

Consequently, it’s important to know that Intel CEO Pat Gelsinger is buying shares of his own company. On January 29, Gelsinger (through a trust and/or his own personal account) reportedly purchased 3,000 Intel shares for $130,100. Then, on February 1, the CEO bought another 2,800 INTC shares for $119,700.

After those purchases, Gelsinger’s Intel stock hoard includes 66,386 shares in a personal account as well as another 456,915 shares in various trusts. The Securities and Exchange Commission (SEC) filings don’t explain why Gelsinger bought all of those Intel shares, but the CEO’s apparent confidence should make reluctant investors wonder if there’s a positive catalyst coming for Intel.

It’s also noteworthy that Gelsinger bought all of those shares soon after INTC stock had its January 25 earnings dip. As you may recall, Intel beat the Q4-2023 consensus earnings estimate of $0.45 per share, as the actual result was earnings of $0.54 per share. Yet, the market dumped Intel stock because investors felt that the company’s forward guidance wasn’t optimistic enough.

I like to see a company’s CEO buying shares when other people are selling them. Clearly, Gelsinger is all-in on Intel’s future growth, and he’s ready to ride with his company for the long haul.

Intel Could Get a $10 Billion Award from the U.S. Government

Undoubtedly, the U.S. government would prefer that powerful, AI-compatible chips come from American foundry businesses rather than from Taiwan Semiconductor. It’s a matter that concerns America’s financial future as well as U.S. security.

To that end, the Biden administration signed the Chips and Science Act into law in 2022. This law provides government funding to support the domestic production of certain products, including chips.

So, how will Intel benefit from the Chips and Science Act as a domestic chip-foundry business? The company could receive a sizable cash award soon, as, according to a Bloomberg report citing “people familiar with the matter,” the Biden administration is “in talks to confer more than $10 billion in subsidies to Intel.”

That’s great news for Intel, especially after the company seemed to suffer a setback when it announced a delay in the opening of an Ohio chipmaking plant. Surely, that announcement, along with Intel’s aforementioned financial guidance, disappointed some investors.

Don’t get the wrong idea here. One way or another, Intel is going to move forward with its plans to become a global chip-foundry business. For instance, Intel is reportedly looking to raise $2 billion or more to help fund a semiconductor fabrication factory in Ireland.

However, the Biden administration would certainly like to see Intel produce its processors domestically and create jobs in the U.S. Therefore, don’t be surprised if the American government moves forward in the near future with substantial financial support for Intel.

Is Intel Stock a Buy, According to Analysts?

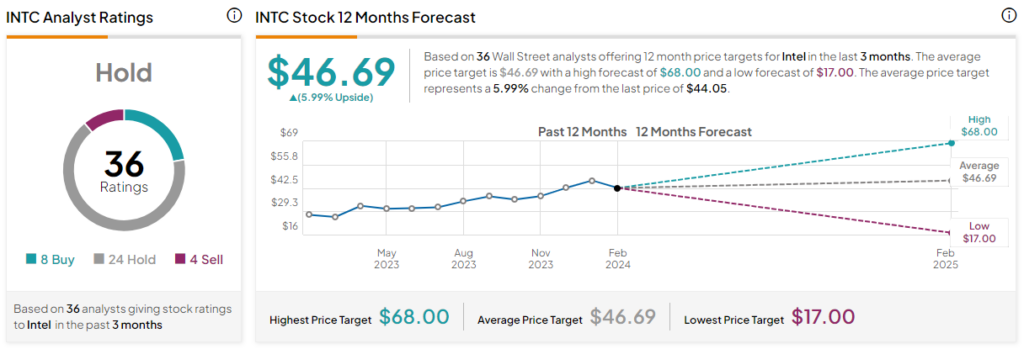

On TipRanks, INTC comes in as a Hold based on eight Buys, 24 Holds, and four Sell ratings assigned by analysts in the past three months. The average Intel stock price target is $46.69, implying 6% upside potential.

Conclusion: Should You Consider Intel Stock?

The market didn’t react positively to Intel’s financial guidance recently. At the same time, though, Intel’s CEO is buying his company’s shares.

Moreover, Intel might soon receive a financial award from the U.S. government. Intel is a premier chipmaker with its own domestic foundry business, and this sets the company apart from some competitors while making Intel a target of government funding. That’s why I remain bullish on INTC stock and am considering it for a long position this year.