Intel (NASDAQ:INTC) impressed investors with its better-than-anticipated third-quarter earnings and its aggressive cost savings plans amid tough business conditions. The semiconductor giant aims to deliver $3 billion in cost reductions next year and is targeting $8 billion to $10 billion in annualized cost reductions and efficiency benefits by the end of 2025.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Intel’s CEO Pat Gelsinger stated, “To position ourselves for this business cycle, we are aggressively addressing costs and driving efficiencies across the business to accelerate our IDM 2.0 flywheel for the digital future.” Intel recorded restructuring charges of $664 million in Q3 as part of its cost reduction initiatives.

The company’s cost reduction actions include headcount optimization. In an interview with Reuters, Gelsinger indicated that the headcount optimization will begin in the fourth quarter, although he didn’t provide any details on how many employees will be impacted.

Intel stock was up 5.6% in Thursday’s extended trading session. Shares have declined 49% year-to-date due to a broader tech sell-off and demand concerns in the semiconductor space.

Intel’s Outlook Reflects Pressure

Intel’s Q3 adjusted earnings per share (EPS) declined 59% year-over-year to $0.59 due to lower revenue and margin pressure. However, adjusted EPS topped analysts’ consensus estimate of $0.34 due to lower-than-anticipated taxes.

Revenue declined 20% to $15.3 billion due to lower revenue from the Client Computing and Datacenter and AI segments.

Intel lowered its full-year guidance, citing macro headwinds. The company now expects adjusted EPS of $1.95 and revenue in the range of $63 billion to $64 billion. It had earlier projected adjusted EPS of $2.30 and revenue between $65 billion to $68 billion.

Is Intel Buy, Sell, or Hold?

Following the print, Rosenblatt Securities analyst Hans Mosesmann reiterated a Sell rating on Intel stock and lowered the price target to $20 from $30.

Mosesmann stated, “Weak outlook across the board and a macro malaise expected to continue well into 2023 creates an immensely delicate balance in committed CapEx expansion, FCF neutrality targets, share losses in data center, non-trivial employee reduction efforts, and a foundry services business that will take years to play out.”

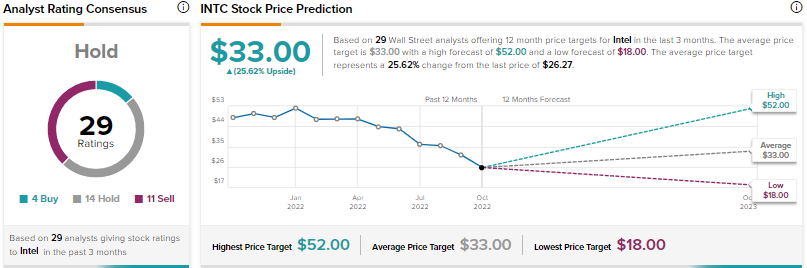

Overall, Wall Street is sidelined on Intel stock, with a Hold consensus rating based on four Buys, 14 Holds, and 11 Sells. The average Intel stock price target of $33 implies 25.6% upside potential.

Conclusion

Intel is taking the required steps to fight challenging market conditions and improve profitability. However, Wall Street remains cautious as the company has been losing ground to rivals like Advanced Micro Devices (AMD).