Every investor likes to find a clear market signal, indicating the right stock to buy – and there are few signals clearer than the insider purchases. Now, these are not criminal moves; the insiders we’re talking about are corporate officers, from the C-suites and the Boards of Directors, who have a responsibility for delivering profits and returns while answering to their investors, and whose positions give them a clear view of the inner workings and prospects of their companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s a heady combination, but what it means is simple. These insiders don’t buy their own firms’ stock shares lightly, and when they start pouring millions of dollars into them, the reason can only be that they believe the stock will soon appreciate.

So let’s start taking a look at some stocks that the insiders like. These are shares that have recently seen million-dollar purchases from their inside owners; according to the TipRanks data platform, both have Strong Buy consensus ratings from the Street’s analysts. A look into the details may show us why you should follow the insiders, and buy into these as well.

MiMedx Group (MDXG)

We’ll start in the medical research field, with MiMedx Group. This biotech research company is a pioneer in the field of wound healing. MiMedx uses placental biologics, particularly placental and amniotic tissue, to develop regenerative treatments for chronic wounds, focusing on wound care, burn care, and post-surgical closures. The company aims to become the medical world’s leading provider of advanced healing solutions, with a direct and positive impact on patients’ quality of life.

MiMedx’s research focuses on developing new lines of allograft products that are based on the healing and regenerative properties of human placental and amniotic tissues. These are the tissues that support fetal development during pregnancy, and they are known to promote growth and development of other human tissues.

Following this approach, MiMedx has developed three product lines. The first is EPIFIX, which uses an allograft of dehydrated amnion/chorion membrane to provide a protective barrier on a wound, with a biocompatible extracellular matrix (ECM) to aid in the development of granulation tissue. The second product line, EPICORD, is a dehydrated human umbilical cord allograft, also designed to provide a protective environment that promotes wound healing. EPICORD’s action is based on an ECM that combines hyaluronic acid and collagen. Finally, EPIEFFECT uses a lyophilized human placental-based allograft membrane to form a barrier that gives acute and chronic wounds a protective environment. EPIEFFECT includes three layers, an amnion layer, an intermediate layer, and a chorion layer.

MiMedx’s products offer numerous advantages to both practitioners and patients. These include their beneficial aspect of directly promoting wound healing, but also include a 5-year stable shelf life and ease of application. The products have found use in the treatment of burns, surgical incisions, and musculoskeletal injuries, as well as the treatment of both surface and deep wounds and ulcers.

The notable recent insider trade here came from Joseph Capper, MiMedx’s CEO. Capper spent $1.268 million early this month to pick up 200,000 shares of the stock, and now holds a stake in the company that exceeds 529,000 shares, a total currently worth almost $3.84 million.

Turning to the company’s financial results, we find that on April 30 of this year MiMedx released its 1Q25 results – and beat the forecast on revenue. The company reported $88 million in sales, $1.88 million ahead of the estimates and showing 4% year-over-year growth. The quarterly sales drill-downs showed that surgical sales were up 16% y/y, to $32 million, while wound care sales were down 2% to $56 million. The firm’s bottom line, the non-GAAP EPS of 6 cents, came in as expected. The company finished Q1 with a cash position, net of balance sheet debt, totaling $88 million, for a $2 million sequential increase.

For Craig-Hallum analyst Chase Knickerbocker, the key point here is that MiMedx continues to run a profit even in a tough environment while improving its cash position. He writes of the company, “MiMedx is managing through the current market challenges, maintaining profitability, and continuing to put cash on the balance sheet. The strategic shift to take a higher-ASP middle ground should aid results in the near term while we await reimbursement change. In the meantime, surgical growth well ahead of overall company growth continues to diversify revenue away from the more volatile Wound market. We still think tailwinds from reimbursement reforms in the physician office Wound business are a when, not an if; in the meantime, investors get a highly profitable business that is well-positioned to weather these headwinds while still driving top-line growth.”

These comments support Knickerbocker’s Buy rating on the stock, and his price target, now set at $13, implies an upside for the next 12 months of 79%. (To watch Knickerbocker’s track record, click here.)

The Strong Buy consensus rating on this stock is unanimous, based on 5 recent positive reviews. The shares are selling for $7.25 and their $12 average target price suggests that they will gain 65.5% by this time next year. (See MDXG stock forecast.)

KKR & Co. (KKR)

Next on our list of insider trading targets is KKR, one of the world’s major asset managers. The company is a big name in global finance, with its hands in private equity, global credit, infrastructure investments, and real estate. KKR’s core business is in wealth management, and giving its customers and clients access to large capital markets. Through its investments, KKR improves its enterprise clients’ abilities to tap into capital resources, and the firm works with those clients to develop debt and equity investments, underwrite market deals, and facilitate a wide range of other financial transactions. As of March 31 this year, KKR has approximately $664 billion in total assets under management.

That total AUM includes $209 billion in private equity, $284 billion in global credit, $83 billion in infrastructure, and $81 billion in real estate. In these areas, KKR has invested in more than 250 companies across a wide range of sectors and industries, deployed large teams of financial experts across the globe, invested billions in small- and mid-sized businesses, supported infrastructure projects around the world, and created innovative solutions for borrowers and creditors alike.

In its latest quarterly financial statement, for 1Q25, the company reported a solid metric in fee-related earnings in the quarter, which came in at $823 million. This was up 23% year-over-year, and translated to 92 cents per adjusted share. The company also raised $31 billion in new capital during the quarter, and realized a 13% year-over-year increase in quarterly management fees, which reached $917 million.

Turning to the insider moves, Robert Scully, of KKR’s Board of Directors, made the last ‘informative buy’ of KKR stock. He bought 13,250 shares last week, for just over $1.5 million, a significant purchase that should spark investor interest.

According to Wells Fargo analyst Michael Brown, there are also several other reasons why investors should be interested in this asset manager. He writes, “Our bullishness reflects: (1) industry tailwinds from the material strength of investor demand for return-enhancing alt products; (2) KKR’s favorable AUM and earnings growth, enhanced by the addition of new areas of market participation via M&A moves in recent years; (3) the stock’s more reasonable valuation after the price pullbacks in 1Q25; and (4) our identification of several potential catalysts, including upside surprises for fundraising and monetizations.”

Brown rates this stock as Overweight (Buy), and he gives the shares a $136 price target that points toward a one-year upside potential of 8.5%. (To watch Brown’s track record, click here.)

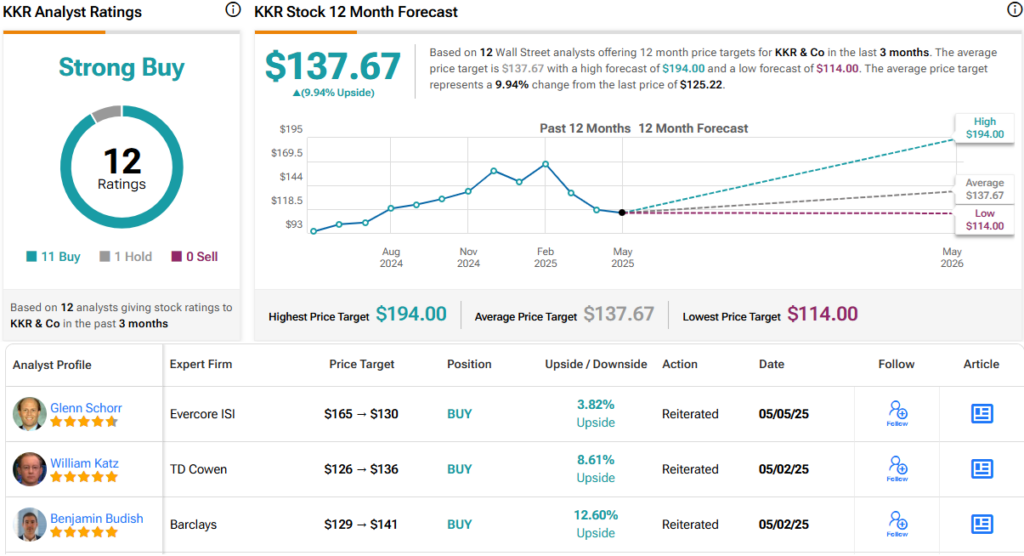

There are 12 recent reviews on record for this stock, and the lopsided 11 to 1 split, favoring Buy over Hold, gives KKR its Strong Buy consensus rating. The stock’s current trading price of $125.22 and its average target price of $137.67 combine to suggest a gain for the year ahead of 10%. (See KKR stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.