Fundamentally, high gasoline prices should lift Tesla (NASDAQ:TSLA) and other electric vehicle (EV) manufacturers. As circumstances stand right now, EVs are priced higher than their combustion-powered counterparts. Additionally, they grapple with issues like range anxiety. So, if a key catalyst can’t bolster EV valuations, that’s concerning. Therefore, I am bearish on TSLA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSLA Stock is Great but Still Needs Help

From the common declarations among experts, EVs represent the future, and Tesla may spearhead the mobility of tomorrow. Against a longer-term framework, TSLA stock may be a great investment. However, both the underlying enterprise and the overall industry still need a considerable amount of help to truly get going.

For starters, EVs are incredibly expensive. With the average price of a new electric-powered passenger vehicle coming in at around $53,400, that’s a difficult hurdle to jump over for any middle-income household. Further, while higher-income households may be able to afford a premium EV brand like Tesla, mass layoffs – especially in the high-paying technology sector – may have diminished this specific consumer demographic.

Following that, EV manufacturers need to pinpoint a compelling product advocacy strategy. Perhaps most notably, range anxiety presents a difficult challenge to overcome. To be sure, battery pack technology has improved over the years, thus improving the range of several EVs. Of course, the vehicles with the most range are priced higher than the modestly endowed, which goes back to the pricing obstacle.

Still, there’s an inaccurate characterization of range anxiety that deserves a proper framing. Many EV advocates will engage in “whataboutism,” noting that society doesn’t discuss hydrocarbon anxiety, even though the concept is the same — the fear of not making it to one’s desired destination.

However, that’s only a component of range anxiety. Mainly, the concern centers on the comparative lack of finding ample and reliable charging stations. When a combustion-powered car runs low on fuel, a driver can find a gas station practically anywhere. The same cannot be said about EVs.

Tesla Risks Losing the Golden Goose

While EV advocates can scream all they want, the bottom line is that consumers have numerous fears – whether rational or not – that prevent them from making the plunge. However, the golden goose for TSLA stock is skyrocketing retail gas prices. When the pain at the pump becomes too severe, prior apprehensions like range anxiety may fall by the wayside.

Notably, as gas prices started picking up from the doldrums of the pandemic, TSLA stock also swung higher. In certain time periods, investors can observe a direct correlation between Tesla share valuations and gas prices: as one metric increased, so did the other.

However, from July through September of this year, the relationship printed an inverse trend. During the aforementioned period, gas prices in the nation increased from $3.712 per gallon to $3.958. However, TSLA stock (on a monthly average basis) dipped from $267.43 to $250.22.

In all fairness, the variance isn’t anywhere near enough to warrant panic. However, it’s unignorable that as gas prices jumped higher amid economic difficulties, investors didn’t believe it was enough to take a long-side bet on TSLA stock.

An Incoming Difficult Setup

Earlier this year, Tesla rattled the EV market through aggressive price cuts, thus sparking a price war. Given its market position, management may have calculated that such a move would hurt the competition more than it would impact TSLA stock. Still, no business enterprise is immune to critical decisions if they go awry. Further, the intensified competition creates a difficult setup for Tesla.

Undoubtedly, the company has enjoyed the expansion of its top line. For example, revenue for the second quarter of Fiscal 2023 came in at $24.93 billion, up over 47% against the year-ago period. Unfortunately, the gross margin in Q2 of this year was about 18.2%, down from the 25% posted one year ago.

With TSLA stock not responding positively to higher gas prices, the last thing the company needs is bruising competition.

Is TSLA Stock a Buy, According to Analysts?

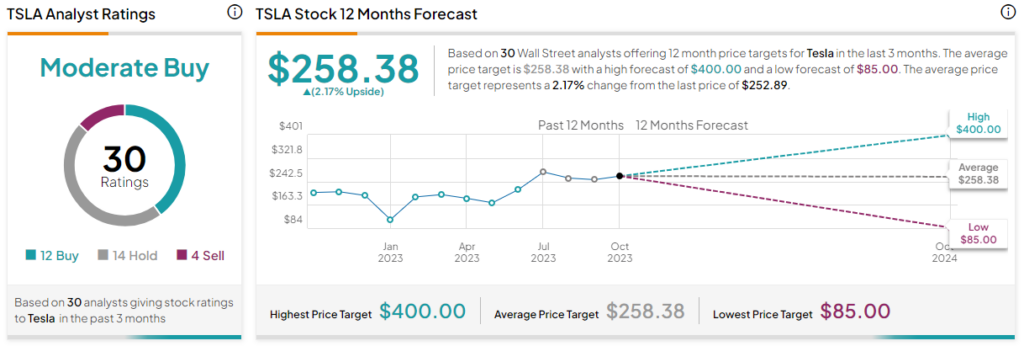

Turning to Wall Street, TSLA stock has a Moderate Buy consensus rating based on 12 Buys, 14 Holds, and four Sell ratings. The average TSLA stock price target is $258.38, implying 2.2% upside potential.

The Takeaway: The Low-Hanging Fruit for TSLA May be Gone

In prior years, TSLA stock surged on a simple premise: as the costs of operating combustion-engine cars increased, so did the value of Tesla shares. Unfortunately, that low-hanging fruit may have been chopped down. Plus, fierce competition makes the EV maker a risky investment.