As macro-economic uncertainty sets in, it is time to look at value stocks. In short, stocks that will give investors more bang for their buck. Even analysts have been shortlisting such stocks from their coverage universe. Value stocks are stocks that are valued lower by the market even as their underlying fundamentals remain strong.

Yesterday, we looked at two such stocks from the retail sector, Nike and Lululemon.

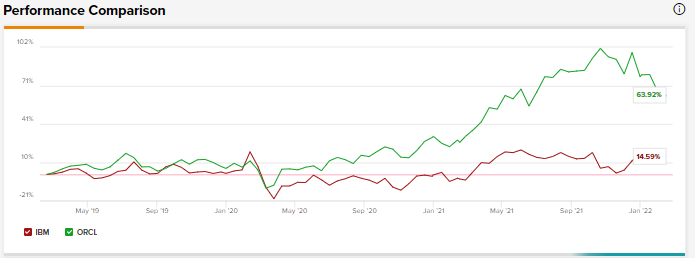

Today, we will compare two such stocks from the technology sector, IBM and Oracle, using the TipRanks stock comparison tool and see what Wall Street analysts are saying about these stocks.

IBM (NYSE: IBM)

IBM is focusing on strengthening its hybrid cloud and Artificial Intelligence (AI) capabilities in a big way and this was reflected in its Q4 results. The technology giant posted revenues of $16.7 billion in Q4, up 6.5% year-over-year.

According to Tigress Financial analyst Ivan Feinseth, this was the company’s best revenue growth in the past ten years. However, the analyst thinks that the company continues to battle competitive pressures.

This rise in revenues was mainly fueled by the growth in IBM’s software and consulting revenues, which increased by 8.2% and 13.1%, respectively, in the fourth quarter.

It is important here to note that IBM’s business segments include: software (including hybrid platform and solutions and transaction processing), consulting, hybrid infrastructure, and infrastructure support and financing.

Arvind Krishna, Chairman and CEO of IBM, commented, “Our fourth-quarter results give us confidence in our ability to deliver our objectives of sustained mid-single digit revenue growth and strong free cash flow in 2022.”

IBM has projected free cash flow ranging between $10 billion and $10.5 billion for FY2022.

The company’s rising focus on its hybrid cloud and AI was evident as it completed the spin-off of its information technology (IT) services management company, Kyndryl. Besides the spin-off, IBM also ramped up its spending on research and development and acquired 15 companies to strengthen its hybrid cloud and AI capabilities. The company invested more than $3 billion in these acquisitions.

Indeed, the company’s management stated on its earnings call that its software and consulting businesses remain its core growth vectors, “and together represent over 70 percent of our annual revenue.”

However, even with the upbeat outlook, analyst Feinseth still thinks that IBM faces rising competition from other cloud service competitors that offer more “robust product offerings” including Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT).

Moreover, according to the analyst, IBM faces the pressure “to innovate and offer new products in fast-growing cloud product and data analytics service offerings.”

Another concern for Feinseth is that IBM continues to be dependent on spending by the U.S. Government and other governments around the world on IT infrastructure as these remain one of its largest customers.

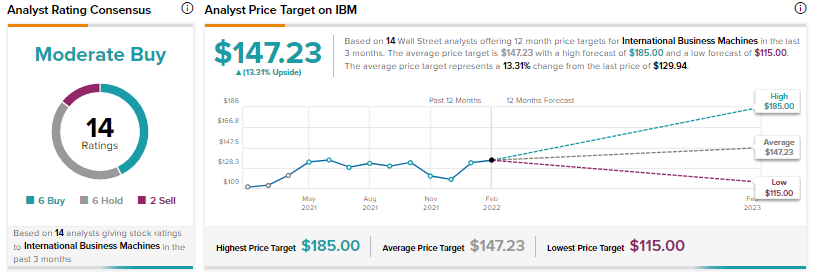

As a result, the analyst remains in a wait-and-watch mode for IBM’s growth vectors to ramp up further. Feinseth has a Hold rating with a price target of $133 (2.4% upside) on the stock and sees “little opportunity for near-term outperformance.”

Interestingly, Feinseth’s views aside, Wedbush analyst Daniel Ives and Jeffries analyst Kyle McNealy are bullish on the stock and view IBM as a value stock amid the current macroeconomic turmoil. Ives thinks that IBM could stand to benefit from a $1 trillion spending over the next few years on digital transformation, with more enterprises shifting their workload to the cloud.

Jeffries analyst McNealy, on the other hand, remains confident “that the company can meet or exceed their mid-single-digit growth target,” and IBM remains on Jeffries’ list of 23 value stocks.

Other analysts on the Street, however, are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 6 Buys, 6 Holds, and 2 Sells. The average IBM stock prediction of $147.23 implies upside potential of approximately 13.3% to current levels for this stock.

Oracle (NYSE: ORCL)

Oracle is another company that is betting big on the cloud business. The company’s products and services include infrastructure offerings and enterprise applications. Oracle’s IT deployment models include cloud-based deployments, on-premise deployments, and hybrid deployments.

The company’s cloud and license business made up 85% of its total revenues on a trailing basis over four quarters. This business had revenues of $8.8 billion at the end of fiscal Q2, up 7.2% year-over-year.

In fiscal Q2, the company’s total revenues of $10.4 billion grew 6% year-over-year and topped analysts’ expectations of $10.21 billion.

Oracle CEO, Safra Catz, said, “Constant currency revenue beat guidance by $200 million. These strong results are being driven by the 22% growth of our infrastructure and applications cloud businesses which are approaching $11 billion in annualized revenue.”

However, the company’s shares have taken a beating in the past month, with the stock falling by 6.8% following the news of the company’s acquisition of Cerner for $28.3 billion.

But Monness Crespi Hardt analyst Brian White thinks that this sell-off is a “knee-jerk reaction” that has created an “attractive buying opportunity” for the stock.

The analyst was positive about ORCL’s annualized total cloud revenues of $10.7 billion.

Indeed, the company’s management is bullish about its cloud revenues, and stated on its fiscal Q2 earnings call that it expects to exit FY22 with revenues in the “mid-20s” or higher, with “cloud bookings growing faster than our cloud revenue growth rate.”

What’s more, Larry Ellison, Chairman, and CTO of Oracle, expects that cloud Enterprise Resource Planning (ERP) revenues could approach $20 billion over the next five years.

Considering the company’s potential to benefit from the digital transformation to the cloud, analyst White is bullish with a Buy rating with a price target of $126 (approximately 58% upside) on the stock.

The analyst added that his current price target is based on a P/E ratio (price-to-earnings) of 24 times the calendar year 2022 EPS estimate. Furthermore, White commented, “This P/E target is above Oracle’s historical average in recent years; however, we believe the successful creation of a solid foundation to support strong cloud growth in the coming years has the potential to increasingly provide the market with more confidence in the company’s long-term business model.”

Other analysts on the Street, however, are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 6 Buys and 12 Holds. The average Oracle stock prediction of $104.40 implies upside potential of approximately 30.8% to current levels for this stock.

Bottom Line

While analysts are cautiously optimistic about both stocks, for analysts such as Ives and McNealy, IBM is a value stock at current levels. However, based on the upside potential over the next 12 months, Oracle seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.