International Business Machines (NYSE:IBM) features the second-lengthiest dividend-growth track record in the information technology sector, boasting 27 years of consecutive annual dividend increases. Shares are currently trading with a substantial yield of 4.9% attached, seemingly strengthening the stock’s case as an appealing dividend-growth play in the space.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That said, it appears that IBM’s dividend-growth story is flawed, as the lack of indicative growth and high indebtedness limit the potential for meaningful payouts, moving forward. Therefore, I am neutral on the stock.

Good Developments, but Not Good Enough

IBM has recorded some positive developments lately. Sadly, these developments are not good enough to support a significant shift in earnings from here. The company recently posted its Q4 and full-year earnings report for Fiscal 2022, with results coming in slightly improved, excluding foreign exchange headwinds. Still, IBM’s core operations continue to lag while its debt load remains worryingly elevated even after continuous deleveraging.

Specifically, for Q4, IBM reported revenues of $16.7 billion, flat year-over-year. While revenues actually grew 6% in constant currency (CC), with the stronger dollar year-over-year being the primary headwind in the top-line growth, it’s once again evident that IBM struggles with meaningfully penetrating deeper into its existing markets.

Software Segment

Even IBM’s Software segment, which contains Hybrid Platforms & Solutions and Transaction Processing and is supposed to be the company’s main growth driver, saw its revenues grow by 2.8% or 8.0% in CC. Remember that this division also includes Red Hat, IBM’s poster child for its “growth story,” and yet, revenues from Red Hat grew by just 10% or 15% in CC.

Red Hat’s growth is hardly enough to uplift the overall Software division, let alone IBM’s overall results. This is especially true given that certain divisions within IBM’s Software segment continue to struggle. Transaction processing revenues, for instance, declined 3% for the quarter, even as the transaction processing industry has seen robust growth lately (see Visa (NYSE:V), Mastercard (NASDAQ:MA) for relevant industry growth metrics).

Consulting & Infrastructure Segments

IBM’s Consulting and Infrastructure segments also reported underwhelming results. Revenues grew by just 0.5% and 1.5%, respectively, and while FX impacts downsized results, as mentioned earlier, mid-single-digit growth in constant currency would have still been dull.

Regardless, the company has a hard time matching the growth of its competitors in these segments as well. Seeing Infrastructure Support revenues down 8%, for instance, is rather unacceptable, given that infrastructure spending has been soaring lately.

Profitability, Outlook, and Indebtedness

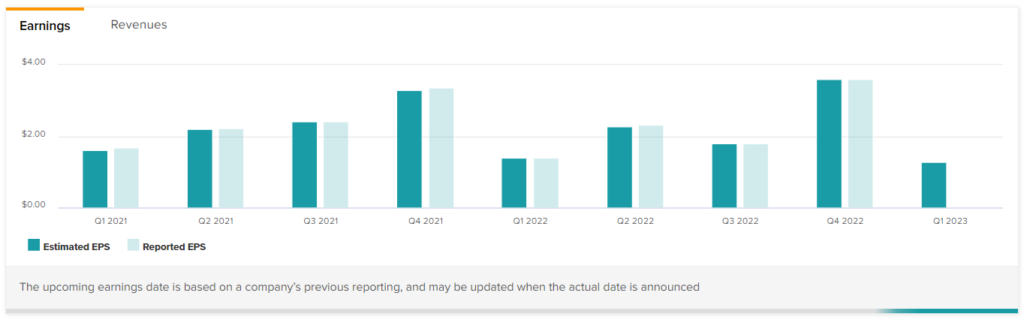

While IBM’s revenues failed to excite, the company did manage to somewhat improve its earnings. For the quarter, adjusted earnings per share grew 7% year-over-year to $3.60. Thus, for the year, adjusted earnings per share landed at $9.13, up 15.1% compared to Fiscal 2021, following improvements in margins.

Nevertheless, given IBM’s expectations for Fiscal 2023, top and bottom-line growth metrics are expected to remain somewhat mediocre. Revenue growth is expected to land in the mid-single-digits, and that’s in constant currency, while free cash flow is expected to be close to $10.5 billion.

Based on these factors, earnings-per-share growth should also come in the mid-single-digits. Further, despite the relatively substantial free cash flow, it is apparently going to be allocated to paying down its debt, which remains at sky-high levels.

Even after gradually paying down its long-term debt over the years, which has declined from $58.4 billion in Q2 2019 to $46.2 billion in Q4 2022, it’s quite unlikely that investors will see this free cash flow being returned to them besides through the dividend, as the company remains heavily indebted.

The 4.9% Dividend Yield is Not Worth It

Given IBM’s legendary dividend-growth track record and substantial 4.9% dividend yield, investors could see the stock as a fitting pick for dividend-growth portfolios. However, as just discussed, IBM’s growth remains uninspiring.

Even in constant-currency terms, mid-single-digit earnings-per-share growth is unable to support meaningful dividend increases, while projections for free cash flow that approaches $10.5 billion fail to excite because IBM would need to allocate a great portion of that to pay down its debt if the balance sheet is to turn healthier.

This is evident by the gradual deceleration in dividend growth, as the company can simply not afford higher payouts as it strives to deleverage.

Specifically:

- Between 2010 and 2015, IBM’s dividend grew, on average, by 14.9% per annum.

- Between 2015 and 2020, IBM’s dividend grew, on average, by 5.4% per annum.

- Between 2017 and 2022, IBM’s dividend grew, on average, by 2.2% per annum.

- Finally, IBM’s latest dividend increase was by a mere 0.6%, further reinforcing this trend.

Is IBM Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, International Business Machines Corporation has a Hold consensus rating based on three Buys, seven Holds, and one Sell assigned in the past three months. At $143.56, the average IBM stock forecast suggests a 5.9% upside potential.

The Takeaway

With IBM’s financials lagging for decades (the company’s revenues are currently below those of its early 90s), the stock’s investment case has been solely supported by its dividend. However, with earnings set to grow in the mid-single-digits at best, moving forward, investors should expect any future dividend hikes to be minor, as indicated by the long-term dividend growth deceleration trend and IBM’s latest insignificant dividend hike.

Also, the majority of the company’s free cash flow is destined to be allocated toward deleveraging. Thus, IBM cannot really pursue any external growth avenues. In that regard, I find the stock’s dividend-growth investment case rather flawed, with future total returns likely unable to exceed the levels of the current dividend.