Listen up, crypto fans. Hut 8 Mining (NASDAQ:HUT) has cryptocurrency mining rigs with plenty of power. If you’re a blockchain bull and like to buy stocks instead of only holding Bitcoin (BTC-USD), owning shares of Hut 8 may be a good strategy to consider. Overall, I am bullish on HUT stock, even though investors should be fully prepared for share price volatility in 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Hut 8 Mining is headquartered in Florida, and the company specializes in mining cryptocurrency. The company does this all day, every day, rain or shine. So, while Hut 8 stock may be considered an indirect path to Bitcoin exposure in one’s portfolio, the company is directly and fully immersed in crypto-mining operations.

Bitcoin is down a little bit today, but HUT stock fell 5% in today’s trading session. That’s the type of leverage you can get if you’re a Hut 8 investor, and leverage occurs in both directions. Consequently, you can be enthusiastic about the blockchain revolution but should still maintain a reasonable position size with Hut 8 shares.

Hut 8’s Unusual Deals

First and foremost, prospective investors should know that Hut 8 released a few updates that might be considered unusual. This doesn’t mean they’re bad, but it will be interesting to see how these developments impact HUT stock in the coming months.

Here’s what you need to know. Last month, Hut 8 announced a successful “stalking horse” bid to acquire four natural gas power plants in Ontario, Canada. A “stalking horse” bidder is one who makes an initial bid on distressed assets, typically during bankruptcy proceedings of the business being bid upon.

To finalize this transaction, Hut 8 would end up creating a new subsidiary, called BidCo, to acquire the assets. The specifics are quite complicated, but suffice it to say that Hut 8 clearly wants the aforementioned natural gas power plants.

Next, Hut 8 received approval for and then was selected to “build out and install mining operations in connection with the Celsius Network LLC bankruptcy proceedings at a site in Cedarvale, Texas.” Again, Hut 8 is associated with what might be called “distressed assets” or damaged goods. Still, Hut 8 should benefit from this arrangement, as the company is tasked with helping to establish around 66,000 cryptocurrency miners at the Texas site.

On top of all that, Hut 8 is involved in the “largest M&A transaction that has ever transpired within our industry,” according to the company’s CEO. That’s pretty unusual, wouldn’t you agree? To be more specific, Hut 8 merged with a similar company with a long name – U.S. Data Mining Group, Inc. dba US Bitcoin Corp.

The press release calls the combined company “New Hut,” but thankfully, Hut 8 is still called Hut 8. In any case, the combined business has access to a whopping 825 megawatts (MW) of gross energy and could prove to be a cryptocurrency mining powerhouse in 2024.

Hut 8: Powerful but Not Profitable

I’m not going to claim that Hut 8’s financials are perfect in every way. The company isn’t profitable, but that’s par for the course in the world of cryptocurrency mining. Frankly, if you’re going to fret over P/E ratios and things like that, you might not want to invest in blockchain companies this year.

Instead of profitability (or the lack thereof), risk-tolerant traders should focus on Hut 8’s output. For example, in the third quarter of 2023, Hut 8 mined 330 Bitcoins. Considering the rise in crypto prices during the past six months, it’s fair to say that 330 Bitcoins are worth a whole lot of money.

Fast-forward to November 2023, and Hut 8 reported that its self-mined Bitcoin reserves had increased to 9,129 Bitcoins. Then, Hut 8’s self-mined Bitcoin reserves grew to 9,195 Bitcoins in December.

At that rate, Hut 8 might reach 10,000 Bitcoins by the end of this year. The aforementioned “New Hut” deal could certainly help Hut 8 achieve this milestone. Plus, acquiring the natural gas power plants I discussed earlier would undoubtedly give Hut 8’s crypto-mining operations a boost.

Finally, I should mention that HUT stock tends to follow the Bitcoin price, so you’ll want to keep tabs on what’s happening in the world of cryptocurrency and the blockchain if you plan to invest in Hut 8. If you’re not bullish on Bitcoin, then it just doesn’t make much sense to hold shares of Hut 8.

Is HUT Stock a Buy, According to Analysts?

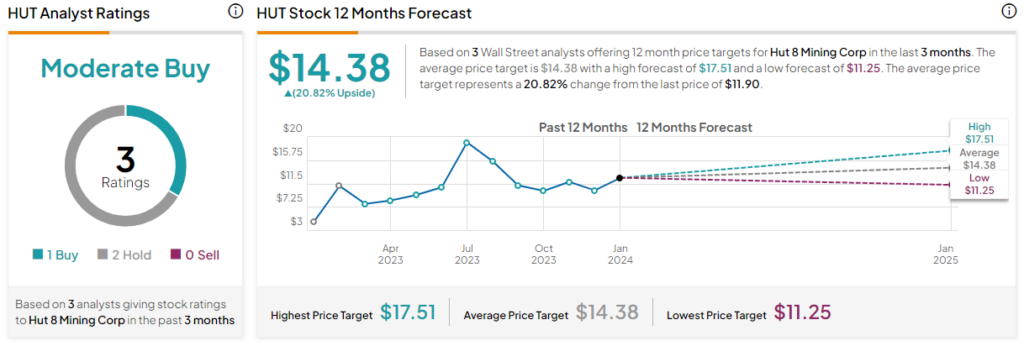

On TipRanks, HUT comes in as a Moderate Buy based on one Buy and two Hold ratings assigned by analysts in the past three months. The average Hut 8 Mining price target is $14.38, implying 20.8% upside potential.

Conclusion: Should You Consider HUT Stock?

Hut 8 Mining Corp. is a highly ambitious Bitcoin miner with some unusual deals and developments in the past six months. What’s encouraging, though, is that Hut 8’s “New Hut” business combination should give the combined company a boost of mining power.

Granted, Hut 8’s financials aren’t ideal in the traditional sense. If you can handle magnified price moves compared to Bitcoin, though, then you might consider a small-sized investment in Hut 8. Consequently, blockchain believers should keep an eye on Bitcoin’s price movements and conduct their due diligence on HUT stock for a possible position this year.