Honeywell International (HON) invents and commercializes technologies that address some of the world’s most critical challenges around energy, safety, and security, amongst others.

The company’s business segments can be broken down into four segments: Aerospace, Honeywell Building Technologies, Performance Materials and

Technologies, and Safety and Productivity Solutions.

Honeywell showcases two major characteristics which come in handy in the current volatile environment.

The first is that the company has a robust backlog which represents the estimated remaining value of work to be performed under firm contracts. Hence, its cash flows are predictable and can remain healthy even during economic environments of high uncertainty.

The second is that many of the company’s major customers include governments. Honeywell services both the U.S. government and international governments. Consequently, it faces minimal counterparty risks as governments are almost impossible to default on their contractual obligations.

I believe that the stock is slightly overvalued at its current levels. Hence, I am neutral on Honeywell. (See Analysts’ Top Stocks on TipRanks)

Recent Results

Honeywell recently released its Q3 results, with performance coming in strong. Revenues increased 8.7% to $8.47 billion, while adjusted EPS was $2.02, 29.5% higher year-over-year.

Specifically, the company’s organic sales increased 8%, with Honeywell recovering from the challenges caused last year from COVID-19, driving operating margin 180 basis points higher to 18.6%, and segment margin 130 basis points higher to 21.2%.

Organic sales growth was led by a 38% growth in Aerospace commercial aftermarket, 21% growth in Safety and Productivity Solutions, 29% growth in UOP, and 14% growth in advanced materials within Performance Materials and Technologies.

Aerospace, the company’s most impacted segment by COVID-19, also reported a humble but promising sales growth of 2%. Growth was driven by the ongoing recovery in commercial aftermarket demand as flight hours continued to grow, as well as by strong growth in general aviation original equipment. However, the segment’s total performance was partially offset by lower defense volumes, which were most impacted by supply chain constraints.

Out of the company’s Q3 report, I am most excited about its backlog growing by 7% to $27.5 billion, indicating strong cash flow visibility in the short to medium term.

Dividend And Valuation

Since 1992, Honeywell has never cut its dividend. The company has paused DPS hikes in the past to preserve liquidity, but generally tends to grow its DPS annually.

Following the latest hike by 5.4% to a quarterly rate of $0.98 in October, the company now numbers 12 years of consecutive annual dividend increases.

Based on management’s guidance for the year, which expects adjusted EPS of $8.00 to $8.10, the current DPS run-rate of $3.92 appears very well-covered, while the stock’s yield of 1.8% should be a decent total return contributor.

The stock is trading 24.5x management’s EPS guidance at the midpoint.

Wall Street’s Take

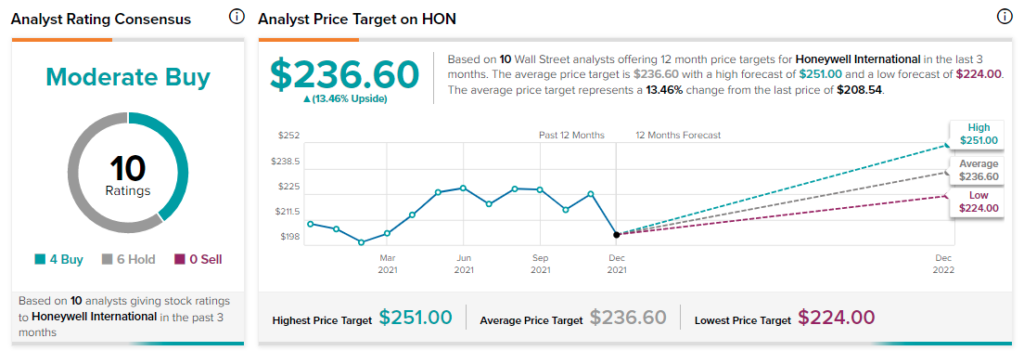

Turning to Wall Street, Honeywell International has a Moderate Buy consensus rating based on eight Buys and six Holds assigned in the past three months.

At $236.60, the average Honeywell International price target implies 13.5% upside potential.

Disclosure: At the time of publication, Nikolaos Sismanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >