Rising mortgage rates and home prices, coupled with tight inventory levels, are squeezing a number of would-be homeowners out of the housing market. Amid such a macro-environment, we focus on UMH Properties (UMH), a name that scores on a multitude of positive factors.

UMH, a real estate investment trust (REIT), has been around since 1968 and owns and operates manufactured home communities. It leases manufactured homes to private homeowners. It currently has 130 manufactured home communities in its portfolio that contain 24,400 home sites.

Furthermore, UMH had a rental portfolio of 8,800 units at the end of Q1 and plans to increase it by 700 to 800 homes each year. Additionally, it has 1,800 acres in the kitty on which it can construct 7,300 future lots. The company has a well-diversified presence across 10 U.S. states and at the end of Q1 saw an average rental occupancy of 95.3% and an average monthly home rent of $839.

Robust Financials

UMH has steadily increased its developed sites from 20,000 in 2017 to 24,400 at present. Keeping in sync, its top line has ticked upwards from $112.6 million in 2017 to $186.1 million in 2021. Simultaneously, FFO has increased from $0.72 in 2017 to $0.87 in 2021. Revenue and funds from operations (FFO) are expected to rise to $215.8 million and $1.2, respectively, in 2023.

This consistency indicates the resiliency of UMH’s business model to face larger challenges, such as the COVID-19 pandemic or the current inflationary environment.

Furthermore, UMH’s net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) metric has improved from 6.8 in 2018 to 3.7 in Q1 2022. With a price-to-book ratio of 3.06 and a price-to-sales ratio of 4.88, UMH seems reasonably priced at current levels after a 30.3% price correction so far in 2022.

Analyst’s Take on UMH

The Street has a Strong Buy consensus rating on the stock alongside a price target of $26.1, implying a 41.08% potential upside. Along with this potential price gain, UMH also offers a dividend yield of 4.27% and has a payout ratio of 409.47%. The company has already undergone two dividend hikes in the past 18 months.

Different Quarters of the Market Are Jumping into the Stock

Along with analysts, UMH’s superior performance has also attracted the attention of other stakeholders in the market.

Hedge funds have increased holdings in the stock by 110,500 shares in the last quarter, indicating a very positive hedge fund confidence signal. Moreover, our data indicates that retail investors are also buying UMH. Over the past 30 days, the number of portfolios on TipRanks that hold UMH has already increased by 11.5%. This, in turn, indicates very positive investor sentiment toward the stock.

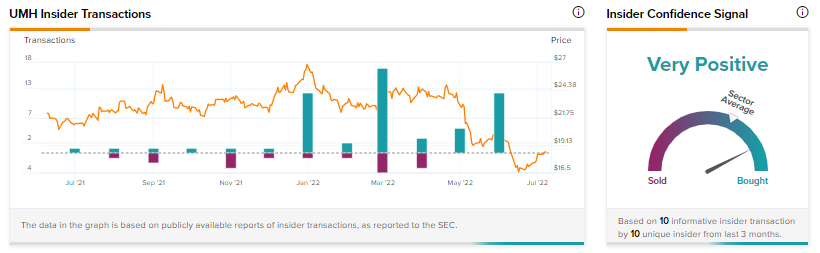

Insiders Jump In on the Action

According to TipRanks data, insiders too, have been making the most of the share price drop in 2022 and have scooped up shares worth $2.2 million in the last three months, which indicates a very positive insider confidence signal for UMH.

Closing Note

UMH has been delivering consistently for a while now and stands to gain from the current trends in the housing market. Although the stock presents compelling metrics, the actions taken by insiders are a major positive for UMH, which sends a strong signal for retail investors when the broader markets are facing a bumpy ride.

Read full Disclosure