Parker-Hannifin (NYSE:PH) and WW Grainger (NYSE:GWW) are famous for their stellar dividend payment and growth history (more than 50 consecutive years). Moreover, these Dividend Aristocrats (learn more about Dividend Aristocrats here) have consistently outperformed the broader markets over the past several years. However, what caught our attention is the recent selling in these stocks by company insiders.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Six Insiders Sold PH Stock in June

According to TipRanks’ Insider Trading Activity Tool, six insiders, including the VP & President of Parker-Hannifin’s Aerospace division, Roger Sherrard, executed six Sell transactions in PH stock in June 2023.

Overall, corporate Insiders sold $2.1 million worth of Parker-Hannifin shares in the past three months.

GWW Stock Witnessed Four Sell Transactions

Per the Insider Trading Activity Tool, two insiders, including GWW’s VP, Controller, Laurie R Thomson, made four Sell transactions last month. Overall, insiders sold $1.8 million worth of W.W. Grainger stock in the last three months.

Is Parker-Hannifin a Good Stock to Buy?

Parker-Hannifin is a diversified manufacturer of motion and control technologies and systems targeting mobile, industrial, and aerospace markets. Its stock has risen over 35% year-to-date, outperforming the broader market.

Overall, its highly-diversified customer base and solid distribution network enable the company to consistently generate strong cash flows and enhance its shareholders’ returns through growing dividend payments. Thanks to its high-quality earnings base, Parker-Hannifin increased its dividend for 67 consecutive fiscal years.

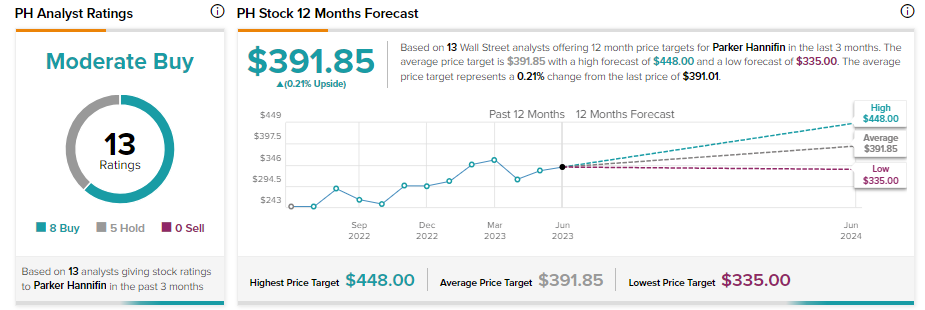

While PH’s fundamentals remain strong, the stock’s recent rally and a weak macro environment are keeping analysts cautiously optimistic about the stock. Parker-Hannifin has received eight Buys and five Hold recommendations for a Moderate Buy consensus rating. The average Parker-Hannifin stock price target of $391.85 is in line with its current market price.

Is GWW a Good Stock to Buy?

W.W. Grainger is a distributor of MRO (maintenance, repair, and operating) products. Its products and services are non-discretionary and are less tied to overall economic activity, making it a reliable company in all market conditions.

Thanks to its ability to generate solid sales and earnings, its stock has increased by about 74% in one year. Moreover, GWW has uninterruptedly increased its dividend for 52 consecutive years.

As GWW stock has appreciated quite a bit, analysts maintain a cautiously optimistic outlook on it. GWW stock has received four Buys, three Holds, and one Sell recommendations for a Moderate Buy consensus rating. Meanwhile, the average GWW stock price target of $735 implies 6.08% downside potential from current levels.

Bottom Line

PH and GWW stocks marked notable gains over the past year. Taking advantage of this appreciation in price, corporate insiders could have sold shares. Further, these trades were informative, implying they indicate insiders’ sentiment. Thus, an informative transaction has a higher predictive ability.

Whether PH and GWW stocks witness a correction remains a wait-and-see story. However, retail investors must take caution due to recent insider selling, especially after a notable price appreciation.