TipRanks’ Hedge Fund Trading Activity is a handy tool for investors looking to find hedge fund activity trends to help make investment decisions in uncertain times. The tool collects data from the filings of around 468 hedge funds to offer hedge fund signals. Today, we narrowed the search to the automotive sector, which has been languishing for most of 2022; and Stellantis (NYSE:STLA) is one automotive stock that is grabbing the attention of hedge fund managers and analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Stellantis is an auto powerhouse that has recently grabbed investor interest with its efforts to fortify its presence in the electric vehicle (EV) market with solid product offerings and partnerships. Its Dare Forward 2030 strategy aims to accelerate its transition to a zero-carbon company by 2038. As part of this goal, the strategy is expected to reduce carbon emissions by 50% by 2030. During this time, Stellantis aims to increase its annual net revenues to $335 billion (almost double its current revenues) while maintaining double-digit profit margins. Meanwhile, the company will also rev up its efforts to launch electrified versions of its cars.

Stellantis’ balance sheet is being fed by meaningful synergies that are bringing down expenditures while boosting free cash flow, helping it finance growth initiatives without additional debt.

In an industry that is still experiencing year-over-year declines in volumes due to several headwinds, including supply-chain issues and high costs, Stellantis is still managing to improve profitability and maintain market share.

Shares of the company have gained 12.3% in the past six months.

Is STLA Stock a Buy, According to Analysts?

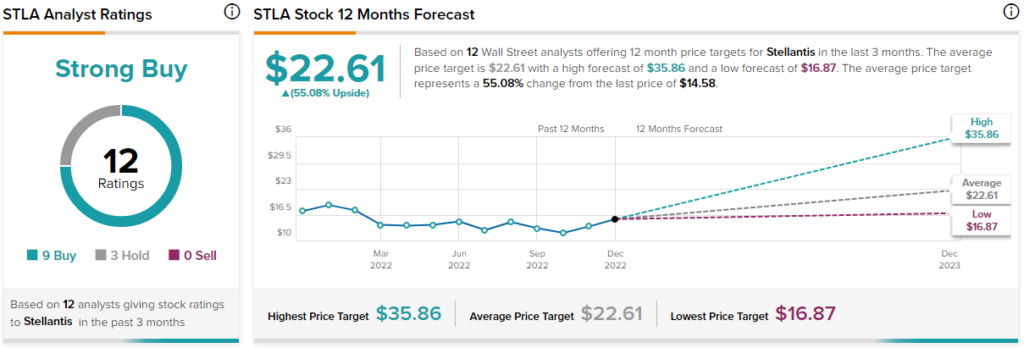

Wall Street consensus is bullish on STLA stock, with a Strong Buy rating based on nine boys and three Holds. The average price target of $22.61 indicates 55.1% upside potential over the next year.

Looking at what hedge funds are doing with the stock, we see that they bought 2 million shares of STLA last quarter. Three hedge fund managers added the stock to their portfolio, including Capital Growth Management’s Ken Heebner, Fisher Asset Management’s Ken Fisher, and Gotham Asset Management’s Joel Greenblatt.

The Takeaway

Hedge funds employ various diversifying and hedging techniques to ensure that they beat the market. Hence, standing at the curb of a recession, it makes sense for investors to keep track of the transactions made by hedge fund managers. That said, maintaining profitability amid industry-wide challenges is keeping Stellantis a part of hedge fund portfolios.