Home improvement stocks took a hit to the chin on Tuesday, with Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) falling 1.86% and 1.3%, respectively, as home sales and consumer confidence numbers came in cooler than expected. Undoubtedly, home improvement stocks are highly discretionary, but their promising longer-term fundamentals may be overlooked as investors draw more focus on the rough economic terrain that’s immediately up ahead.

Despite recent rocky moves, some upbeat analysts, like Alliance Bernstein’s Dean Rosenblum, are standing by the home improvement stocks as they navigate uncertainties, given that they will eventually get a boost once the U.S. housing market goes on the mend.

Even as home sales slump, homeowners still have the means to spend on renovations to fetch a prettier price once the housing market is ready to heat up again. In fact, a housing market cooldown may be a great time to spruce up the home for those who still have disposable income.

For other homeowners feeling the pinch, it could take a while longer before they’re ready to invest in upgrades around the home again. However, for longer-term investors, both Home Depot and Lowe’s shares seem to be more than worth the wait, as macro headwinds have a chance to top out while valuations contract.

Major home projects may be discretionary in nature. However, they’re also investments that entail a long-term return in the form of a higher selling price. In that regard, I am bullish on both Home Depot and Lowe’s as the home improvement plays could be among the first of the discretionary cohort to rise once the economic coasts gradually clear.

The Worst of Macro Headwinds May Already be Priced In

For now, disappointing consumer confidence data and higher mortgage rates stand to delay any such investment booms around the home as the cost of everyday living continues to take a bigger chunk out of American’s wallets. Inflation has cooled by a great deal over the past year, but it’s still running hot, especially regarding certain staples.

In any case, a big chunk of the interest rate, housing market, and consumer confidence woes have likely been priced in here, especially after the latest September slump in stocks.

The top home improvement companies have been in ugly bear markets for well over a year now, with Home Depot and Lowe’s shares now off more than 27% and 20% from their late-2021 all-time highs. As inflation winds down further, the Federal Reserve can lift its foot slightly off the gas pedal.

In such a scenario, consumer confidence and likely home sales could pick up well before any promising economic data has a chance to be put in the books. To get the most out of the home improvement plays, investors will probably have to brave the macro storm well before inflation and rates cool while consumer confidence and housing heat up.

With all that in mind now, let’s check in with TipRanks’ comparison tool to see where analysts stand on the two top home improvement plays.

Is LOW Stock a Buy, According to Analysts?

Even as the home improvement market felt the pinch, Lowe’s has been making major strides to nibble at the heels of the heavyweight champ Home Depot. Earlier this month, analyst Dean Rosenblum hiked LOW stock to Buy from Hold while hiking his price target to $282.00 from $252.00, entailing a solid 36.3% gain from current prices.

A major reason behind the upgrade? Rosenblum likes Lowe’s growth prospects in the Pro business (think contractors), which has predominantly been Home Depot’s strong point. As Lowe’s continues to beef up its Pro business, Rosenblum believes upward pressures on operating margins will follow. All considered, Lowe’s likely deserves to trade at a richer premium to Home Depot as the companies brave out the rough waters en route to the housing market’s inevitable recovery.

At writing, LOW stock trades at 20.5 times trailing price-to-earnings, a slight premium to the home improvement retail industry average of 19.4 times. Given the pace of Lowe’s earnings growth (EPS has grown at a 20% compound annual growth rate in the past five years vs. 18% for Home Depot), I view the premium as warranted.

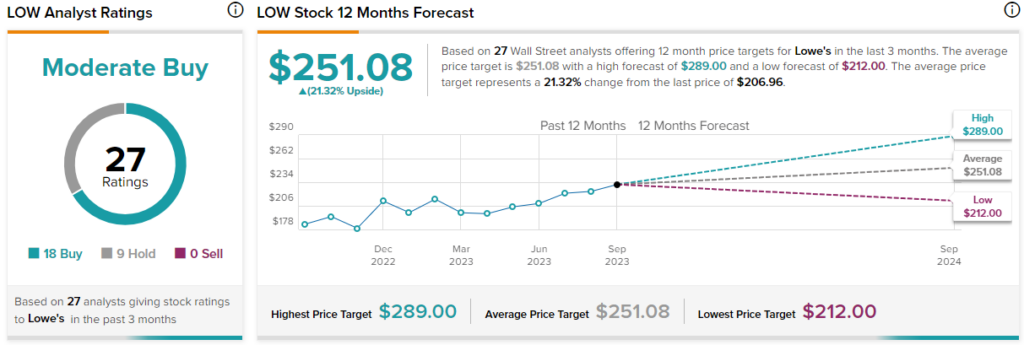

Overall, Lowe’s stock comes in as a Moderate Buy, according to analysts, with 18 Buys and nine Holds assigned in the past three months. The average LOW stock price target of $251.08 entails 21.3% upside potential.

Is HD Stock a Buy, According to Analysts?

Home Depot trades at 18.9 times trailing price-to-earnings, which is a slight discount to the industry average. Though Lowe’s is catching up on some fronts, you can’t discount Home Depot’s Pro business, which still sports a strong backlog — not bad, considering the magnitude of macro headwinds facing the sector.

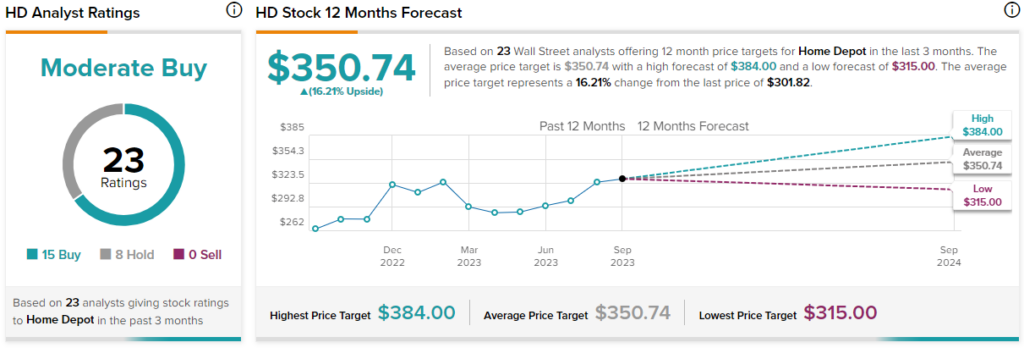

Home Depot stock is also a Moderate Buy, according to analysts, with 15 Buys and eight Holds assigned by analysts in the past three months. The average HD stock price target of $350.74 entails 16.2% upside potential from here.

The Bottom Line

Analysts still like the home improvement plays as they sail through rougher waters. At this juncture, Lowe’s stock takes the cake for having more upside potential (21.3% vs. 16.2%) and a slightly higher buy-to-hold ratio. Home Depot is the king of the industry, but Lowe’s has the means to catch up and justify a higher growth multiple. All considered, I believe LOW seems to be the slightly better bet.