Shares of Hasbro (NASDAQ: HAS) have tanked 22.3% this year amid a broader market sell-off, and the stock is currently hovering near its 52-week low of $77.79. Hasbro is expected to announce its Q2 results today.

Even as the overall macroeconomic environment remains volatile, Stifel Nicolaus analyst Drew Crum continues to be bullish about the stock. Let us look at Crum’s bullish thesis for the stock.

For Q2, the top-rated analyst has forecasted Hasbro to generate revenues of $1.335 billion in Q2 (up 1% year-over-year), compared to consensus estimates of $1.37 billion. Crum anticipates adjusted earnings to come in at $1.03 per share, while Street estimates stand at $0.94 per share.

Hasbro is a global entertainment company whose product portfolio includes consumer products, including games and toys, as well as gaming and entertainment solutions. The company’s portfolio of brands includes Nerf, Monopoly, Dungeons & Dragons, Power Rangers, and others.

Hasbro’s Optimistic Outlook about Its Digital Gaming Business

The company’s management stated on its Q1 earnings call that for FY22, it expects its revenues to grow in “low-single digits,” driven by “continued strength in our highly profitable Wizards & Digital Gaming business.”

Hasbro anticipates an adjusted operating profit margin of 16% in FY22.

Hasbro’s key business segments include Consumer Products, Wizards of the Coast, Digital Gaming, and Entertainment. The Wizards of the Coast and Digital Gaming businesses are involved with the promotion of Hasbro’s brands through trading cards, role-play, and digital gaming experiences based on the company’s games and Wizards of the Coast.

The entertainment company is upbeat about the Wizards of the Coast and Digital Gaming segments and expects this business to grow at the upper end of its range in “mid-single digits with a potential to reach low-double digits.”

Even Crum is optimistic about this business and expects it to generate revenues of $441 billion in Q2, up by 9% year-over-year “led by Magic: The Gathering.” Overall, the analyst does not anticipate any “material adjustments to ’22 guidance,” given the current macro environment.

Concerns about Hasbro’s Consumer Products

The analyst expects that in Q2 point-of-sales (POS) for Hasbro’s Consumer Products segment is likely to be down year-over-year for multiple reasons. This includes current supply chain disruptions, which have impacted the availability of its products and Crum’s store checks, and industry data indicating “weakening trends for Hasbro in May-June.”

Another factor, according to the analyst, that could impact this business segment includes the “timing of Amazon Prime Day this year (July 12th-13th) vs. last year (June 21st-22nd), notwithstanding an easier comp with Consumer Products POS off by MSD%s [mid-single digits] in the year-ago period.”

Crum anticipates that the Consumer Products segment is likely to see its revenues decline by 3% year-over-year to $671 million in Q2.

Hasbro Could Still Prove to Be Resilient

As there is growing concern about a recession, Crum examined how toy manufacturers have performed in past business cycles. This study ended with a surprising conclusion; “toy companies are NOT recession proof, but have demonstrated greater resiliency during past recessions, at least relative to other consumer discretionary categories.”

In fact, the top-rated analyst pointed out that through all the “recession years” from the mid-70s through 2021, has delivered a 5% year-over-year growth in revenues, “with y/y [year-over-year] increases in 7 of the 9 recession years.”

Wall Street Is Bullish about HAS

Crum continues to be bullish about the stock with a Buy rating but lowered the price target to $103 from $111 earlier. The analyst’s price target implies an upside potential of 29.7% at current levels.

Besides Crum, even other Wall Street analysts are upbeat about Hasbro, with a Strong Buy consensus rating from Wall Street analysts based on six Buys and two Holds. The average Hasbro price target of $107.71 implies an upside potential of 35.6% at current levels.

Bottom Line

Even as the macro environment seems to be heading towards a recession, it is likely that Hasbro will rise to the challenge. As Crum pointed out in his report, “We believe a parent’s willingness to spend on their children, regardless of the economic climate, may provide the best explanation as to why toys [companies] tend to exhibit more defensive characteristics.”

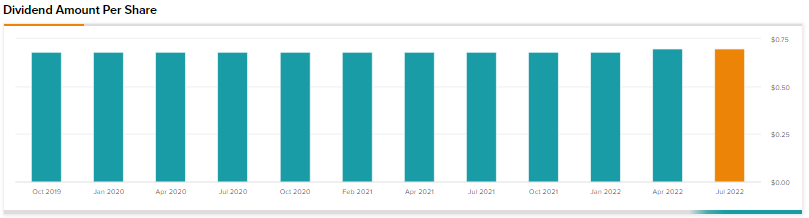

What makes Hasbro a more attractive Buy is also its dividends. Currently, the stock offers a 3.5% dividend yield, which is more than double the market average.