Global tech giant Apple (NASDAQ: AAPL) recently announced that the iPhone 14 has a brand new satellite SOS messaging feature that stands directly in the path of billionaire and visionary engineer Elon Musk and 5G wireless giant T-Mobile’s (NASDAQ: TMUS) ambitions to bring satellite connectivity to cellphones using SpaceX’s Starlink satellites. Apple might have disrupted some aspects of T-Mobile and Musk’s envisioned dream in big and small ways.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

T-Mobile’s held its “Above and Beyond” event in August. During the event, SpaceX’s Chief Engineer Elon Musk and T-Mobile’s CEO Mike Sievert promised to unlock satellite connectivity on T-Mobile’s customers’ existing cellphones so they can remain connected to the world, at least through text and multi-media messaging when in remote areas.

Most noteworthy, T-Mobile sees the partnership with SpaceX as “more than just a groundbreaking alliance” but as an industry-shaking innovation that will “create something entirely new that will further connect customers and scare competitors.”

The satellite messaging offering is expected to go live by the end of 2023.

Now that Apple has introduced a device with a similar service feature, T-Mobile should get scared instead, but Elon Musk’s SpaceX might welcome the new iPhone 14 feature.

iPhone 14’s Satellite Feature – A Threat to Musk?

T-Mobile’s partnership with Elon Musk’s SpaceX to connect customers to Starlink satellites could have expanded service offerings and selling points to subscribers. The service could win over some new subscribers to its premium services. It could potentially bring roaming fees (a new revenue source) as international operators come aboard. However, the iPhone 14 unlocks the satellite feature to T-Mobile’s competitors in November to neutralize TMUS’s “threat” to competitors.

Apple plans to offer SOS messaging as a free service to the phone’s users for two solid years. Mobile phone operators, including TMUS, may have no cut in the deal – no fees, probably nothing!

That said, if SpaceX and T-Mobile manage to add voice and data coverage to their satellite offering soon enough, their platform could prove superior to the iPhone 14’s bundled feature as customers may enjoy better service than Apple’s currently limited offering.

The most critical are the timelines, though. The iPhone 14’s satellite feature may be available as soon as November, while T-Mobile and Elon Musk planned a rollout by the end of next year. Apple will beat the duo to market launch, gain first mover advantage in North America, and might significantly upgrade its sat-service offering by late next year.

Elon Musk’s SpaceX May Still Win Either Way

A proliferation of mobile devices capable of efficiently connecting to SpaceX’s Starlink low-Earth-orbit (LEO) satellites should be good news for Elon Musk’s ambitious project. News broke out within hours of Apple’s iPhone 14 announcement that the billionaire had some promising conversations with the iPhone maker concerning its potential use of SpaceX satellites.

Where does that leave T-Mobile? On the one hand, SpaceX has a growing total addressable market. Although Apple has chosen Globalstar Inc. (NYSE American: GSAT) as its initial satellite services provider, SpaceX still has a chance to join the program and share in Apple’s $450 million advanced manufacturing fund meant to support satellite infrastructure. On the other hand, T-Mobile has a weaker bargaining position with any competitors who may wish to negotiate roaming fees for its enhanced network offering.

The Huawei Mate 50 and Mate 50 Pro will be able to send short texts and utilize navigation thanks to China’s global BeiDou satellite network, allowing for communication in areas without cellular signals.

What are the Implications for T-Mobile Stock?

Elon Musk shines the spotlight on anything he touches, more so if it’s anything publicly traded. If SpaceX commits to a T-Mobile partnership, TMUS stock may enjoy an Elon Musk boost to its valuation.

However, given that original equipment manufacturers (including China’s Huawei, which announced a similar satellite feature on its Mate 50 a day ahead of Apple’s iPhone 14 event) have joined the party, T-Mobile is at risk of being left behind by its ambitious partner. SpaceX may pursue direct deals with phone manufacturers instead.

The big question is whether it’s globally feasible for phone manufacturers and satellite companies to set up new networks that bypass existing mobile operators’ licensed spectrums. Should that ever be the case, T-Mobile should be scared of the cut-throat competition as satellite antennas increasingly compete with cell towers to provide mass communication services.

Meanwhile, T-Mobile’s recently announced massive $14 billion stock repurchase plan may support positive shareholder returns through September 2023. The wireless firm gained a competitive advantage over rivals AT&T (NYSE: T) and Verizon Communications (NYSE: VZ) following its acquisition of Sprint’s assets. T-Mobile’s balance sheet quality has improved, as evidenced by credit rating agency Moody’s (NYSE: MCO) upgrading TMUS to an investment-grade rating in July.

TMUS stock may still offer positive investment returns over the next 12 months as it repurchases shares and continues to grow its user base. I am, therefore, bullish on T-Mobile stock.

That said, satellite-enhanced services may be a nice-to-have feature for customers in the near term – just in case of emergencies. However, I doubt that the new capabilities may entice a significant number of new customers to switch wireless service providers and move the needle for TMUS stock.

Now that the feature is open to “everyone” holding an iPhone 14 in the United States and Canada (and the service is free for 24 months), TMUS loses some anticipated network advantage. It is beaten to the launch timeline, but the business remains well-positioned to generate lucrative investment returns for shareholders.

Is T-Mobile Stock a Buy, Sell, or Hold?

T-Mobile stock has returned 25% in capital gains so far this year and outperformed the S&P 500’s (SPX) negative 14% return. T-Mobile has a Strong Buy consensus rating based on 15 unanimous Buy ratings, with the average TMUS stock price target of $175.86 implying 21.2% upside potential upside over the next twelve months.

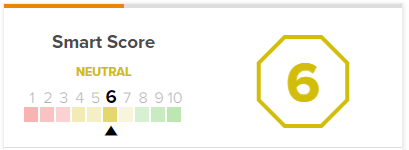

Conversely, TMUS’s Smart Score rating of 6 out of 10 on TipRanks implies that the stock is likely to perform in-line with the overall market, going forward.

Conclusion: Apple Has Leveled the Playing Field

Apple has just leveled the playing field for U.S. mobile operators on the satellite messaging front. T-Mobile has the opportunity to still go ahead and launch its service with SpaceX, targeting non-iPhone 14 users – and there are millions of them. However, the service may not necessarily entice new customers to switch over from other network providers to boost TMUS’s revenues and cash flows.

Although T-Mobile’s dreams of scaring off competitors may have been dented in some way, SpaceX may still partner with Apple, compete with Globalsat for the $450 million fat wallet, and clinch similar deals with other phone manufacturers. Elon Musk’s dream of Starlink satellites carrying direct-to-cellphone signals remains alive.

One thing may be for sure: the days of carrying around clumsy, bulky satellite phones with heavy antennas when going on holiday or visiting remote projects are coming to an end – fast.