Despite the current headwinds faced by the retail sector in the UK, the bakery chain Greggs’ (GB:GRG) third-quarter update was good news – the company has managed to keep its product demand high and is optimistic about higher earnings.

Even in tough economic times, Britain still demands steak bakes, it seems.

The business is in good health, and the company remains consistent with its cost inflation guidance – the stock could well be up for some delicious returns.

The company’s shares are trading down by 40%, after a turbulent few months. Recently, the stock gave a positive reaction to the trading update announced by the company. The stock jumped almost 15% on the day after the announcement.

Greggs Plc is a British food-on-the-go retailer dealing in all types of bakery items – and is legendary for foods such as steak bakes and vegan sausage rolls – with around 2000 shops in the UK.

Strong numbers

Greggs’ third quarter update paints a positive picture for investors.

The company reported a jump of 14.5% in its total sales in 13 weeks of its third quarter. Like-for-like sales increased by 9.7% in the company’s managed shops. This was mainly supported by more people returning to work and more footfall in the company’s stores.

The company’s expansion of menu options has received a good response from customers. Vegan-friendly food options were especially popular. It is further focusing on developing a new menu with a higher focus on healthy options and also extending its opening hours.

Stronger outlook

Greggs has opened 90 stores so far this year and is on track to meet the target of opening 150 net stores in 2022. The company is targeting a goal of 3,000 shops soon. This depicts that the company is out of pandemic recovery now and is focusing on expansion mode.

The company’s expansion strategy has evolved over the last few years, and it has found its way into new markets, especially suburban locations.

Looking ahead, the company expects its full-year numbers to be in line with the expectations riding on profitable growth.

Another favourable point is the company’s management of its costs. Even with the increasing cost pressures in the economy, the company has not increased its cost guidance for the full year. It also stated that the company holds an energy cover for the first quarter of 2023, which will help to keep costs down.

Greggs’ share price forecast

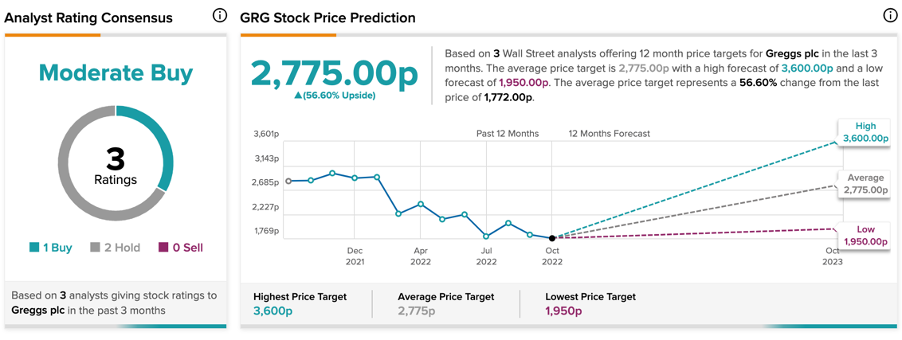

According to TipRanks’ analyst consensus, Greggs’ stock has a Moderate Buy rating.

The GRG price target is 2,775p, which represents a 56.6% change in the price from the current level. The price has a low and high forecast of 1,950p and 3,600p, respectively.

Conclusion

Greggs appears to be on top of its game in the current tough economic climate. After so many years in the business, the company is still highly ambitious.

The five-year growth strategy launched in 2021 is targeted at doubling sales in the next five years. This will help the company to reach its full potential in the coming years.

Overall, the stock has bullish prospects.