2024 is up and running and it’s hard to say how the year will pan out, with the S&P 500 so far remaining at roughly the same level it exited 2023.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

According to the Portfolio Strategy Research team at Goldman Sachs, there are indications sentiment remains decidedly bullish. “After the strong rally across assets in 2023Q4, our Positioning and Sentiment Indicator has risen to relatively bullish levels and reflects a more constructive macro outlook,” the team said in a recent note. “Net equity futures positioning has climbed to record highs in the US (and on MSCI EAFE) and investor sentiment surveys suggest a very bullish stance.”

That said, the team also notes that should inflation start climbing upwards again or growth “surprises materially to the downside,” the present level of positioning “might exacerbate set-backs.”

However, several other elements point toward the run continuing. “A combination of factors, including a potential improvement of momentum in activity data, widening breadth both across regions and within US equities and still elevated cash to deploy, might sustain the bullish sentiment and positioning levels,” the team went on to add.

So, with the prospect of the bull market continuing, the Goldman analysts are pointing investors toward the names worth betting on right now. Using the TipRanks database, we’ve decided to get the lowdown on 3 of their recent picks. Let’s check them out.

Comerica, Inc. (CMA)

We’ll start with a stock in the US banking sector, Comerica. Headquartered in Dallas, Texas, and holding total assets worth more than $85 billion, Comerica is ranked among the 50 largest banks in the US. The company offers financial services at all scales, from small individual accounts to high-net-worth wealth management, and includes services for small businesses and commercial enterprises. Comerica traces its roots to Detroit, Michigan, and while no longer based in that city, the company has maintained its ties with the region – the Detroit Tigers play baseball at Comerica Park.

Comerica has an expanding footprint across the US. The bank currently operates more than 400 branch locations in the states of Michigan, Texas, California, Arizona, and Florida, and has offices in a total of 17 states. The bank has a presence in 14 out of the 15 largest metro areas in the US.

The bank has made serving small businesses a priority. In the last quarterly release, from 3Q23, the company reported that it had exceeded its 3-year goal of extending $5 billion in loan support to small businesses. According to Comerica’s financial release, the bank has provided loans to more than 15,000 such businesses in its service areas.

Turning to the company’s financial results, we find that Comerica reported a net income of $251 million for 3Q23, the last reported. This was down $100 million from 3Q22. Drilling down, the bank company’s GAAP EPS came to $1.84 for the quarter, down 76 cents per share year-over-year – although the EPS was 15 cents per share higher than had been expected. The bank declared a 71-cent dividend for common shareholders, which was paid out on January 1. With an annualized rate of $2.84, the dividend gives a yield of 5.25%.

In the Goldman view, Comerica presents multiple positive attributes, leading analyst Ryan Nash to write, “While the market has moved past the prior narrative of deposit volatility for CMA (based on our investor conversations), many perceive CMA as an asset sensitive name given its prior-cycle positioning, and we don’t believe its swap position and debt-paydown story is being properly appreciated.”

Nash goes on to present detailed reasons why investors should consider this stock: “In 2024, we see several catalysts moving shares higher including 1), we see significant TBV accretion of 76% by YE25… as well as solid accretion in 2024/2025 of ~18% annual (~14% peers) from organic capital generation, RWA discipline, and static AOCI earnback, 2) while 2024 is likely to be a transition year due to lagged deposit betas with rate cuts, we see significant upside to NII/NIM in 2025+ driven by lower swap headwinds and debt paydown (FHLB, as well as brokered deposits), and 3) we see lower-than-peer credit risk at CMA given its historical track record as well as limited exposure to Office CRE (1% total loans).”

The bottom line, for Nash, is a Buy rating for the stock. His price target, set at $70.50, suggests the shares will gain 30% on the one-year horizon. (To watch Nash’s track record, click here)

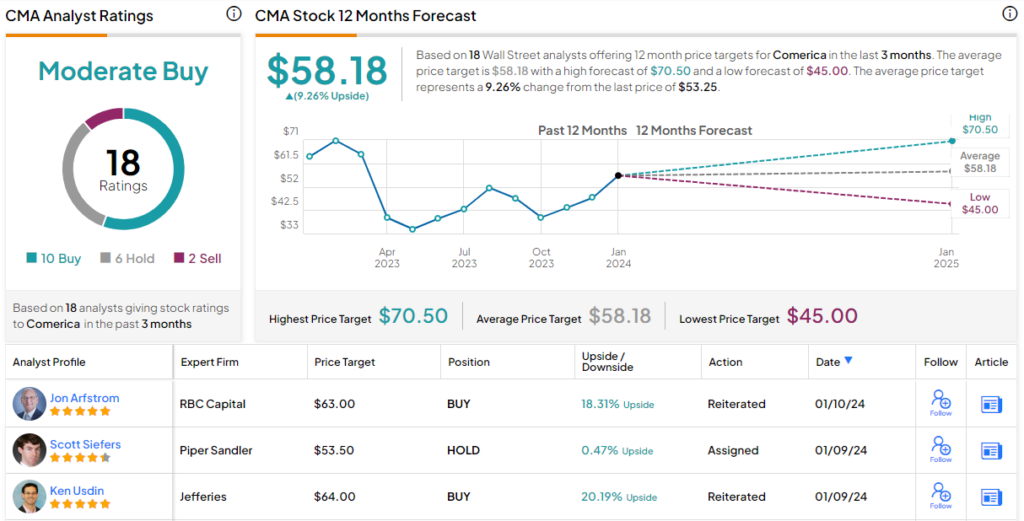

Looking at the ratings breakdown, based on 10 Buys, 6 Holds, and 2 Sells, the stock gets a Moderate Buy consensus rating. The average target price of $58.18 implies a 9% increase from the current share price of $53.25. (See Comerica stock forecast)

Toast, Inc. (TOST)

The next stock on our Goldman-backed list is Toast, a company involved in both the tech and restaurant worlds. Toast offers a software platform optimized for the food service industry, capable of streamlining everything from point-of-sale to payroll. Users can access a wealth of features allowing smooth operations in restaurants, from taking customer orders to ordering food and supplies to managing online orders and processing payments.

The purpose behind Toast is simple: make running the eating establishment ‘effortless and friction-free’ at every stage of the process, so that the restauranteur can focus on providing the best food and keeping customers happy. And, Toast’s platform is scalable, to fit restaurants of any type – fine dining, casual dining, the neighborhood bakery, craft breweries, the corner food truck, even the bar and lounge in a swanky hotel.

Overall, restaurant stocks tended to underperform in 2023, even though it was a generally good year for equities. TOST is a good example of this – the stock has fallen more than 14% in the last 12 months.

A look at the last earnings release, from 3Q23, will put Toast’s shares into some perspective. The company claimed a net of 6,500 new locations that began using the platform during the quarter, although the bottom line was a net loss of $31 million, or 6 cents per share by GAAP measures. That net loss was, however, 4 cents per share better than had been forecast. At the top line, Toast brought in a total of $1.03 billion in revenue, up 37% year-over-year and in-line with expectations. The company’s annual recurring revenue (ARR), a metric that predicts future business, came in at nearly $1.22 billion at the end of the quarter, for a y/y gain of 40%.

That all sounds pretty good. However, the outlook disappointed as the company sees Q4 revenue hitting the range between $1.00 -$1.03 billion vs. consensus at $1.02 billion, while adjusted EBITDA is expected in the range between $5-$15 million compared to the Street’s forecast of $14.6 million.

Nevertheless, Goldman analyst Will Nance sees the stock as a long-term gainer. He notes that the restaurant business is highly competitive, and that Toast can bring a direct advantage to its users. This is the company’s main support, and Nance writes of it, “TOST has grown quickly in the last few years, especially in the SMB-middle market space for restaurants. As a result, TOST has quickly approached ~20% market share (ex enterprise), which we believe was the generally accepted ballpark for a mature market share. However, we do not see a structural reason for TOST to be restricted to 20% market share in restaurants. While restaurants is a competitive space, we estimate TOST is adding locations at a rate equivalent to ~300bps of market share gains per year, and we believe TOST still has a significant product advantages over competitors…”

“While TOST is already a large player in the restaurant POS space,” Nance adds, as he describes a path forward, “we believe it is possible for TOST to continue to take market share from incumbents and competitors and drive towards ~30-40% market share over time among SMBs, and view the enterprise and international push as positive optionality.”

These comments back up Nance’s outlook on the stock, an upgrade from Neutral to Buy. Nance gave TOST shares a $24 target price, pointing toward a 39% one-year upside potential. (To watch Nance’s track record, click here)

There are 14 recent analyst reviews on TOST, and they include 8 Buys, 5 Holds, and 1 Sell for a Moderate Buy consensus rating. The shares are trading for $17.30 and their average price target of $20.46 implies a 12-month gain of 18%. (See Toast’s stock forecast)

Brink’s Company (BCO)

Last on our list is the private security company, Brink’s. This firm is active around the world, offering services that include armored courier trucks; armed guards; and ATM installation, replenishment, and maintenance. Brink’s services are used across multiple sectors, and the company counts large and small businesses, banks, and government agencies among its clients. The company is particularly popular with jewelry retailers.

Brink’s describes itself as a global leader in the management of cash and valuables. The company’s operational and logistic network extends into 52 countries, and claims more than 72,000 employees and 16,000 vehicles of various types. On the customer side, Brink’s makes its services available in more than 100 countries, with those services based out of more than 1,300 facilities. Brink’s will work with its customers, to create a security solution that fits the business.

From the investor’s perspective, Brink’s offers a sound policy of supporting its share value. The company in November announced a major addition to its share repurchase authorization, totaling $500 million. This authorization will last until the end of 2025. We should note here that the newly announced policy effectively replaces the previous authorization, which expired on the last day of 2023.

Turning to Brink’s results, we find that the company reported $1.23 billion in top line revenue for its last reported quarter, 3Q23. This was up 8% from the prior-year period, and matched the forecast expectations. The bottom line, reported as a non-GAAP EPS of $1.92, was 13 cents over the estimates – and up an impressive 39% year-over-year. The company’s quarterly free cash flow was $261 million, up $143 million from one year earlier.

When we check in with Goldman Sachs, we find analyst George Tong upbeat on this stock. He notes the company’s multiple avenues toward gains, and writes, “We believe Brink’s is favorably leveraged to a rising mix of high-growth, high-margin Digital Retail Solutions and ATM Managed Services, which on a combined basis grew 18% y/y organically in 3Q and represented 20%+ of TTM revenue. We expect DRS/AMS revenue to sustain double-digit organic growth driven by new location growth and a strong pipeline in DRS, and European momentum and rising US transaction volumes in AMS. BCO is additionally realizing improved pricing gains due to contract optimization efforts, leading to strengthened revenue growth and margin flow-through.”

Tong is especially appreciative of BCO’s potential for goosing the share price to ensure investor returns, and adds, “We expect healthy organic revenue growth trends in the mid-to-high single-digits coupled with margin expansion from revenue mix, efficiency gains and pricing to drive valuation upside in BCO shares, augmented by a stepped up pace of buybacks.”

In-line with this stance, Tong rates this stock as a Buy, and his $98 price target indicates a potential for 22% gains in the next 12 months. (To watch Tong’s track record, click here)

Both recent analyst reviews on Brink’s are positive, making the Moderate Buy consensus rating unanimous. The stock is trading for $80.45 and its $94 average target price suggests it has an upside potential of 17% over the one-year timeframe. (See Brink’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.